Introduction:

In the fast-paced world of forex trading, every second counts. Traders who master the art of 60-second trading can potentially reap significant rewards by exploiting short-term market fluctuations. However, finding the right pattern that consistently yields profits can be a daunting task. To assist you in your endeavors, this article will unravel the secrets of the most effective pattern for 60-second forex trading, empowering you to maximize your earnings and navigate the dynamic forex markets with confidence.

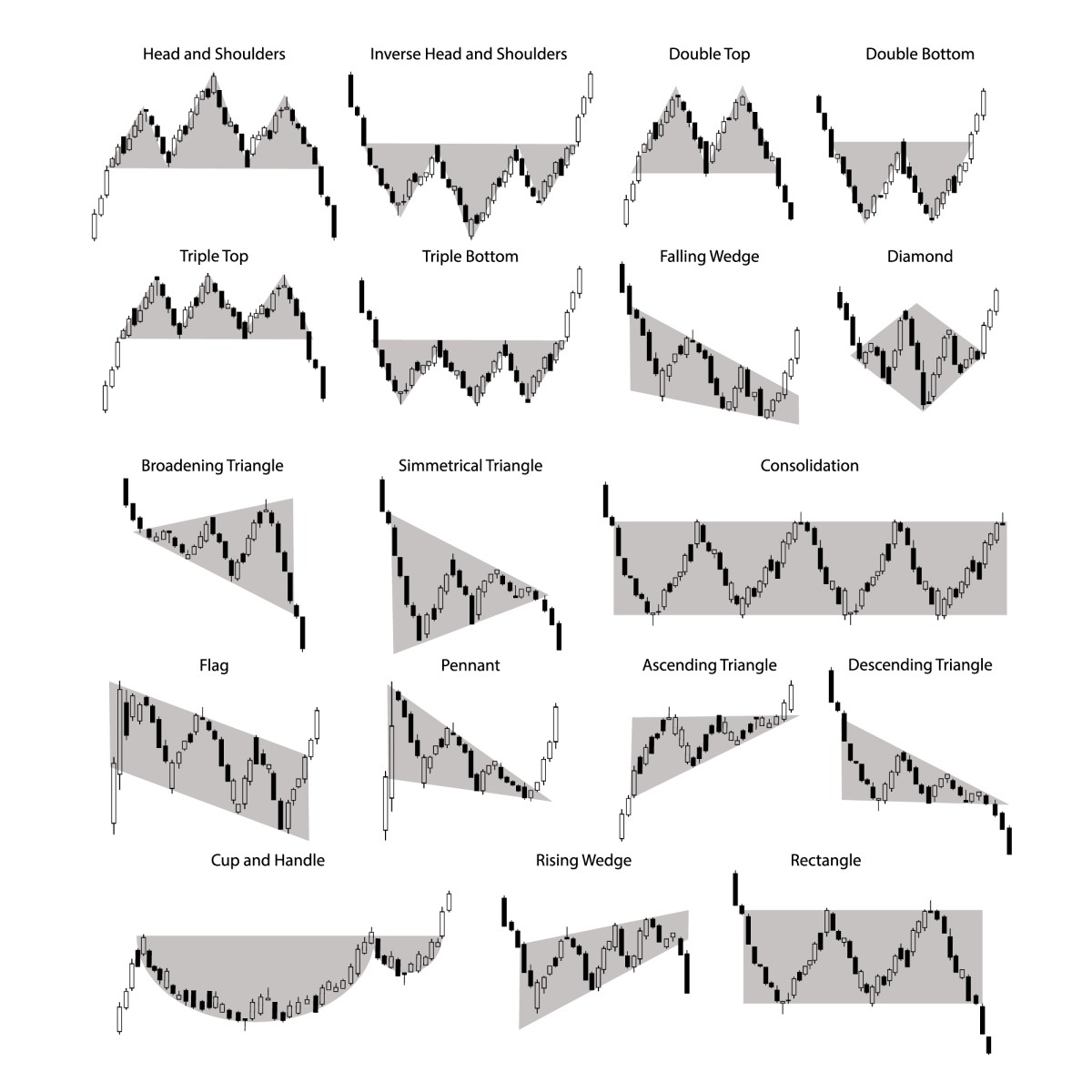

Image: libertex.com

The 1-Minute Momentum Strategy:

This strategy leverages the power of price momentum to identify potential trading opportunities. It involves analyzing the direction and magnitude of price movements over a 1-minute interval. When the price consistently breaks through previous highs or lows, it indicates the presence of momentum. Traders can capitalize on this momentum by entering trades in the direction of the breakout.

How to Implement the 1-Minute Momentum Strategy:

- Choose a currency pair that exhibits high volatility and frequent price fluctuations.

- Use a 1-minute candlestick chart to observe price action.

- Identify a clear uptrend or downtrend by analyzing the sequence of candlesticks.

- Enter a buy trade when the price breaks above a recent high (resistance level) and a sell trade when the price falls below a recent low (support level).

- Set a stop-loss order a few pips below the entry point for sell trades and above the entry point for buy trades.

- Take profit when the price reaches the next major resistance or support level.

Latest Trends and Developments:

The 1-Minute Momentum Strategy continues to evolve, with traders incorporating advanced indicators and technical analysis tools to enhance their decision-making. Artificial intelligence (AI) and machine learning algorithms are also gaining popularity, providing traders with real-time insights and predictive analytics. Additionally, social media platforms and forums have become invaluable resources for traders to exchange ideas, strategies, and market updates.

Image: www.pinterest.com

Tips and Expert Advice:

-

Control your emotions: 60-second trading can be exhilarating, but it’s crucial to stay composed and not let emotions cloud your judgment. Stick to your trading plan and avoid making impulsive decisions.

-

Master risk management: Protect your capital by implementing a sound risk management strategy. Use stop-loss orders to limit losses and avoid overleveraging.

-

Seek professional guidance: Consider consulting with an experienced mentor or financial advisor who can provide personalized guidance and support.

FAQs on 60-Second Forex Trading:

-

Is 60-second trading profitable? It can be, but it requires a deep understanding of the markets, a robust trading plan, and disciplined risk management.

-

What are the risks involved? Losses are a part of trading, and 60-second trading carries higher risks due to its short time frame and volatile market conditions.

-

Can I make a living from 60-second trading? While it’s possible, it requires a significant amount of time, effort, and capital. Most successful traders use 60-second trading as a supplement to other trading strategies.

Best Pattern For 60 Sec Trading Forex

Conclusion:

Mastering the 1-Minute Momentum Strategy is a powerful step towards successful 60-second forex trading. By understanding the mechanics of the strategy, staying informed about market trends, and adhering to sound trading principles, you can increase your chances of profitability. Are you ready to embark on this exciting and potentially lucrative journey in the forex markets?