Introduction: Navigating the forex labyrinth and seeking the holy grail

For countless traders navigating the intricate landscape of foreign exchange (forex) markets, the quest for a foolproof “no-loss” strategy has been an elusive dream. While the allure of effortlessly profiting from currency fluctuations can captivate our imaginations, it’s essential to approach this endeavor with a realistic understanding. In this article, we’ll delve into the complexities of forex trading, explore the intricacies of a “no-loss” approach, and equip you with practical insights to navigate this dynamic market.

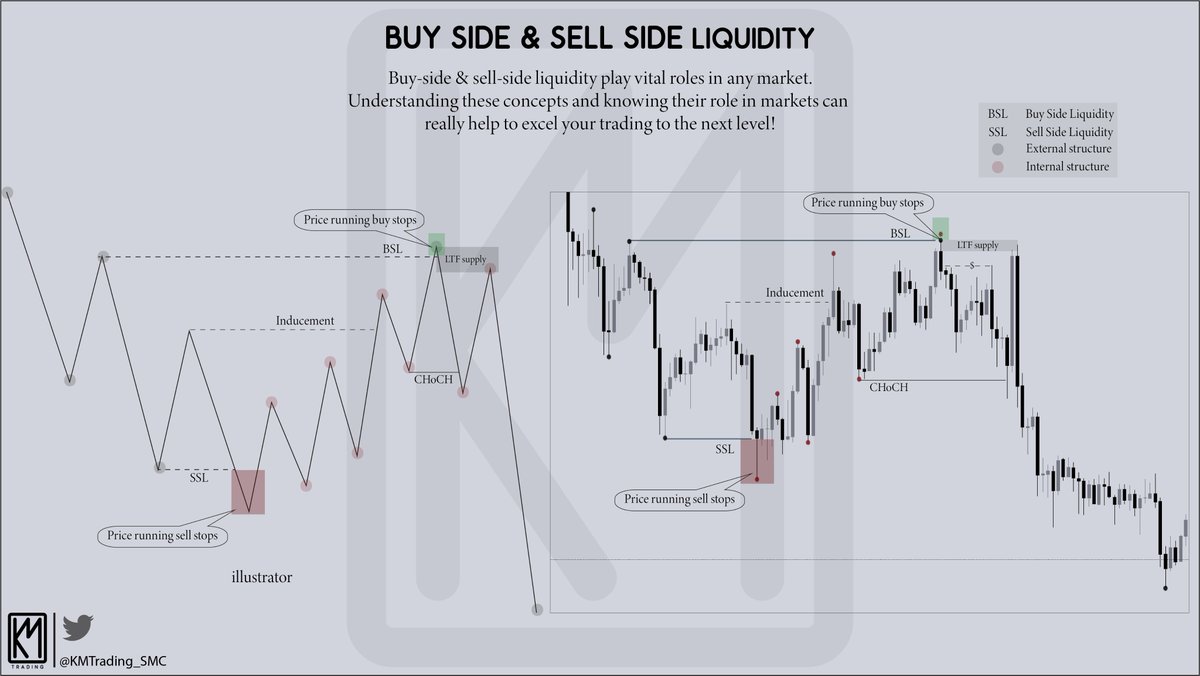

Image: twitter.com

Deciphering the Forex Enigma: A Lucrative Market with Fluid Risks

Forex trading, the largest financial market globally, facilitates the exchange of currencies between individuals, businesses, and financial institutions. As a decentralized market, it offers vast opportunities for profit but also carries inherent risks. Understanding these risks and implementing sound risk management strategies is crucial to mitigate potential losses and safeguard your capital.

The Myth of No Loss: Embracing the Unpredictable Nature of Forex Trading

While the concept of a “no-loss” trading strategy may seem alluring, the reality of forex trading presents a different picture. The market’s inherent volatility and unpredictable nature make it impossible to guarantee consistent gains without any risk of loss. External factors such as geopolitical events, interest rate changes, and economic data can swiftly alter market dynamics, making it challenging to predict outcomes with absolute certainty.

Busting the No-Loss Myth

The relentless pursuit of a “no-loss” strategy can distract traders from developing a prudent trading plan and implementing proper risk management practices. Embracing the risk inherent in forex trading is not a sign of defeat but rather an acknowledgment of the dynamic nature of the market. Rather than seeking elusive foolproof methods, successful traders focus on managing their risk exposure, minimizing potential losses, and optimizing their long-term trading strategies.

Image: www.pinterest.com

Tips and Expert Advice: Navigating Forex Trading with Informed Decisions

-

Embrace a Risk Management Framework: Define clear risk thresholds, implement stop-loss orders, and manage your risk-to-reward ratio. By pre-determining your exit points, you can limit potential losses and safeguard your trading capital.

-

Stay Informed and Adapt to Changing Market Dynamics: Diligently monitor market news, economic data, and global events that can influence currency fluctuations. Anpass your trading strategies accordingly to respond to shifting market conditions, making informed decisions rather than relying solely on intuition.

-

Seek Continuous Education and Market Analysis: Along with following prominent financial news portals and forums, consider enrolling in reputable trading courses or webinars. Develop a comprehensive understanding of forex trading, analyzing market trends, and refining your trading skills.

Frequently Asked Questions: Unraveling Forex Trading Mysteries

Q: Is it possible to achieve consistent profits without any risk of loss in forex trading?

A: No, the volatility and unpredictable nature of forex trading make it impossible to guarantee consistent gains without the potential for losses.

Q: Should I rely solely on technical analysis or incorporate other factors into my trading decisions?

A: While technical analysis is valuable, considering geopolitical events, economic data, and market sentiments provides a more comprehensive approach to making informed trading decisions.

Q: How can I manage the emotional roller coaster of forex trading?

A: Implement sound risk management practices, stick to your trading plan, and seek emotional support from a mentor or counselor to minimize the impact of emotional fluctuations on your trading decisions.

Both Side Buy Sell Forex Trading No Loss Trick

Conclusion: Embracing Informed Trading Decisions and the Thrill of the Market

While there may not be a predefined “no-loss” trick in forex trading, adopting a disciplined approach, embracing risk management, and continually refining your strategies can help you navigate the challenges and capitalize on market opportunities. Remember, the true thrill of forex trading lies in the pursuit of knowledge, embracing calculated risks, and witnessing firsthand the ever-evolving nature of the financial markets.

Are you ready to embark on this exciting journey? Let us know in the comments below.