In the enthralling realm of currency trading, where fortunes can be made and lost with each passing moment, devising a winning forex strategy is paramount. This comprehensive guide will unveil the secrets of the most effective forex strategies, empowering you to outsmart the markets and secure financial success.

Image: www.youtube.com

Throughout this article, we will explore proven trading techniques, analyze market trends, and provide expert advice to elevate your forex game. Are you ready to uncover the strategies that will unlock your trading potential?

Understanding Forex Trading Strategies

Defining Forex Trading Strategies

Forex trading strategies are systematic plans that guide traders in making informed decisions about when and how to enter and exit currency trades. These strategies provide a framework for analyzing market conditions, identifying trading opportunities, and managing risk.

Types of Forex Trading Strategies

The forex market offers a vast array of trading strategies, each with its unique characteristics and risk-reward profile. Some common strategies include:

- Scalping: involves making multiple small trades within a short time frame.

- Day Trading: focuses on opening and closing positions within the same trading day.

- Swing Trading: holds trades for several days or weeks to capture larger price movements.

- Trend Following: seeks to trade with the prevailing market trend, profiting from bullish or bearish price action.

- Counter-Trend Trading: aims to identify and trade against short-term market reversals.

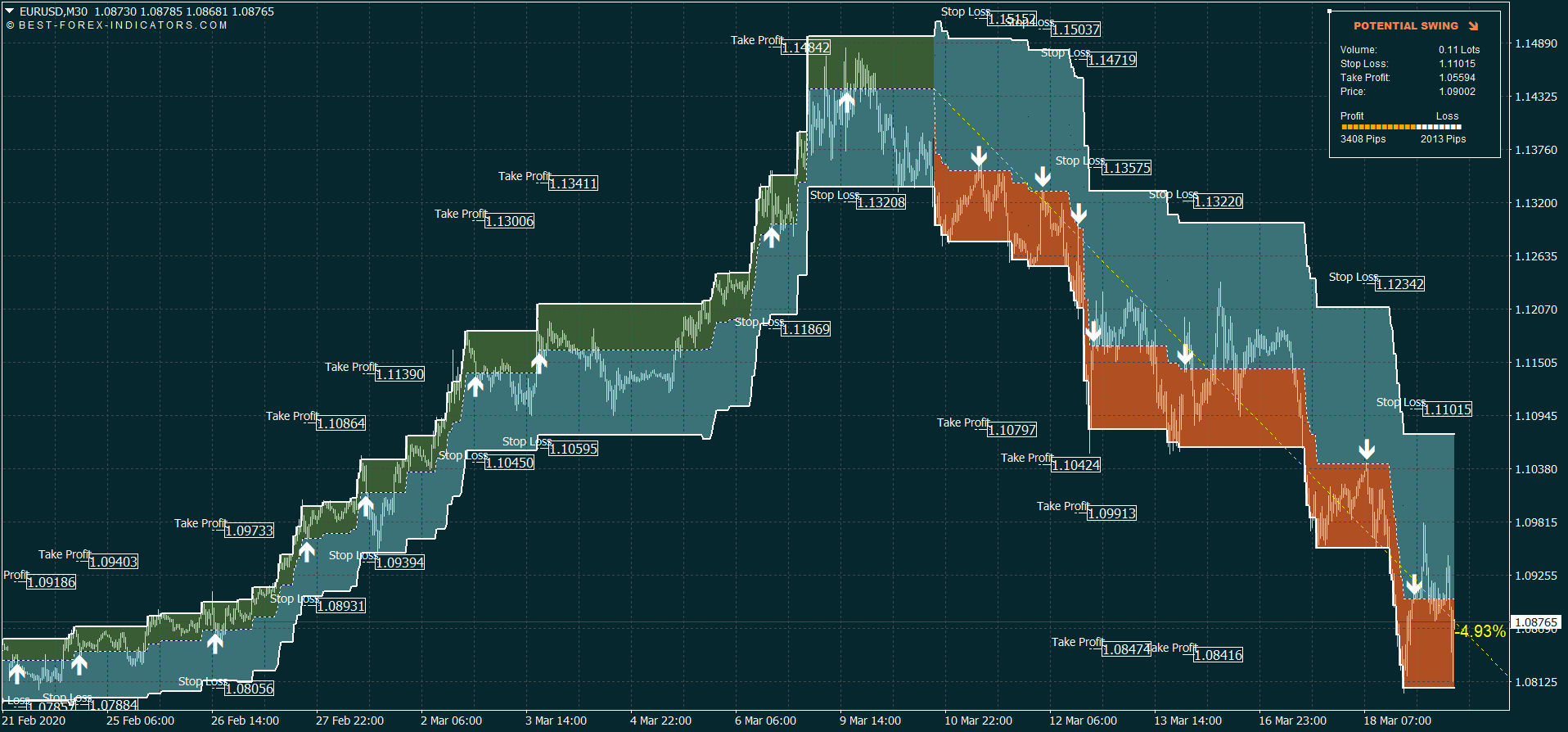

Image: best-forex-indicators.com

Essential Forex Strategies for Beginners and Experienced Traders

The Moving Average Strategy

The Moving Average (MA) strategy is a widely used technical analysis tool that helps traders identify market trends and potential trading opportunities. It involves calculating the average price of a currency over a specific period, smoothing out price fluctuations and revealing the underlying trend.

Traders can use MAs to identify support and resistance levels, confirm current trends, and make informed decisions about trade entry and exit points.

Support and Resistance Trading

Support and resistance levels represent significant price points where the market tends to bounce back or reverse its direction. Identifying these levels allows traders to place stop-loss orders (to limit losses) below support levels and take-profit orders (to realize profits) above resistance levels.

By understanding the behavior of price near support and resistance zones, traders can increase their chances of making profitable trades.

Stochastic Oscillator Strategy

The Stochastic Oscillator is a momentum indicator that helps traders identify overbought and oversold market conditions. It compares the closing price of a currency pair to its price range over a specific period, indicating whether the market is in a bullish or bearish phase.

When the oscillator is near 80, it suggests that the market is overbought and may be due for a pullback. Conversely, when it falls below 20, it indicates that the market is oversold and may experience a rebound.

