Prologue: Embarking on Forex Mastery

In the ever-evolving financial landscape, forex trading stands as a beacon of potential financial gains. With billions of dollars traded daily, it offers a lucrative opportunity for those seeking to navigate the currency markets. However, success in this realm requires not only market knowledge but also a robust strategy that sets the stage for profitable trades. This article delves into the intricacies of the best win setup in forex, providing a comprehensive guide to unlocking market potential and maximizing returns.

Image: www.pinterest.com

Delving into the Win Setup

A win setup in forex refers to a specific combination of technical indicators and chart patterns that suggests a high probability of a successful trade. When these elements align, traders can enter the market with increased confidence, anticipating a favorable outcome. Numerous win setups exist, each with its unique characteristics and advantages.

Moving Averages Convergence Divergence (MACD)

The MACD indicator measures the relationship between two moving averages, creating a histogram and signal line. When the histogram crosses above the signal line, it signals a potential buying opportunity. Conversely, when the histogram crosses below the signal line, it indicates a potential selling opportunity.

Relative Strength Index (RSI)

The RSI indicator gauges the momentum of price movements, ranging from 0 to 100. When the RSI rises above 70, it suggests that the market is overbought, indicating a potential sell signal. Conversely, when the RSI falls below 30, it suggests that the market is oversold, signaling a potential buy signal.

Image: peacecommission.kdsg.gov.ng

Stochastics Oscillator

Similar to the RSI, the Stochastics Oscillator measures the momentum of price movements. However, it does so by comparing the closing price to the price range over a specific period. When the oscillator rises above 80, it indicates overbought conditions and potential selling opportunities. When it falls below 20, it indicates oversold conditions and potential buying opportunities.

Harmonious Convergence: Chart Patterns

Technical indicators provide valuable insights into market momentum and trend direction. However, using chart patterns in conjunction with indicators can enhance the accuracy of trade signals. Common chart patterns associated with win setups include:

Bullish Engulfing Pattern

A bullish engulfing pattern forms when a red candle is followed by a green candle that completely engulfs the previous candle’s body. It suggests a reversal from a downtrend to an uptrend, signaling a potential buy opportunity.

Bearish Engulfing Pattern

A bearish engulfing pattern is the inverse of the bullish engulfing pattern. It forms when a green candle is followed by a red candle that completely engulfs the previous candle’s body. This pattern indicates a potential reversal from an uptrend to a downtrend, signaling a potential sell opportunity.

Pin Bar

A pin bar is a candlestick pattern with a long wick on one end and a small body on the other end. The long wick represents a rejection of a price level, while the small body indicates indecision. Pin bars can signal potential trend reversals, depending on their location within the chart.

Risk Management: Navigating Forex with Prudence

While the best win setup can increase the likelihood of successful trades, risk management is paramount in forex trading. Here are some crucial risk management strategies to employ:

Proper Position Sizing

Determine the appropriate trade size based on your account size and risk tolerance. Avoid risking more than you can afford to lose.

Stop-Loss Orders

Place stop-loss orders below the entry price for buy trades and above the entry price for sell trades. This safeguards you against substantial losses if the market moves against your position.

Take-Profit Orders

Set take-profit orders at predefined profit targets to secure your gains and prevent greed-driven overstay in losing trades.

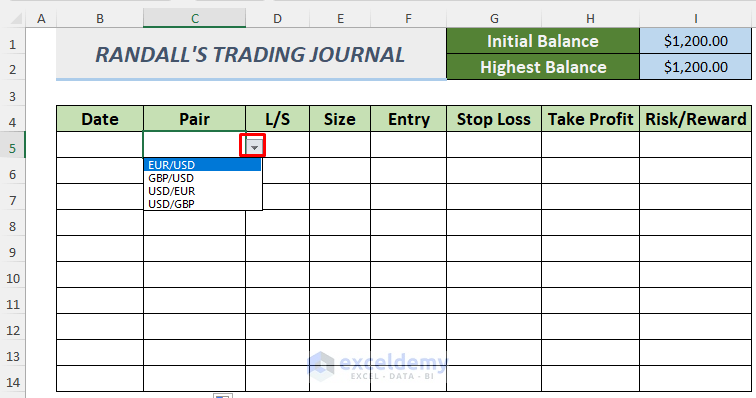

Best Win Setup In Forex

Conclusion: Mastering Forex Success

The best win setup in forex is a combination of technical indicators and chart patterns that provides a high probability of a successful trade. By understanding these elements and employing sound risk management strategies, traders can navigate the forex market with increased confidence and maximize their returns. Remember, continuous learning, adaptability, and discipline are key to achieving consistent profitability in the ever-evolving financial landscape.