In the ever-evolving world of forex trading, finding reliable indicators to guide your decisions can be a daunting task. Enter candlestick patterns – a time-tested treasure trove of visual cues that can help illuminate market behavior and influence your trading strategy. Like flickering flames casting shadows on a dimly lit path, candlestick patterns reveal intricate patterns in price action, providing valuable insights into market sentiment and future price movements.

Image: www.facebook.com

Deciphering the Language of Candlesticks

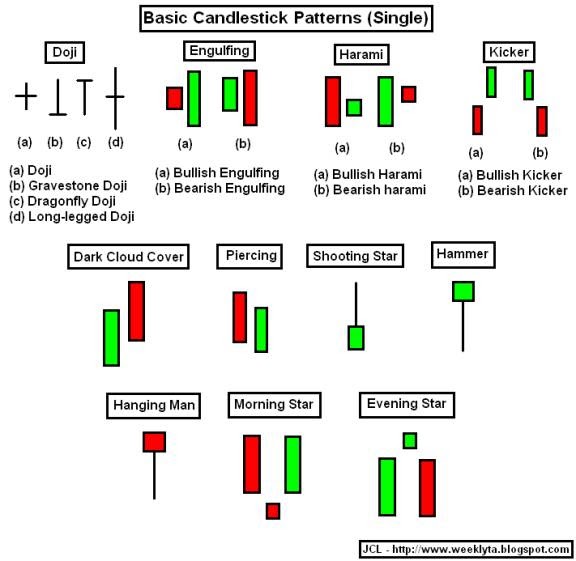

Candlesticks are graphical representations of price movement over a specific period, typically a day, a week, or a month. They consist of a body and a pair of wicks or shadows. The body, the central part of the candlestick, indicates the opening and closing prices for that period. When the closing price exceeds the opening price, the candlestick is colored green (or white), signaling an uptrend. Conversely, when the closing price falls below the opening price, the candlestick is colored red (or black), reflecting a downtrend.

The wicks, or shadows, extend above and below the body, representing the highest and lowest prices reached during the specified period. Long wicks indicate significant market volatility, while short wicks suggest a more stable price environment.

Empowering Your Trading with Candlestick Patterns

Candlestick patterns transcend mere graphical representations; they embody a rich lexicon of market behavior. By understanding the distinct characteristics of various candlestick patterns, you can gain a deeper comprehension of trader psychology and forecast price direction with increased accuracy.

For instance, a bullish engulfing pattern, characterized by a large green candlestick that completely engulfs the preceding red candlestick, signifies a strong reversal of the downtrend. This pattern hints at a surge in buying pressure and indicates a high likelihood of further price increases.

Conversely, a bearish engulfing pattern, its inverse counterpart, features a large red candlestick that engulfs the prior green candlestick. This pattern portends a shift in market sentiment towards selling, indicating a potential downtrend and suggesting the possibility of further price declines.

Expert Insights for Forex Dominance

Professional forex traders often leverage candlestick patterns in conjunction with technical indicators to enhance their trading decisions. By combining the insights derived from candlestick patterns with the predictive power of indicators, traders can triangulate their analysis, increasing the probability of profitable outcomes.

Traders acknowledge that no single candlestick pattern is foolproof. However, by mastering the art of pattern recognition, traders can cultivate an intuitive understanding of market dynamics and develop trading strategies tailored to their risk tolerance and investment objectives.

Image: 9pahala.blogspot.com

Candles Cander Application For Forex

https://youtube.com/watch?v=FQc4hKetzig

The Guiding Light in Forex Trading

Candlestick patterns are more than just aesthetic representations of price action; they are illuminating beacons that guide the path of successful forex traders. By embracing the wisdom of candlestick patterns, traders can transform market uncertainty into informed decisions and navigate the ever-changing forex landscape with increased confidence and profitability.

Remember, the mastery of candlestick patterns is an ongoing journey. The more you immerse yourself in their intricate nuances, the more adept you will become at unlocking the secrets of market behavior. With dedication and practice, candlestick patterns can become your guiding light in the forex trading arena, casting a radiant glow on your path to financial success.