Currencies are traded in pairs in the foreign exchange market, and the first currency listed in a pair is the base currency.

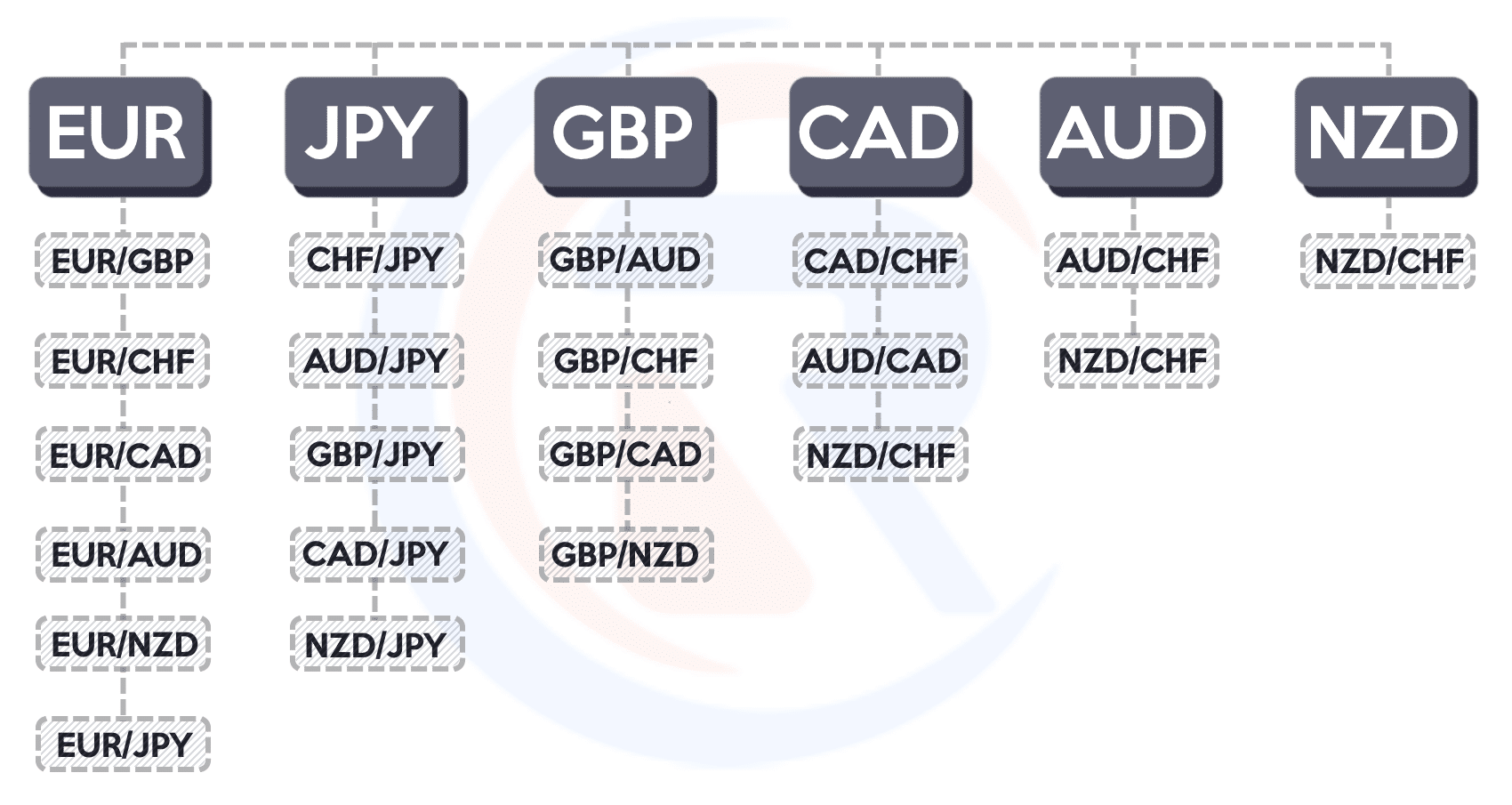

Image: www.tradingwithrayner.com

The base currency is the currency that is being evaluated against the second currency, known as the counter currency or quote currency. The value of the base currency is expressed in terms of the counter currency.

Understanding the Role of the Base Currency

The base currency plays a crucial role in determining the exchange rate of the currency pair. For instance, if the currency pair is EUR/USD, the base currency is the Euro (EUR) while the counter currency is the US Dollar (USD).

In this case, the exchange rate would represent the value of one Euro in US Dollars. If the exchange rate is 1.1234, it implies that one Euro is worth 1.1234 US Dollars at the present moment.

Factors Influencing the Base Currency

The value of the base currency can fluctuate based on several factors, including economic conditions, interest rate differentials, political stability, and global market trends.

For example, if the economy of the country issuing the base currency is performing well, with low inflation and a stable political environment, the base currency tends to appreciate against other currencies.

Importance of Choosing the Right Base Currency

Selecting the appropriate base currency is essential for effective currency trading. Traders typically choose a base currency that they are familiar with or that represents their home country’s currency.

By doing so, they can more easily understand the exchange rate movements and make informed trading decisions. It also simplifies calculations and reduces the risk of misinterpreting the exchange rate.

Image: the5ers.com

Tips for Choosing the Base Currency

1. Consider your Trading Strategy: If your trading strategy involves frequent currency conversions, selecting a base currency with low transaction costs and high liquidity, such as the US Dollar or Euro, would be beneficial.

2. Market Analysis: Analyze the economic conditions and market trends of the countries issuing the potential base currencies. Choose a currency that shows signs of stability and growth.

Frequently Asked Questions (FAQs)

Q: What is the difference between a base currency and a counter currency?

A: The base currency is the first currency listed in a currency pair, while the counter currency is the second currency. The base currency’s value is expressed in terms of the counter currency.

Q: Can I choose any currency as the base currency?

A: While it is possible to select any currency as the base currency, it is generally advisable to choose a major currency with high liquidity and low transaction costs, such as the US Dollar or Euro.

Q: How does the base currency affect my trading profits?

A: The base currency influences the calculation of your trading profits or losses. If the base currency appreciates against the counter currency, your profit will increase, but if it depreciates, your profit will decrease.

Conclusion

Understanding the concept of the base currency is crucial for success in the foreign exchange market. By carefully considering the factors discussed above, traders can select the appropriate base currency that aligns with their trading strategy and risk tolerance.

Remember, whether you are a seasoned trader or just starting out, staying informed about the latest currency pair base currency trends and developments will empower you to make informed decisions and enhance your trading performance.

Currency Pair Base Currency

Are you interested in learning more about currency pair base currency?

If so, I encourage you to conduct further research and consult with experienced traders or financial experts to gain a deeper understanding of this fundamental concept in the world of currency trading.