Navigating the ever-changing forex market can be a daunting task, but understanding the concept of overbought and oversold conditions can give traders a significant edge. This guide will dive deep into these market phenomena, providing valuable insights and actionable tips to help traders make informed decisions.

Image: www.forexmt4indicators.com

Defining Overbought and Oversold

In the forex market, overbought refers to a situation where a currency pair has risen sharply over a short period of time, creating an assumption that it may be due for a downward correction. Oversold, on the other hand, indicates that a currency pair has fallen sharply, signaling a potential for a rebound. These conditions arise when the market sentiment becomes excessively bullish or bearish, driving prices to extreme levels.

Identifying Overbought and Oversold Patterns

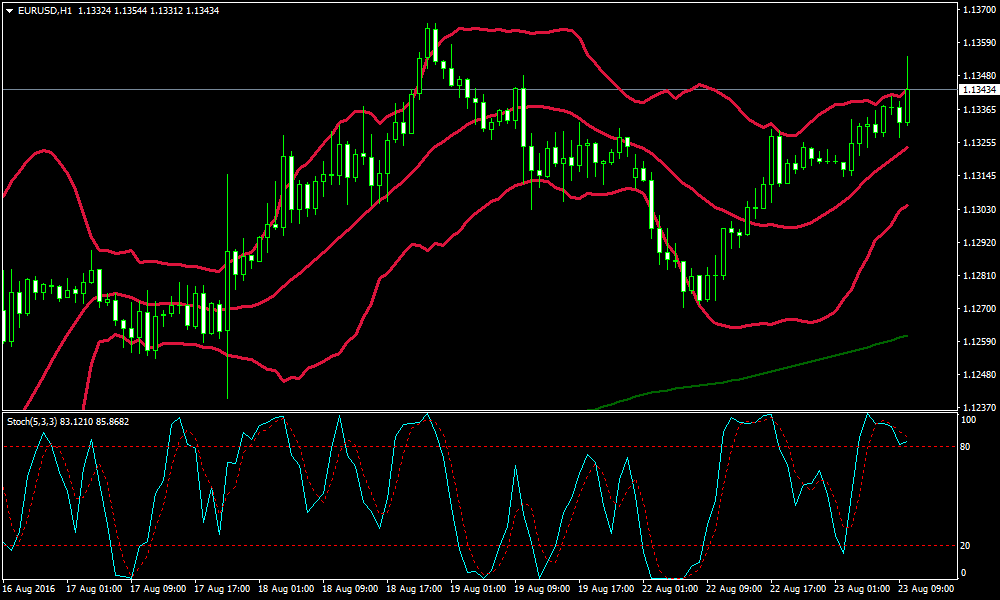

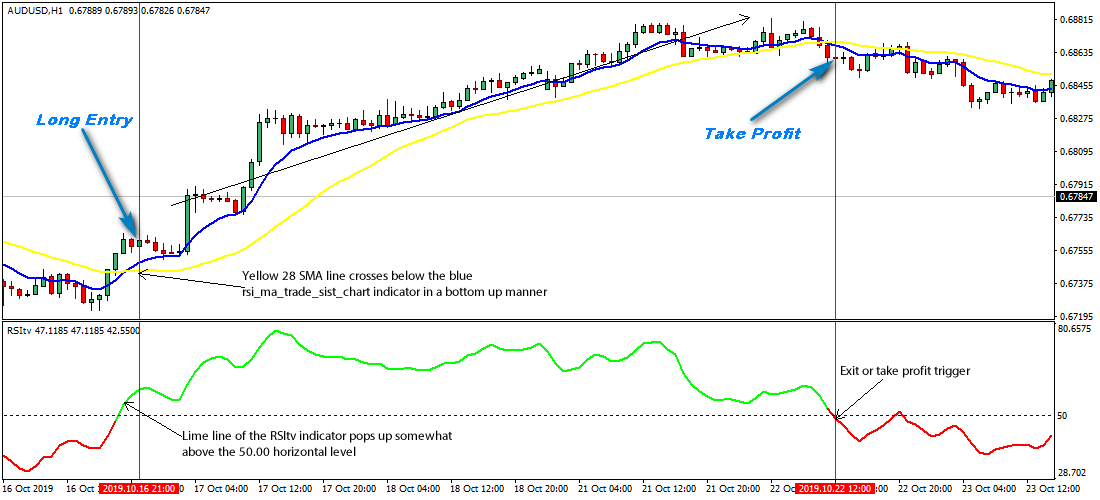

Traders can use technical indicators to identify overbought and oversold conditions. Commonly used indicators include:

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes and is often used to identify overbought or oversold levels. A reading above 70 indicates an overbought market, while a reading below 30 suggests an oversold condition.

- Stochastic Oscillator: Similar to RSI, the Stochastic Oscillator compares the closing price of an instrument to its range over a specific period. An overbought signal is generated when the indicator rises above 80, while an oversold signal occurs when it falls below 20.

Trading Strategies for Overbought and Oversold Conditions

Traders can employ various strategies when dealing with overbought and oversold markets:

- Short-term Reversal Strategy: During overbought conditions, some traders opt to sell the overvalued currency pair, anticipating a downward move. Conversely, when a pair is oversold, they might buy, betting on a price recovery.

- Momentum Riding Strategy: This strategy involves trading in the direction of the established trend. In overbought markets, traders may look to ride the momentum by selling at higher prices. In oversold markets, they might buy at lower prices, speculating on a continuation of the upward trend.

- Range Trading Strategy: Some traders prefer to trade within defined ranges during overbought or oversold conditions. They identify support and resistance levels and place trades accordingly, aiming to profit from fluctuations within these ranges.

Image: www.dolphintrader.com

Expert Insights

- “Identifying overbought and oversold conditions requires a combination of technical analysis tools and an understanding of market fundamentals.” – John Bollinger, renowned technical analyst

- “Trading against extreme market sentiment can be rewarding, but it’s crucial to manage risk effectively.” – Kathy Lien, esteemed currency strategist

Actionable Tips

- Avoid blindly trading against overbought or oversold conditions. Consider multiple indicators and technical analysis tools to confirm signals.

- Set realistic expectations and acknowledge that not all overbought or oversold signals will result in profitable trades.

- Integrate overbought and oversold analysis into your broader trading strategy, considering market context and other factors.

- Stay informed about global economic events and geopolitical factors that can influence forex market sentiment.

- Practice discipline and manage risk diligently by using stop-loss orders and appropriate position sizing.

Overbought And Oversold In Forex

Conclusion

Understanding overbought and oversold conditions empowers traders to navigate the forex market more effectively. By recognizing these market phenomena, employing tailored trading strategies, and incorporating expert insights, traders can gain an edge and enhance their profitability in the ever-evolving world of forex trading. Remember, knowledge is the key to success, and continuous learning and adaptation are the hallmarks of a true market master.