Every Forex trader seeks the upper hand, and that’s where Forex expert advisors (EAs) come into play. These automated trading tools can empower traders with data-driven insights and execution capabilities that human traders may struggle to match. Among the many types of EAs, currency strength meters stand out as invaluable instruments for understanding market dynamics. This comprehensive guide will delve into the world of Forex EA currency strength meters, empowering you with the knowledge to navigate volatile markets like a seasoned professional.

Image: play.google.com

What is a Forex EA Currency Strength Meter?

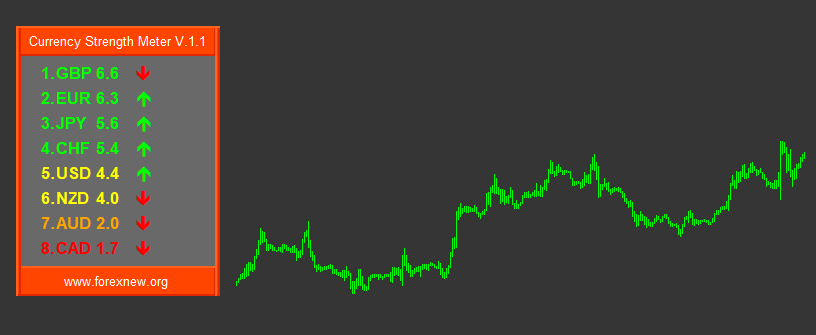

A Forex EA currency strength meter is a sophisticated trading tool that analyzes various technical factors to determine the relative strength or weakness of different currency pairs. By assessing indicators such as moving averages, oscillators, and price action patterns, these EAs provide traders with actionable insights into market trends and potential trading opportunities. Understanding currency strength is crucial, as it can give traders an edge in making informed trading decisions.

Why Use a Forex EA Currency Strength Meter?

Forex EA currency strength meters offer a multitude of benefits that can elevate your trading game:

- Objectivity and Accuracy: EAs are free from emotions and biases that can cloud human judgment, providing traders with clear and unbiased market assessments.

- Real-time Monitoring: These EAs work diligently, constantly monitoring market conditions and providing traders with up-to-date insights, allowing for more nimble trading decisions.

- Technical Analysis Expertise: Currency strength meters employ advanced technical analysis techniques that can be challenging for novice traders to grasp and implement. EAs automate these processes, making the insights accessible to traders of all experience levels.

- Data-Driven Decisions: By leveraging data and objective metrics, currency strength meters offer a solid foundation for making informed trading decisions rather than relying solely on gut instinct.

- Automation: These EAs automate the analysis process, freeing up traders’ time for other aspects of their trading or personal life.

How to Choose the Best Forex EA Currency Strength Meter

Selecting the best Forex EA currency strength meter requires consideration of the following factors:

- Compatibility: Ensure the currency strength meter is compatible with your trading platform and your preferred trading style.

- Accuracy and Reliability: Look for EAs with a proven track record of reliable performance and accurate market analysis.

- Customization Options: Choose an EA that allows you to customize the parameters and settings to match your trading preferences.

- Support and Updates: Opt for EAs backed by responsive support and regular updates to ensure optimal performance.

- User Reviews: Explore user reviews and testimonials to gain insights into the real-world experiences of other traders.

Image: forexwine.com

Best Forex Ea Currency Strength Meter

Conclusion

Forex EA currency strength meters are pivotal trading tools that equip traders with invaluable market insights. By automating complex analysis, these EAs empower traders to make informed decisions, navigate market volatility, and optimize their trading strategies. Embracing the power of currency strength meters can enhance your trading journey, enabling you to unlock the potential of the Forex market. So, whether you’re a seasoned veteran or a novice just starting out, consider harnessing the power of Forex EA currency strength meters to elevate your trading game to new heights.