The foreign exchange market, also called Forex, is the world’s largest and most liquid financial market.

Image: zufabodoryteb.web.fc2.com

With a daily trading volume that exceeds $5 trillion, Forex offers opportunities for both novice and experienced traders alike.

The allure of Forex Trading

One of the main reasons why Forex trading has become so popular is because it offers the potential for high returns.

With a leverage of 100:1 or more, successful traders can multiply their earnings and establish financial independence within a short timeframe.

The Challenges of Forex Trading

However, Forex trading also poses various challenges.

Without proper knowledge and preparation, traders can quickly lose funds.

The market is highly volatile, and it requires constant monitoring and timely execution of trades.

Overcoming the Challenges with a Solid Forex Trading System

To increase your chances of success in Forex trading, implementing a reliable trading system is crucial.

A comprehensive Forex trading system should include well-defined parameters for entering and exiting trades, risk management strategies, and profit maximization techniques.

Following a structured approach can help you make informed decisions, manage your risks effectively, and increase your earning potential.

Image: tqm.hairflair-garching.de

The Best Forex Trading System

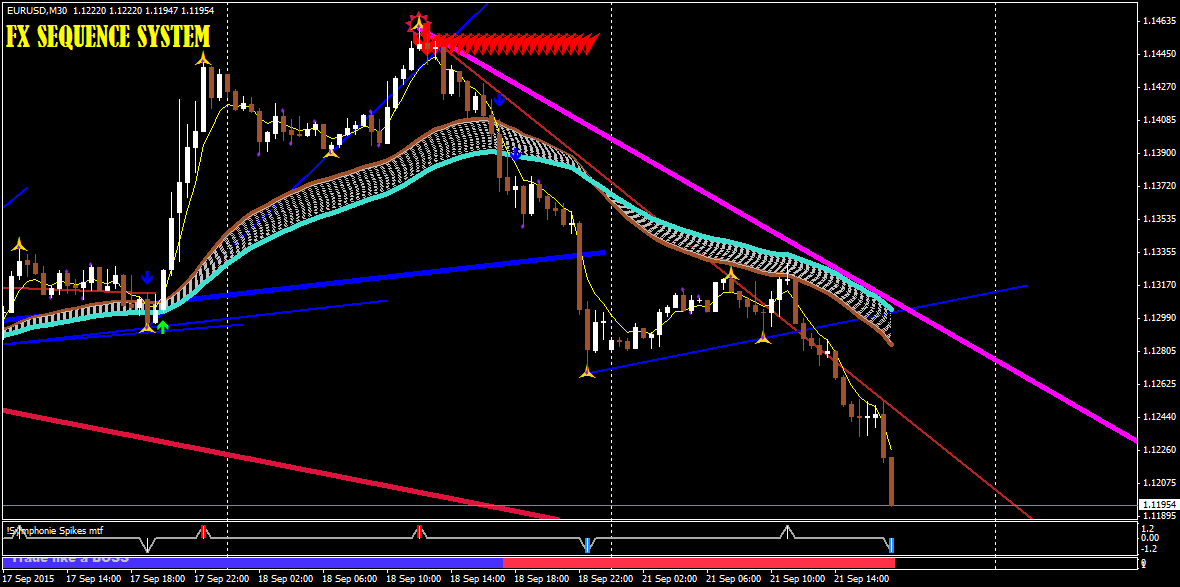

The best forex trading system involves combining a robust methodology with technical analysis,

such as the Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands.

Technical analysis indicates the trend and momentum of a currency pair by studying its past price movements, volume, and other relevant indicators.

Identifying key support and resistance levels can help you determine areas where prices are likely to bounce or reverse, providing opportune moments to enter or exit trades.

Technical Indicators

RSI measures the strength of a trend by calculating its magnitude and duration.

MA shows the average price of a currency pair over a specified period, providing insights into the overall trend.

Bollinger Bands define areas of price movement, helping identify opportunities to buy or sell.

Listen to the Experts

The Importance of a Trading Plan

A clearly defined trading plan is essential for success in Forex trading.

A well-thought-out plan should include your trading objectives, risk tolerance, and entry and exit strategies.

The presence of a trading journal can offer valuable insight into your trading performance and allow you to identify areas for improvement.

By following a disciplined approach and constantly evaluating and adapting your strategy, you can increase your chances of generating consistent profits.

Frequently Asked Questions

How much capital is required to start Forex trading?

The initial capital needed varies depending on the account’s currency, the broker, and individual risk appetite.

Some brokers may offer micro accounts with minimum deposits as low as $25.

However, traders should consider starting with an initial capital of at least $1000 to maintain sufficient risk diversification and trading flexibility.

What are the risks involved in Forex trading?

Forex trading carries significant financial risks.

The market’s volatility, leverage, and unpredictable nature can result in substantial losses for traders.

Risk management strategies and proper execution of trades are crucial for mitigating these risks.

How do I find a reliable Forex broker?

Conduct thorough research to identify reputable and licensed brokers with a proven track record.

Check for regulatory compliance, platform reliability, and customer support, and seek advice from experienced traders or online forums.

Conclusion

With the right system and a disciplined approach, Forex trading offers opportunities for financial success.

By utilizing reliable trading strategies, practicing risk management, and constantly adapting to market conditions, traders can improve their chances of consistent profitability.

Best Forex Trading System Only Profit

Call to Action

Embark on your Forex trading journey today by researching reliable brokers and adopting a well-defined trading system.

Follow the tips and expert advice outlined in this article to increase your chances of success and attain financial freedom through Forex trading.