The Elusive Art of Timing the Forex Market

Venturing into the world of forex trading presents itself as a tantalizing journey filled with uncharted territories and captivating possibilities. Yet, within this realm of financial exploration, one particular aspect stands paramount: timing. Identifying the optimal trading times can be likened to wielding a mystical amulet, bestowing upon you a distinct advantage in this dynamic and ever-evolving market. In this comprehensive guide, we embark on a quest to unravel the secrets of the forex calendar, empowering you with the wisdom to target the most lucrative trading hours for your financial endeavors.

Image: omadyqudubiyo.web.fc2.com

Navigating the Forex Market’s Temporal Landscape

The foreign exchange market, often regarded as the most liquid and accessible in the world, embraces traders from every corner of the globe. This global tapestry, woven together by varying time zones, presents a unique challenge in pinpointing the ideal trading times. To conquer this temporal labyrinth, we must zoom in on the specific time windows when market activity surges, mirroring the ebb and flow of the world’s financial capitals.

Sunrise in London, Twilight in Tokyo: Uncovering Optimal Trading Zones

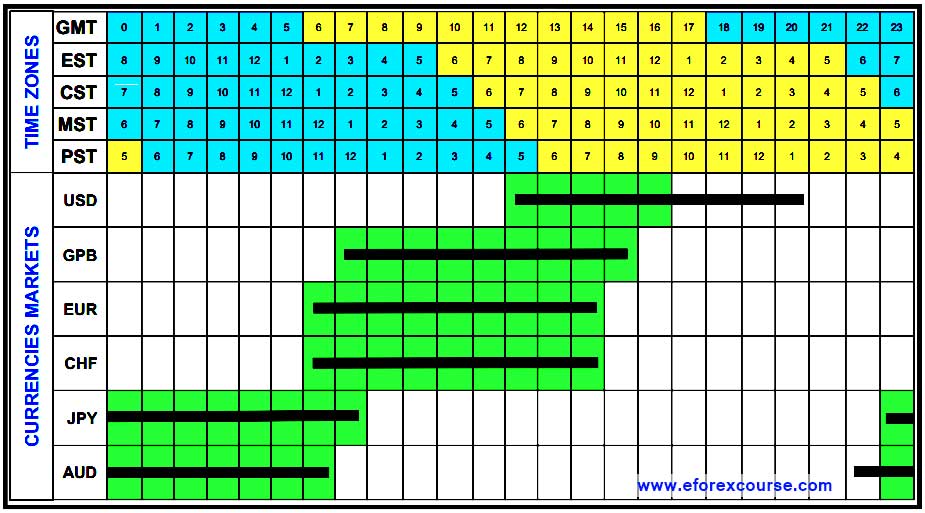

London, the bustling metropolis that serves as a hub for global finance, welcomes the morning sun as traders from various continents converge to set the market in motion. This period, spanning from 8:00 AM to 11:00 AM GMT, marks the commencement of robust trading activities. As the clock strikes noon in the heart of Europe, the baton of market dominance passes to New York, where the North American financial center takes the reins. From 1:00 PM to 4:00 PM EST, the trading tempo remains vigorous.

Yet, the global forex dance does not cease as dusk descends upon New York. The torch is passed to Tokyo, the financial beacon of the East, where trading intensifies once more from 7:00 PM to 11:00 PM JST. These overlapping trading sessions, harmoniously orchestrated across different time zones, create a continuous tapestry of market activity, offering traders a wealth of opportunities to capitalize upon price movements.

Defying the Myth of One-Size-Fits-All: Tailoring Trading Times to Your Unique Strategy

Identifying the best trading times for you extends beyond aligning with global market hours. Delving into the diverse trading strategies employed by forex practitioners, we discern that the optimal timing hinges upon the specific strategy adopted.

Scalpers, those adept at exploiting fleeting market fluctuations, thrive during peak trading hours. The high liquidity and volatility present during these intervals provide the ideal environment for their rapid-fire trades. On the other hand, swing traders, who seek to capture larger price movements over extended periods, may prefer off-peak hours when market volatility subsides. These quieter periods offer opportunities to identify and capitalize upon emerging trends.

Image: s3.amazonaws.com

A Master’s Counsel: Insider Tips for Maximizing Trading Outcomes

Harnessing the collective wisdom of seasoned forex traders, we have compiled an invaluable compendium of expert advice:

-

Prioritize Liquidity: Seek trading times when market liquidity is at its zenith. Higher liquidity ensures tighter spreads and smoother execution of trades, minimizing slippage risks.

-

Embrace Volatility: Volatility, often perceived as a formidable foe, can be a trader’s ally when judiciously managed. Target trading times when volatility is elevated, as it can amplify profit potential.

-

Monitor Economic Events: Keep a keen eye on economic events that may impact currency prices. These events, often scheduled during specific time slots, can trigger substantial market movements, affording astute traders the opportunity to capitalize upon market reactions.

-

Capitalize on News Releases: News releases, with their power to sway market sentiments, present unparalleled trading opportunities. Study the forex calendar to align your trading activities with scheduled news events, maximizing the chances of profiting from market reactions.

Unveiling the Mysteries of Forex Trading: A Comprehensive FAQ

Q: What factors should I consider when determining the best trading times?

A: Market liquidity, volatility, economic events, news releases, and your personal trading strategy are key factors to evaluate.

Q: Are there specific currency pairs that are more suitable for certain trading times?

A: Certain currency pairs exhibit more pronounced activity during particular trading sessions. For instance, the EUR/USD pair tends to be more volatile during the European and American trading sessions.

Q: How can I stay updated on economic events and news releases?

A: Economic calendars and reputable financial news sources provide real-time updates on scheduled events and their potential impact on currency markets.

Q: Is it essential to trade during peak trading hours?

A: While peak trading hours offer increased liquidity and volatility, they are not exclusively the best trading times. Off-peak hours can present opportunities for swing traders or those preferring a less hectic trading environment.

Q: Can I automate my trading to capitalize on optimal trading times?

A: Forex trading platforms offer automated trading tools, enabling traders to set parameters for trade execution based on predetermined criteria, including specific trading times.

Best Times To Trade The Forex

The Path Forward: Embracing the Art of Timing in Forex Trading

Unveiling the best trading times in forex requires a multi-faceted approach that encompasses market dynamics, trading strategy, and individual preferences. By meticulously considering these factors and leveraging the expert insights provided, you can elevate your trading prowess and navigate the ever-shifting landscape of the forex market with greater confidence and precision.

As you embark on this transformative journey, let us leave you with this final question: Are you ready to embrace the art of timing in forex trading and witness the transformative power it holds for your financial endeavors?