In today’s globalized world, transferring money across borders has become essential. Whether you’re sending funds to family and friends abroad, making international business payments, or withdrawing funds for travel, having convenient and cost-effective options is crucial. Forex cards and PayPal are two popular services that cater to this need. But can you transfer money from a forex card to PayPal?

Image: darrenlsdyvqm.blogspot.com

In this comprehensive guide, we’ll delve into the topic of using forex cards to transfer money to PayPal, covering various aspects like supported currencies, transaction fees, processing times, and potential limitations. We’ll also explore alternative methods for transferring funds from forex cards to PayPal.

Using a Forex Card to Transfer Money to PayPal

The short answer is yes, you can transfer money from a forex card to PayPal. Forex cards, also known as prepaid travel cards, are linked to a pre-funded account that allows you to make payments in foreign currencies. They offer competitive exchange rates and can be a convenient option for managing international payments.

Supported Currencies: Forex cards typically support a wide range of currencies, including major currencies like USD, EUR, GBP, and JPY. The specific currencies supported by your forex card will depend on its issuing bank or provider.

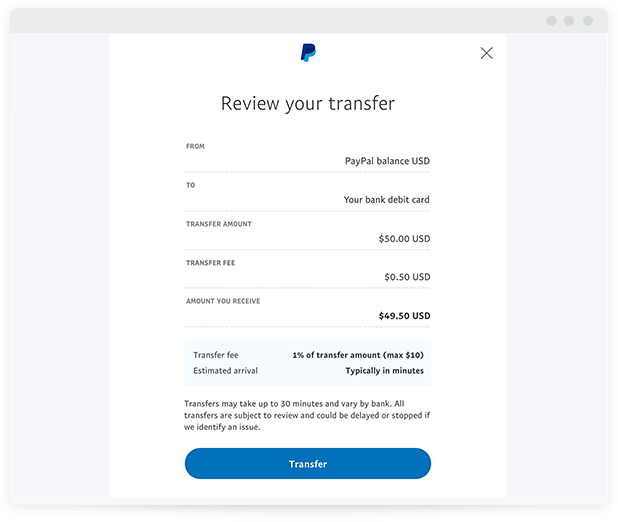

Transaction Fees: Forex card providers usually charge a small transaction fee for transferring funds to PayPal, typically ranging from 1% to 3%. It’s important to check with your forex card provider for their specific fee structure to avoid unexpected charges.

Processing Times: The processing time for a forex card transfer to PayPal varies depending on the card provider and the destination currency. In general, transfers can be processed within a few business days.

Limitations: While forex cards are a convenient option for transferring funds to PayPal, there may be certain limitations to consider, such as:

- Maximum Transfer Limits: Forex cards often have daily or monthly transfer limits, which can restrict the amount of money you can transfer at one time.

- Service Fees: Some forex card providers may charge additional service fees for transferring funds to PayPal or other services.

- Withdrawal Restrictions: Forex cards may not allow direct withdrawals to bank accounts, so you may need to use a combination of methods to get the funds into your PayPal account.

Alternative Methods for Transferring Funds

If you’re not able to transfer funds directly from your forex card to PayPal, there are a few alternative methods you can consider:

1. Using a Third-Party Currency Exchange: You can use a third-party currency exchange service to convert the funds on your forex card to another currency, which can then be transferred to your PayPal account.

2. Withdrawing to a Bank Account: If your forex card allows withdrawals to bank accounts, you can withdraw the funds to a linked account, and then transfer the funds to PayPal from your bank account.

3. Purchasing Cryptocurrencies: Some forex cards allow you to purchase cryptocurrencies, which can then be sold on a cryptocurrency exchange and transferred to your PayPal account.

Image: medium.com

Can I Use Forex Card To Transfer Money To Paypal

Choosing the Best Option

The best option for transferring funds from a forex card to PayPal depends on your specific requirements and preferences. Consider factors like transfer fees, processing times, currency exchange rates, and any applicable limitations to make an informed decision.

Overall, using a forex card can be a convenient and cost-effective way to transfer funds to PayPal, especially if you frequently make international payments in multiple currencies. However, it’s important to carefully review the terms and conditions of your forex card to understand any fees or limitations associated with transferring funds to PayPal.