In the realm of forex trading, currency pairs are the traded assets, representing the value of one currency relative to another. Understanding the value of a pip, or percentage in point, is crucial for savvy traders, as it determines the profit or loss potential for each trade. Embark on this comprehensive journey to unriddle the essence of a pip, empowering you with valuable insights that can unlock market success.

Image: muladharayogawear.com

Understanding the Pip: A Cornerstone of Forex Trading

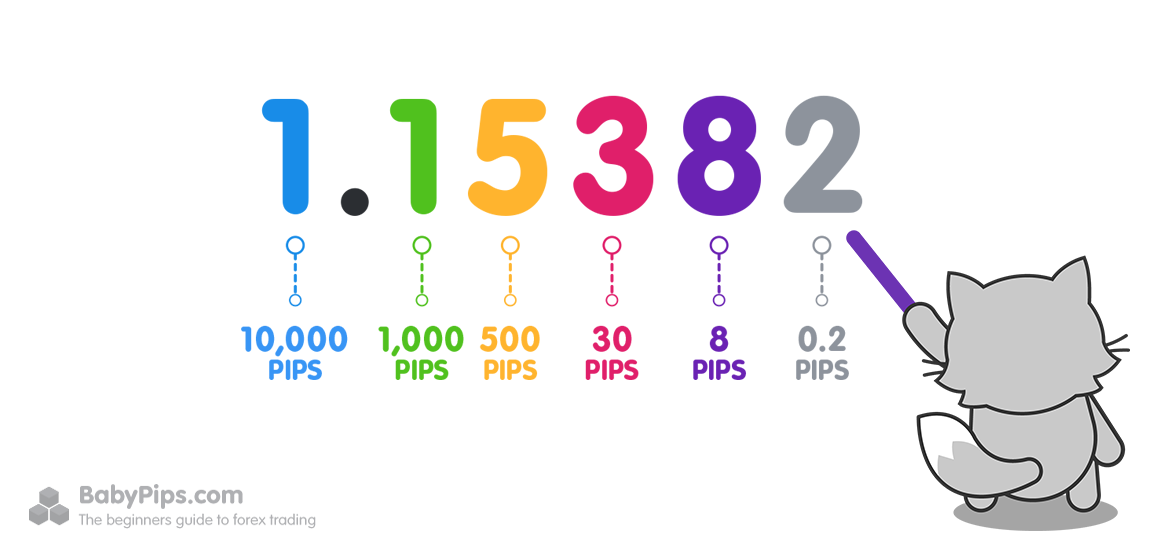

A pip, also known as a point in percentage, represents the smallest price increment in a currency pair quotation. Forex markets commonly display prices to the fourth decimal place, making a pip the fourth digit after the decimal point. For instance, if the EUR/USD currency pair is quoted at 1.0629, a one-pip movement would be to 1.0630.

The significance of a pip lies in its monetary value, which varies based on the trade size or lot. A standard lot represents 100,000 units of the base currency, while a mini lot is 10,000 units. Therefore, if the EUR/USD exchange rate moves by one pip, the trader’s profit or loss on a standard lot would be 10 euros or 100 pips for a mini lot.

Pip Values: Unveiling the Monetary Impact

The value of a pip varies drastically depending on the currency pair and the trade size. To determine the precise value, traders can use the following formula:

Pip value = (1 pip / exchange rate) * trade sizeLet’s delve into a practical example. Suppose the EUR/USD exchange rate is 1.0629 and the trader places a standard lot trade (100,000 euros). If the market moves in favor of the trader, resulting in a one-pip gain, their profit would be:

Pip value = (1 pip / 1.0629) * 100,000 = 10 eurosThe pip value, in this case, is 10 euros. It’s important to consider that currency pairs with a higher exchange rate will have a lower pip value. Conversely, pairs with a lower exchange rate will yield a higher pip value.

Mastering Pip Calculations: A Path to Precision

Proficient pip calculations empower traders with the ability to evaluate potential profits and losses accurately. Let’s explore two fundamental scenarios that traders encounter:

1. Calculating Pip Gain/Loss:

If the EUR/USD exchange rate moves from 1.0629 to 1.0631, representing a 2-pip gain, the trader’s profit on a standard lot trade would be:

Profit = (2 pips / 1.0629) * 100,000 = 20 euros2. Determining the Required Pip Movement:

Suppose a trader aims to secure a profit of 50 euros on a standard lot trade of EUR/USD at 1.0629. To calculate the necessary pip movement, the formula is:

Required pips = (Desired profit * exchange rate) / trade sizeRequired pips = (50 euros * 1.0629) / 100,000 = 5 pipsBy mastering pip calculations, traders gain the ability to make informed decisions, set realistic targets, and manage their risk effectively.

Image: howtotradeonforex.github.io

Leveraging Pips in Forex Trading: A Journey to Profits

Harnessing the knowledge of pip value opens up a realm of trading possibilities. Here are some key strategies:

1. Pip Scalping:

Scalpers capitalize on small price movements, executing numerous trades within a short time frame. By accumulating small pip profits, they aim to generate substantial returns.

2. Range Trading:

Range traders identify price consolidation zones and place orders near support and resistance levels. Their strategy involves buying at the support level and selling at the resistance level, profiting from price fluctuations within the range.

3. Trend Following:

Trend followers ride the wave of established market trends, buying in uptrends and selling in downtrends. They hold positions for extended periods, accumulating pips as the trend progresses.

How Much Is 1 Pip

Conclusion: Unveiling Market Insights, Maximizing Trading Potential

Understanding the concept of a pip is an essential cornerstone for successful forex trading. By grasping its significance, traders can unlock a wealth of market insights, empowering them to make informed decisions and optimize their profit potential. Embracing the strategies discussed in this article, coupled with diligent practice, can propel you toward trading mastery. Remember, the key to success lies in knowledge, precision, and a deep-seated understanding of market dynamics. Embrace this knowledge and embark on your path to financial freedom.