Pip – the Pivotal Unit of Currency Fluctuations

In the enigmatic realm of forex trading, where global currencies dance in an intricate ballet of exchange rates, the pip emerges as a fundamental unit of measurement. A pip, an acronym for “point in percentage,” represents the fractional change in the value of a currency pair. This seemingly minute movement can hold profound implications for traders, as even the slightest pip fluctuation can cascade into substantial gains or losses.

Image: alpari.com

A Pip’s Journey: From Concept to Calculation

The concept of a pip is deeply rooted in the structure of exchange rates. Currency pairs are quoted in terms of their relative values, with one currency serving as the base and the other as the quote. As currency values fluctuate, the pip quantifies the change in the quote currency’s value relative to the base currency.

For currency pairs involving the US dollar (USD), the pip is typically defined as the fourth decimal place. For instance, if the EUR/USD exchange rate shifts from 1.1234 to 1.1235, the pip movement is one, indicating a one-pip appreciation of the euro against the US dollar.

The Nuances of Pip Calculations

Pip calculations can vary depending on the currency pair and the currency units involved. For major currency pairs like EUR/USD, GBP/USD, and USD/JPY, one pip is generally equivalent to 0.0001. However, for currency pairs involving the Japanese yen, the pip value is typically 0.01 since the yen is quoted in hundredths instead of thousandths.

To grasp the impact of pip movements, it’s crucial to consider the lot size in a given trade. A lot represents a standardized unit of currency, typically worth 100,000 units of the base currency. Therefore, a one-pip gain or loss on a standard lot of EUR/USD translates into a profit or loss of 10 euros.

Pips in Perspective: The Significance of Fractional Shifts

While pips may seem insignificant at first glance, their cumulative impact can be substantial. In high-volume trading, even small pip movements can result in significant profits or losses. For instance, if a trader holds a long position of 10 standard lots of EUR/USD and the exchange rate rises by 100 pips, their profit amounts to 1000 euros. Conversely, a 100-pip drop would incur a loss of the same magnitude.

The significance of pips is particularly pronounced in scalping strategies, where traders capitalize on short-term fluctuations by entering and exiting trades rapidly. In scalping, even a few pips of profit per trade can add up to substantial gains over time.

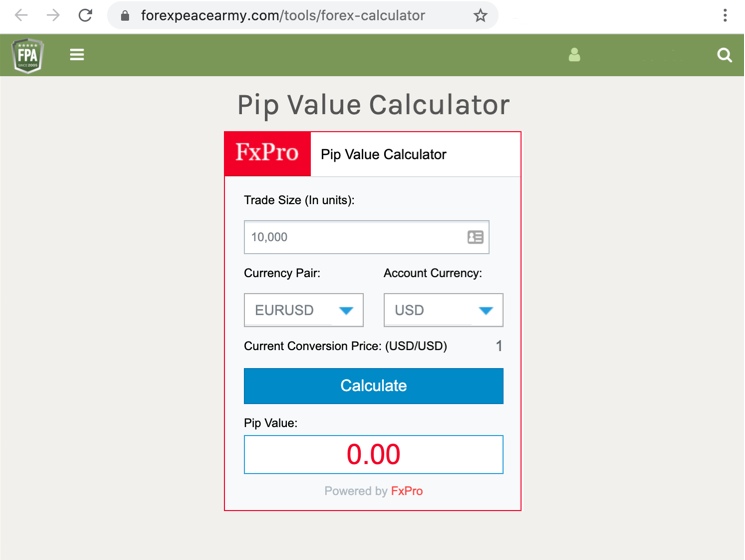

Image: www.forexpeacearmy.com

Leverage: A Double-Edged Sword in the Pip Arena

Leverage, a common tool in forex trading, amplifies both the profit potential and the risk associated with pips. Leverage allows traders to control a larger position size with a smaller initial investment, thereby increasing the potential returns. However, it also magnifies the impact of pip movements, exacerbating both potential gains and losses.

How Much Is One Pip

https://youtube.com/watch?v=abiUBnX8hkU

Conclusion: Mastering Pips for Forex Success

In the unforgiving arena of forex trading, understanding pips is paramount. These seemingly minuscule units of currency fluctuation hold the power to shape trading outcomes, offering opportunities for both profit and loss. By mastering the concept of pips, calculating their movements, and appreciating their significance, traders can navigate the currency markets with greater precision and confidence.

Remember, the path to forex mastery lies not only in technical proficiency but also in the art of handling risk and managing emotions. As you embark on your trading journey, embrace a spirit of continuous learning, pragmatic decision-making, and unwavering resilience. With dedication and a commitment to excellence, you can unlock the true potential of pips and conquer the dynamic world of foreign exchange trading.