In the fast-paced world of digital finance, the ability to seamlessly transfer money between accounts is crucial. With the growing popularity of forex cards for currency conversion, many individuals seek convenient methods to integrate these funds into their PayPal accounts. In this comprehensive guide, we delve into the intricate details of transferring money from forex cards to PayPal, exploring its feasibility, processes, and potential benefits.

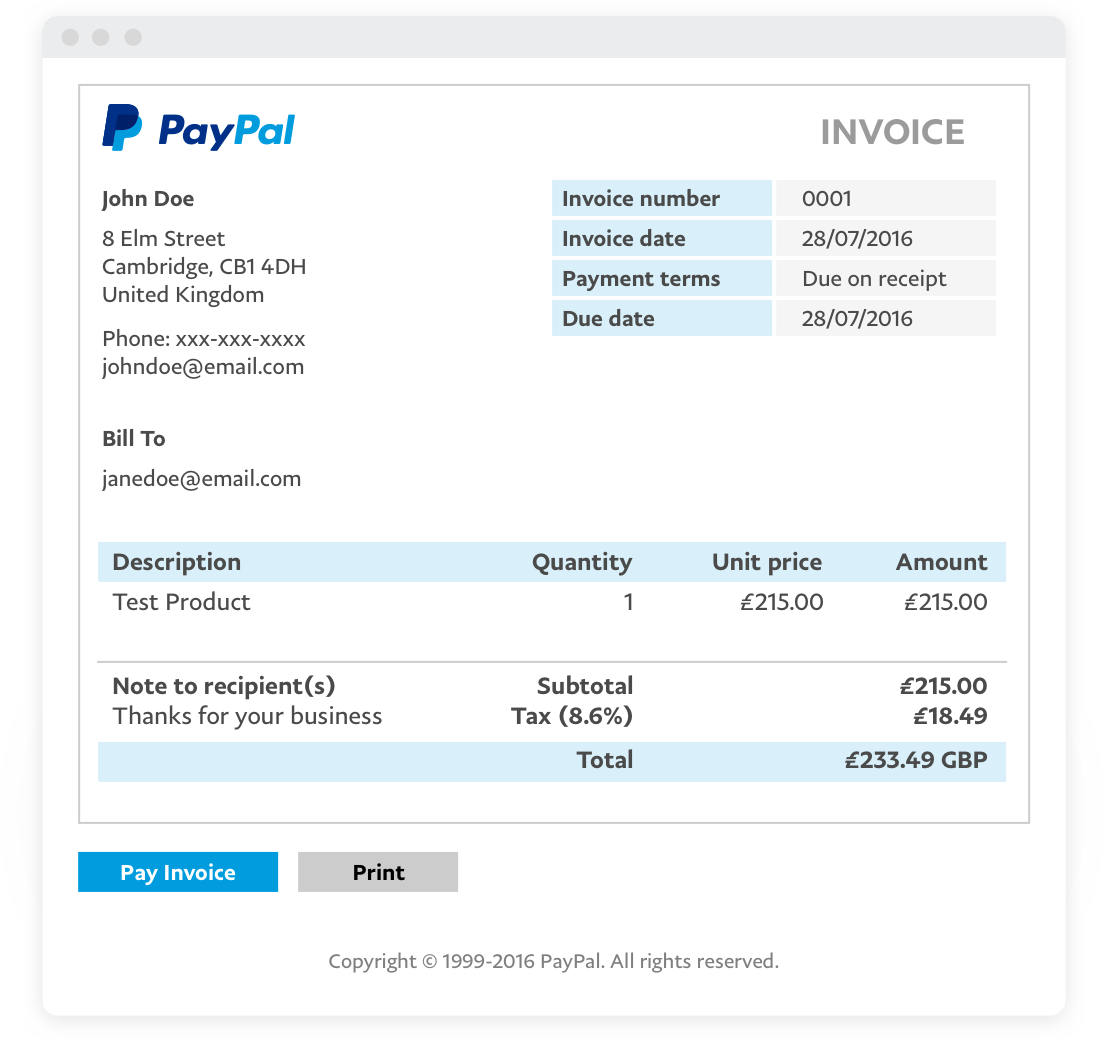

Image: payingbrain.com

Navigating the Transfer Labyrinth: Is it Possible?

