In the dynamic realm of foreign exchange (forex) trading, every trade revolves around the fundamental unit called a pip. Understanding pips is crucial for currency traders to accurately quantify profits, calculate risk, and make informed trading decisions. This comprehensive article delves into the intricacies of pips, empowering traders to navigate the forex market with confidence and precision.

Image: alpari.com

What Are Forex Pips? Pips as the Measuring Stick of Currency Value

In essence, pips (short for “percentage in point” or “points in percentage”) represent the smallest price increment for a given currency pair. They measure the change in the value of one currency relative to another, enabling traders to pinpoint the exact changes in currency valuations.

The value of a pip varies depending on the currency pair traded. For major currency pairs like EUR/USD, a pip is equivalent to a change of 0.0001 in the exchange rate. For instance, if the EUR/USD rate moves from 1.1234 to 1.1235, this signifies a change of one pip.

The Significance of Pips: Measuring Gains and Managing Risks

Pips serve as the cornerstone for quantifying profits and losses in forex trading. Every successful trade results in a gain measured in pips. Conversely, unsuccessful trades incur losses measured in the same unit. Comprehending pip values enables traders to determine the exact size of their profits or losses, allowing for precise account management and risk mitigation.

Moreover, pips play a vital role in calculating profit margins and risk-to-reward ratios. By accurately measuring the potential gain or loss in pips, traders can optimize their trading strategies to maximize profits while minimizing losses.

Understanding Pip Calculations: Breaking Down Currency Movements

Calculating pips accurately is essential for effective forex trading. The following formula provides a clear understanding of how pips are determined:

Pip Value = (1 / Exchange Rate) x (Pip Count)Let’s consider another example to illustrate the calculation. Suppose the current EUR/USD exchange rate is 1.1250, and the price moves by 25 pips to 1.1275. Using the formula, the pip value calculation is:

Pip Value = (1 / 1.1250) x 25 = 0.0022This calculation indicates that the price movement of 25 pips represents a change of 0.0022 or $2.2 per standard lot (100,000 units) of EUR/USD.

Image: analiticaderetail.com

The Impact of Pip Value on Trading Strategies: Currency Pair Selection and Leverage

The value of a pip varies based on the currency pair traded. Major currency pairs like EUR/USD have smaller pip values compared to exotic currency pairs like USD/ZAR. This difference influences trading strategies, as traders need to consider the pip value when selecting currency pairs that align with their risk tolerance and trading goals.

Leverage, which can magnify both profits and losses, also affects pips. Traders using leverage amplify the impact of each pip, leading to potentially amplified profits but also increased risk. Prudent leverage management is crucial to mitigate risks and optimize trading outcomes.

Advanced Pip Considerations: Spread, Bid-Ask Prices, and Lot Size

In forex trading, the spread refers to the difference between the bid and ask prices of a currency pair. The spread is a commission charged by brokers for facilitating trades. Traders must account for the spread when calculating pips, as it directly influences their profitability.

Understanding bid-ask prices is fundamental for accurate pip counting. The bid price is the rate at which a trader can sell a currency pair, while the ask price is the rate at which they can buy it. Pips are calculated based on the difference between the bid and ask prices.

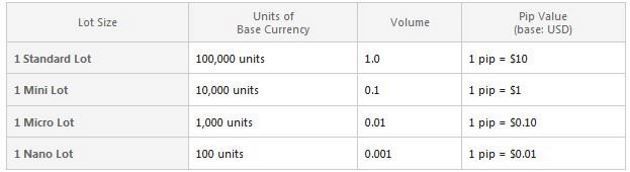

Finally, lot size, expressed in standard units, also impacts pips. A standard lot is 100,000 units of a base currency. Trading larger lot sizes multiplies the gain or loss potential per pip.

Forex Pips Explained

Conclusion: Pips as the Guiding Compass in Forex Trading

Pips are the cornerstone of forex trading, enabling traders to measure currency movements, calculate profits and losses, and develop effective trading strategies. By thoroughly understanding pips, traders gain a profound grasp of the market dynamics and can navigate the complexities of forex trading with precision. Whether you are a seasoned trader or a novice entering the forex arena, mastering the concept of pips is paramount to your success in this fast-paced and rewarding financial market.