Introduction

Image: www.bbc.com

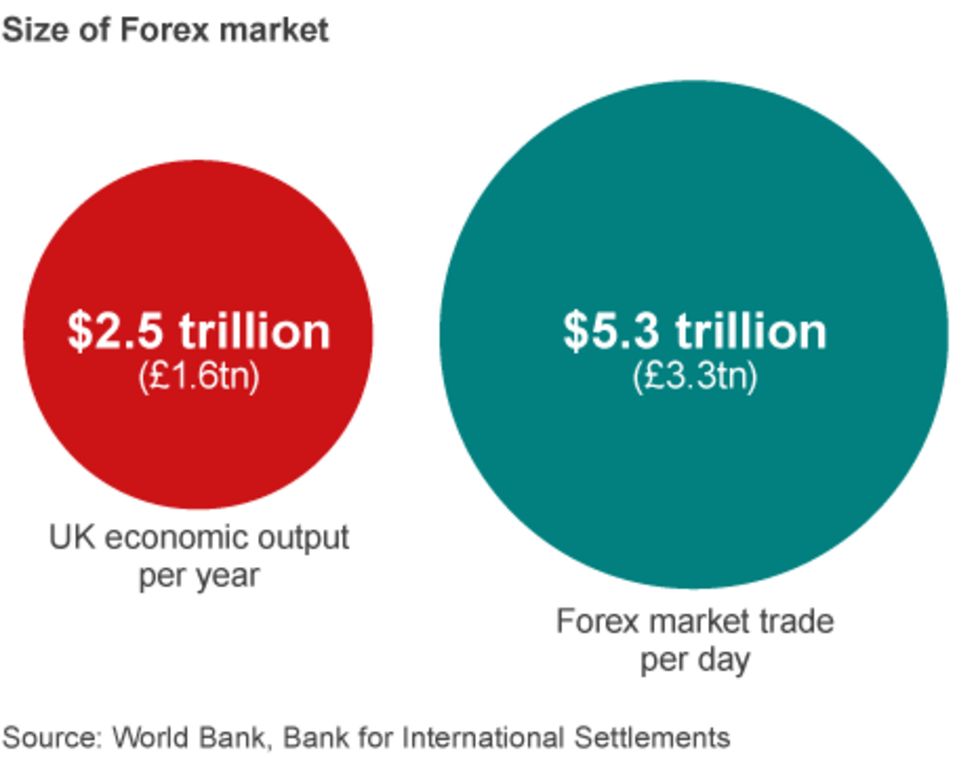

The British pound, also known as sterling, is a currency that holds significant influence in the global economy. Understanding the intricacies of its buy and sell rates is paramount for individuals and businesses engaged in international trade, travel, or investments. This article endeavors to provide comprehensive insights into the dynamics of British bound buy and sell rate forex, empowering readers with the knowledge to make informed financial decisions.

Understanding Buy and Sell Rates

Every currency pair consists of two rates: buy and sell. The buy rate, also referred to as the bid rate, represents the price at which a currency dealer is willing to purchase a particular currency. Conversely, the sell rate, often called the offer rate, signifies the price they are willing to sell the currency. The difference between these two rates, known as the spread, serves as the profit margin for currency dealers.

Factors Influencing Buy and Sell Rates

The buy and sell rates of the British pound are influenced by a complex interplay of factors, including:

- Economic Data: Economic indicators such as GDP growth, inflation, and employment data impact the perception of the pound’s stability and value. Positive economic news typically leads to a stronger pound.

- Interest Rates: The Bank of England’s monetary policy, including interest rate decisions, can influence the demand for the pound. Higher interest rates generally attract foreign investment and strengthen the currency.

- Political Stability: Political uncertainties, such as elections or Brexit negotiations, can trigger volatility in the pound’s value.

- Global Economic Conditions: The overall health of the global economy can affect the demand for the pound. A strong global economy often leads to an appreciating pound.

- Market Sentiment: Speculation and market sentiment can drive short-term fluctuations in the pound’s buy and sell rates.

How to Obtain Competitive Exchange Rates

Securing competitive exchange rates is crucial to maximize financial outcomes. Here are some strategies to consider:

- Compare Brokers: Research and compare the rates offered by various currency brokers to identify the best provider.

- Live Market Orders: Monitor live market rates and execute trades when they are most favorable.

- Negotiate Spreads: In larger transactions, skilled traders may negotiate with brokers to reduce the spread.

- Zero-Margin Brokers: Select brokers that offer zero-margin accounts, eliminating additional spread costs.

- Timing: Buy or sell during periods of currency strength to gain optimal rates.

Conclusion

Comprehending British pound buy and sell rate forex dynamics is essential for making informed decisions in international finance. By staying abreast of economic developments, understanding market sentiment, and employing effective strategies, individuals and businesses can mitigate exchange rate risks and harness opportunities to secure competitive rates. Whether you’re embarking on a global adventure, expanding your business ventures, or managing investments, mastering the complexities of British bound forex is an invaluable asset.

Image: www.investmentnews.com

British Bound Buy And Sell Rate Forex