The answer is a resounding yes! PayPal, a global payment processing giant, recognizes the need for effortless fund transfers between various financial instruments. As such, it enables users to link their forex cards and transfer funds directly to their PayPal accounts with relative ease.

Unveiling the Transfer Process: A Step-by-Step Guide

The process of transferring money from a forex card to PayPal involves several straightforward steps. Let’s break it down into a user-friendly guide:

-

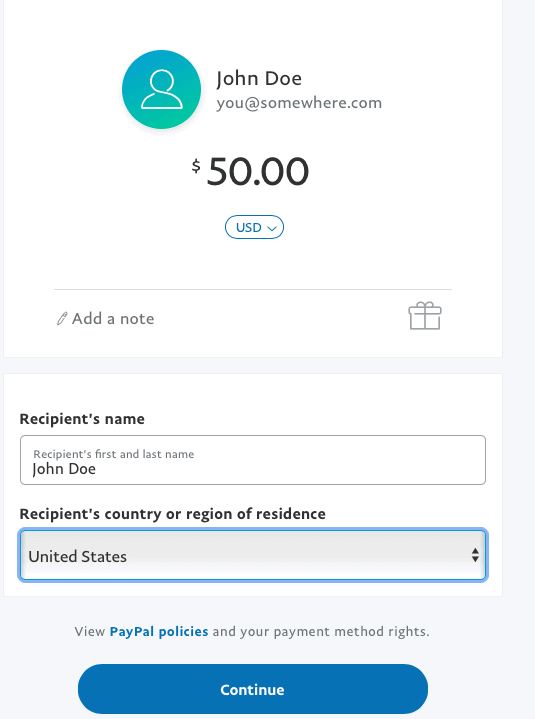

Link Your Forex Card: Initiate the process by linking your forex card to your PayPal account. This typically involves providing your card number, expiration date, and CVV code within the PayPal interface.

-

Initiate the Transfer: Navigate to the “Wallet” section of your PayPal account and select the “Transfer Funds” option.

-

Select Forex Card as Source: Identify the “Add Funds” tab and locate the “From” section. From the available options, select your linked forex card.

-

Specify Transfer Amount: Enter the desired amount you wish to transfer from your forex card to your PayPal account.

-

Verify and Execute: Carefully review the transfer details to ensure accuracy. Once satisfied, complete the transaction by confirming the transfer.

Harnessing the Advantages: Why Transfer Funds to PayPal?

Transferring funds from a forex card to PayPal offers a host of advantages that enhance financial flexibility:

-

Currency Conversion Convenience: Forex cards are designed for convenient currency conversion, eliminating the need for multiple currency accounts. By transferring funds to PayPal, you can avoid exchange rate hassles and enjoy simplified fund management.

-

Enhanced Payment Options: PayPal boasts global reach and acceptance, significantly expanding your payment options. With a PayPal account funded from your forex card, you can make international payments, online purchases, and more.

-

Secure Platform: PayPal employs robust security measures to safeguard user funds and transactions. Transferring funds from a forex card to PayPal adds an extra layer of protection, reducing the risk of fraud or unauthorized withdrawals.

-

Transaction Tracking: PayPal provides a detailed transaction history, giving you complete visibility and control over your transferred funds. You can easily track the status of individual transfers and monitor your financial activity.

Image: wallethacks.com

Can I Use Paypal To Transfer Money From Forex Card

https://youtube.com/watch?v=pN_5RKmCDGo

Conclusion: Embracing Seamless Financial Management

Transferring money from forex cards to PayPal empowers individuals with greater financial control and versatility. Whether it’s for currency conversion, enhanced payment options, or security concerns, utilizing PayPal as a destination for forex card funds offers numerous advantages. Embrace the seamless transfer process and unlock the full potential of your financial resources.