Harness the Daily High and Low Forex Strategy: A Key to Unlocking Market Opportunities

Image: optionstradingiq.com

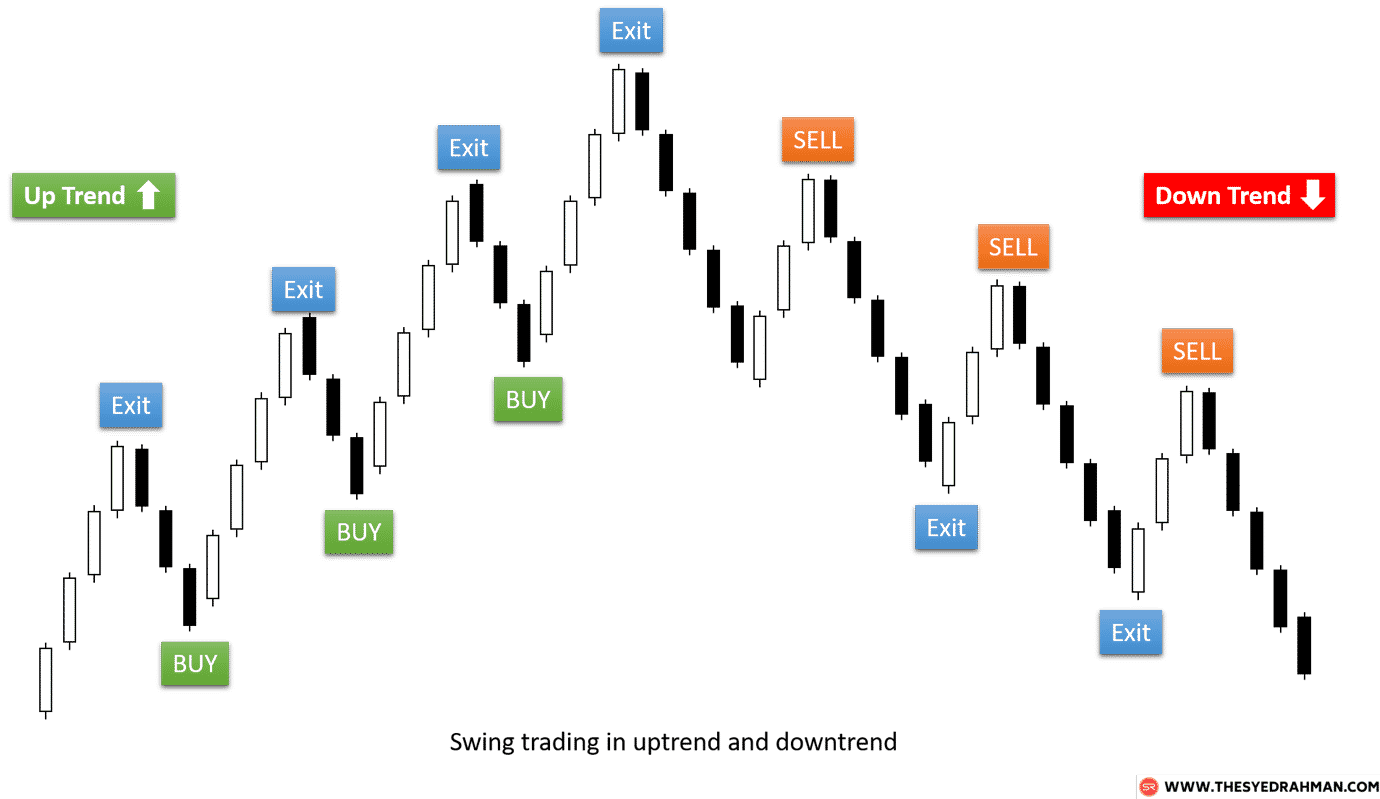

Embrace the daily high and low forex strategy, a powerful tool that empowers traders to navigate the dynamic forex market with precision and profitability. This strategy revolves around identifying the daily price extremes – the high and low points – and utilizing them to make informed trading decisions. As you delve into this guide, you will discover the intricacies of this strategy and grasp the techniques used by seasoned traders to maximize their returns.

Unveiling the Daily High and Low Forex Strategy: A Gateway to Informed Trading

Imagine a treacherous river, its currents constantly shifting and swirling. A savvy boatman would carefully observe the river’s behavior, noting the highest and lowest water levels. This knowledge would guide their navigation, enabling them to avoid perilous rapids and sail towards their destination. Similarly, in the forex market, understanding the daily high and low prices provides invaluable insights into market sentiment and price direction.

The daily high represents the highest price a currency pair reaches during a given trading day, while the daily low marks its lowest point. These extremes reveal crucial information about supply and demand dynamics. A surge in the daily high suggests increased buying pressure, while a plunge in the daily low indicates a shift towards selling. By analyzing these highs and lows, you gain a comprehensive picture of market sentiment, empowering you to make informed trades aligned with the market’s prevailing momentum.

Navigating the Daily High and Low Forex Strategy: A Step-by-Step Approach

-

Determine the Daily Range: Calculate the difference between the daily high and low to establish the daily range. This range provides an indication of market volatility and potential trading opportunities.

-

Identify Support and Resistance Levels: The daily high often acts as a resistance level, preventing the price from rising further, while the daily low serves as a support level, hindering further price declines. Pinpoint these levels to determine potential entry and exit points for your trades.

-

Assess Market Sentiment: Analyze the relationship between the daily high and low. A widening range suggests increasing volatility and market uncertainty, while a narrowing range indicates a consolidation period or a lack of clear direction.

-

Plan Your Trades: Develop a trading plan based on the information gathered from the daily high and low analysis. Consider the market sentiment, support and resistance levels, and your risk tolerance to formulate a strategy that aligns with your trading objectives.

Expert Insights: A Compass for Navigation in the Forex Market

Seasoned forex traders emphasize the significance of incorporating the daily high and low strategy into their trading toolkit. “The daily high and low provide a foundational understanding of market behavior,” says renowned trader John Person. “By harnessing this knowledge, I can identify potential trading opportunities and make informed decisions.”

Another expert, Sarah Jones, adds, “Respecting the daily high and low levels is crucial for risk management. These levels often act as magnets, pulling the price back towards them. By incorporating them into my trading strategy, I can minimize my risk exposure.”

Sharpen Your Trading Skills: Tips for Mastering the Daily High and Low Strategy

-

Pair Your Analysis: Combine the daily high and low strategy with other technical indicators, such as moving averages or Bollinger Bands, to enhance your analysis and improve trading accuracy.

-

Practice Patience: The forex market is a complex and ever-changing environment. Develop patience and discipline to avoid impulsive trades. Wait for the right trading opportunities by allowing the market to establish clear trends and validate your analysis.

-

Manage Your Risk: Implement strict risk management practices, such as using stop-loss orders to limit potential losses. Never risk more than you can afford to lose.

Conclusion: Empowering Traders with a Proven Edge

The daily high and low forex strategy is a powerful tool that empowers traders with a comprehensive understanding of market sentiment and price behavior. By mastering this strategy and incorporating it into your trading plan, you unlock the potential to navigate the forex market with increased confidence and profitability. Remember, success in forex trading requires not only technical knowledge but also patience, discipline, and a commitment to continuous learning. Embrace the daily high and low strategy today and embark on a journey towards trading mastery.

Image: mylivetradingforex.blogspot.com

Daily High And Low Forex Strategy