Embarking on the thrilling journey of automated forex trading? Harnessing the power of a robust trading platform is essential. Join us as we delve into the world of the best automated forex trading software, equipping you with the knowledge to select the perfect companion for your trading endeavors.

Image: yzyjifoh.web.fc2.com

Unveiling the Power of Automated Forex Trading

Automated forex trading is the utilization of software programs to execute trades on your behalf, freeing you from the time-consuming and often exhausting tasks of monitoring markets and manually placing orders. These platforms leverage sophisticated algorithms, technical indicators, and risk management tools to streamline your trading, allowing you to capitalize on market opportunities with greater precision and efficiency.

Advanced Algorithms: Precision at Your Command

Automated forex trading software employs advanced algorithms engineered to interpret market data and identify trading opportunities in real-time. Armed with technical indicators and statistical models, these platforms analyze historical price movements, market trends, and economic news, enabling you to make informed decisions based on reliable data rather than emotions.

Navigating the Software Landscape: Essential Factors

Selecting the optimal automated forex trading software requires considering several key factors. Assess your trading style and determine the features that align with your specific needs. Seek platforms that offer intuitive user interfaces, seamless order execution, and robust risk management tools to safeguard your investments.

Image: bestonlineforextradingsoftware.blogspot.com

Customization: Tailor Software to Your Trading Strategy

Customization is paramount when selecting automated forex trading software. Look for platforms that allow you to configure algorithms, customize indicators, and set risk parameters that match your trading style. This tailored approach ensures that the software operates in sync with your trading strategy, maximizing your chances of success.

Staying Ahead of the Curve: Latest Trends and Developments

The automated forex trading landscape is a dynamic one, constantly evolving with new technologies and innovations. Stay abreast of the latest trends by monitoring industry news, participating in online forums, and engaging with thought leaders on social media. This knowledge will empower you to harness the most cutting-edge tools available.

Trade Safely: Embrace Risk Management Controls

Remember, forex trading carries inherent risks. Mitigating these risks is crucial for long-term success. Choose automated forex trading software that includes robust risk management features such as stop-loss and take-profit orders. By implementing these protective measures, you can limit potential losses and safeguard your capital in volatile market conditions.

Expert Advice: Insights from Seasoned Traders

Seasoned forex traders have navigated the complexities of the market and possess invaluable insights to share. Seek their guidance to gain a deeper understanding of automated trading software, identify best practices, and avoid common pitfalls. Their experience-based knowledge can provide a significant advantage.

Leverage Strategies of Successful Traders

Emulate the strategies of successful traders to elevate your own trading game. Study their approaches, identify the technical indicators they employ, and analyze their risk management practices. Incorporating their insights into your own trading methodology can enhance your performance, bringing you closer to achieving your financial goals.

FAQs: Demystifying Automated Forex Trading

Q: Is automated forex trading legal?

A: Yes, automated forex trading is legal in most jurisdictions. However, it’s essential to adhere to regulatory guidelines and avoid platforms that engage in illegal activities.

Q: How much money do I need to start automated forex trading?

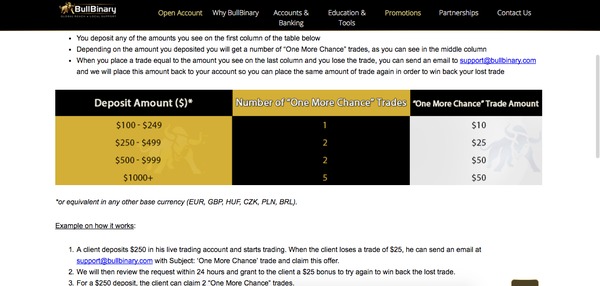

A: The initial capital required varies depending on the trading platform and your trading strategy. Consult with the software providers to determine the minimum deposit amounts.

Q: Does automated forex trading offer guaranteed profits?

A: No, forex trading, including automated trading, involves risk, and there are no guarantees of profit. Conduct thorough research and practice risk management strategies to minimize potential losses.

Best Automated Forex Trading Software 2016

Conclusion: Empowering Traders with Automation

Embracing automated forex trading software can revolutionize your trading experience, empowering you with precision, efficiency, and risk mitigation. Carefully consider the factors outlined in this article to select the platform that aligns with your goals. By staying informed about the latest trends and leveraging expert advice, you position yourself for success in the dynamic world of forex trading.

Are you ready to unlock the potential of automated forex trading? Let us guide you on the path to market dominance. Explore our recommended software picks and embark on an extraordinary trading journey today.