Staying Up-to-Date with Forex Market Trends

In the ever-evolving forex market, keeping abreast of the latest trends and developments is crucial for successful trading. Here are some ways to stay informed:

- Economic News: Monitor economic releases such as inflation reports, GDP data, and interest rate announcements that can significantly impact currency prices.

- Central Bank Updates: Follow statements and decisions by central banks, as their monetary policies can trigger substantial market movements.

- Market Analysis: Read insights from reputable brokers, financial analysts, and news sources to gain expert perspectives on market outlook.

- Social Media: Engage with trading communities and forums on social media platforms to gather real-time information and exchange ideas with fellow traders.

Tips and Expert Advice for Successful Forex Trading

Here are some invaluable tips and expert advice to enhance your forex trading skills:

- Define Your Trading Plan and Strategy: Outline your trading goals, risk tolerance, and specific strategies before entering the market.

- Practice with a Demo Account: Test your strategies and gain experience without risking real capital.

- Manage Your Risk Effectively: Use stop-loss orders, position sizing, and leverage to mitigate losses and preserve capital.

- Control Your Emotions: Avoid making impulsive trades based on fear or greed. Stay disciplined and execute your trading plan.

- Stay Informed and Adaptive: Regularly monitor market news, analyze trends, and adapt your strategies as the market evolves.

By implementing these tips, you can increase your chances of becoming a successful forex trader.

Frequently Asked Questions (FAQs) on Forex Trading Strategies

To address some common questions about forex trading strategies, here are concise answers:

- Q: What is the best forex trading strategy for beginners?

A: Moving Average and Support and Resistance strategies are suitable for beginners due to their simplicity and effectiveness. - Q: How can I minimize risks in forex trading?

A: Practice risk management techniques such as stop-loss orders, position sizing, and proper leverage. - Q: How can I stay updated with the latest market trends?

A: Monitor economic news, follow central bank updates, read market analysis, and engage with online trading communities. - Q: Are there any guarantees in forex trading?

A: Forex trading involves inherent risks. While strategies can enhance decision-making, there is no guarantee of success.

Best Forex Strategies That Work

Conclusion

Navigating the complexities of forex trading can be daunting, but with the right strategies and knowledge, you can unlock the potential for financial success. By applying the principles outlined in this guide, from identifying support and resistance levels to monitoring market trends, you empower yourself to make informed trading decisions and maximize your profits.

Remember, the journey to becoming a proficient forex trader is an ongoing process. Embrace the learning curve, adapt your strategies, and stay updated with market dynamics to achieve your financial goals. Are you ready to embark on this exciting and potentially rewarding journey?