In the realm of foreign exchange (forex) trading, leverage has emerged as a pivotal tool that can supercharge your profits—or magnify your losses. By effectively harnessing the power of leverage, you can amplify your returns without accumulating excessive capital. However, wielding this financial magnifier requires a thorough understanding of its intricacies and potential risks.

Image: www.compareforexbrokers.com

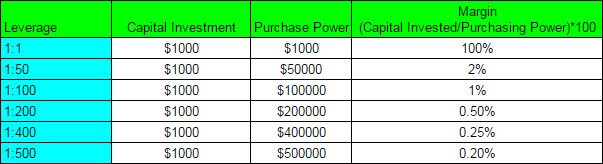

Simply put, leverage allows forex traders to control a larger amount of currency—up to hundreds or even thousands of times their account balance—using a relatively small deposit (known as margin). This financial leverage enables traders to take more significant positions and potentially reap bigger gains. For instance, a trader with a $1,000 account and 100:1 leverage can trade $100,000 worth of currency.

The Ups and Downs of Leverage

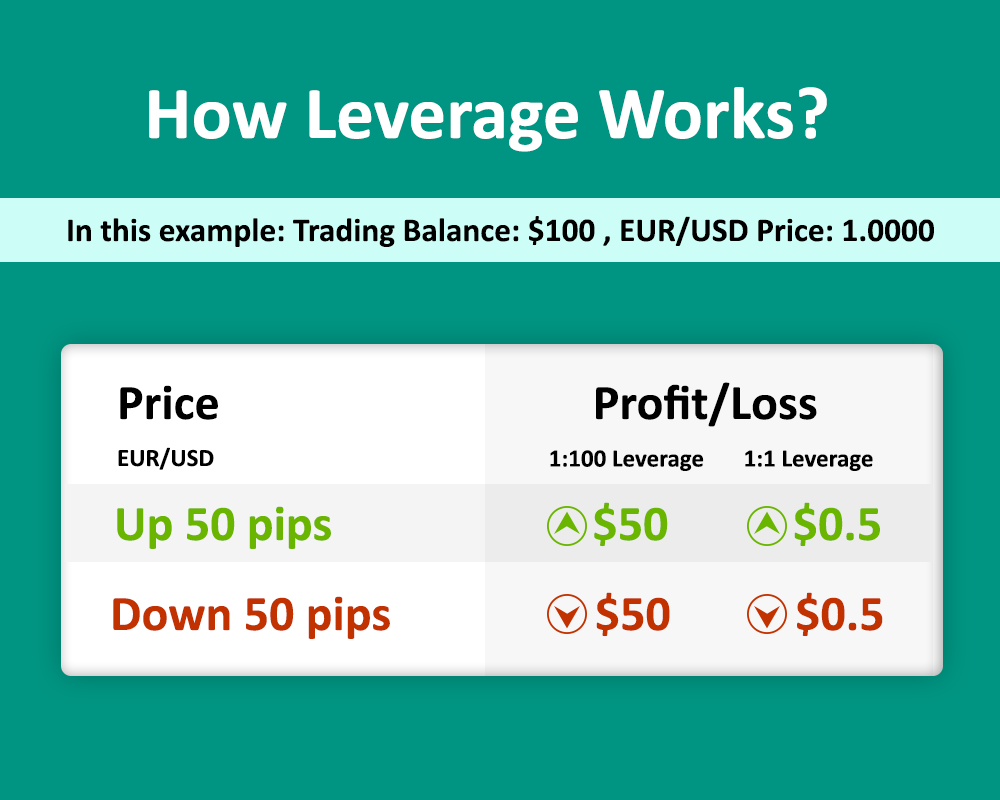

While leverage can be a potent tool in the forex arsenal, it demands caution. The high returns it offers come at a price—the potential for substantial losses. As leverage amplifies gains, it also multiples losses.

Consider the case of a trader with 100:1 leverage and a $1,000 account. If the chosen currency pair moves against them by 1%, they will lose $100—a hefty 10% drop in their account balance. This underscores the importance of understanding your risk tolerance and implementing sound risk management practices.

Finding the Optimal Leverage Ratio

Determining the appropriate leverage ratio—the amount of leverage you can safely utilize—requires careful consideration. Factors to weigh include your:

- Risk tolerance: Assess your emotional and financial capacity to withstand losses.

- Trading strategy: Analyze how leverage fits into your trading style, objectives, and the specific strategies you employ.

- Market conditions: Fluctuating market volatility may necessitate adjustments to your leverage ratio.

- Account size: Larger accounts can typically support higher leverage levels.

As a general rule of thumb, novice traders are advised to start with lower leverage ratios, such as 10:1 or 20:1. As you gain experience and develop a deeper understanding of forex trading, you may gradually increase your leverage ratio, but always within the bounds of prudent risk management.

Image: howtotradeonforex.github.io

Best Leverage For Forex Account

Practical Considerations for Leveraged Trading

To maximize your potential in leveraged trading, consider incorporating the following guidelines into your approach:

- Use stop-loss orders: These pre-determined exit points can safeguard your account by automatically closing positions when the market moves against you, limiting potential losses.

- Manage your risk-to-reward ratio: Aim for trades with favorable risk-to-reward ratios, ensuring that your potential profits outweigh potential losses.

- Test your strategy thoroughly: Before risking real capital, simulate your trading strategy using a demo account to gain familiarity and fine-tune your approach.

- Continuously monitor market conditions: Monitor market news, economic data releases, and technical indicators to anticipate potential price fluctuations and adjust your leverage accordingly.

- Stay disciplined: Avoid over-leveraging and stick to your predefined risk management rules.

Leverage, when harnessed wisely, can become a formidable tool for amplifying your forex profits. By carefully considering your risk tolerance, employing sound risk management practices, and continuously evaluating market conditions, you can unlock the full potential of leverage while mitigating its inherent risks.

Remember, forex trading involves inherent risks, and past performance is not indicative of future results. Approach leveraged trading with caution, and always consult with a reputable forex broker before making any investment decisions.