Introduction

Imagine stepping into the realm of financial markets, eager to conquer the mysteries of currency trading. As you navigate this captivating world, the concept of “price action” emerges, a beacon guiding you towards informed decision-making. In this comprehensive guide, we illuminate the intricacies of price action forex trading, empowering you with the knowledge and strategies to conquer financial markets. Discover the secrets of this esteemed trading technique and embark on a journey of financial success.

Image: e-purse.blogspot.com

Understanding Price Action

Price action, the cornerstone of technical analysis, deciphers the language of currency price movements. It’s a visual representation of how market forces collide, shaping patterns and trends that reveal the underlying sentiments and intentions of traders. By scrutinizing historical price data, traders can unravel valuable insights, predict future market direction, and make informed trading decisions.

Key Elements of Price Action

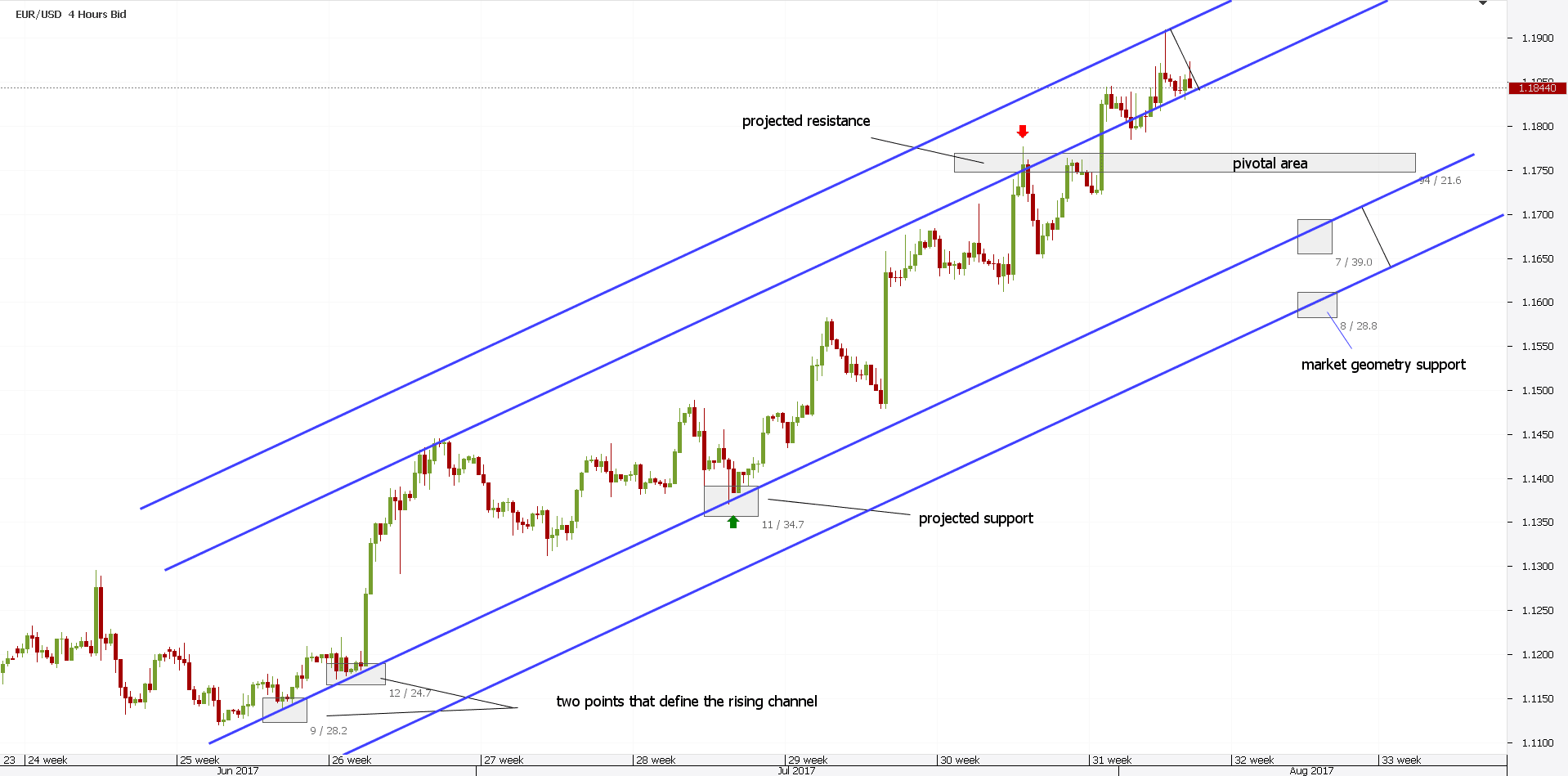

- Support and Resistance Levels: These horizontal lines signify areas where price movements have paused or reversed, indicating potential boundaries for future price action.

- Trends: Price movements often exhibit persistent patterns, indicating an underlying bias in the market. Identifying and aligning with trends can amplify potential profits.

- Candlesticks: These graphical representations provide a detailed overview of price movements, including opening, closing, high, and low prices. By studying candlestick patterns, traders can gain insights into market sentiment and potential turning points.

Price Action Trading Strategies

- Trend Following: This strategy involves identifying established trends and trading in alignment with them. By buying in uptrends and selling in downtrends, traders can capitalize on market momentum.

- Breakout Trading: Breakout traders seek opportunities to enter or exit a trade when prices break through significant support or resistance levels, anticipating an extension of the subsequent price move.

- Reversal Trading: This approach aims to identify and trade against short-term price reversals, capturing potential changes in market direction.

Image: in.pinterest.com

Expert Insights

“Price action is the purest form of technical analysis, directly reflecting the ebb and flow of market sentiment.” – George Soros, legendary investor

“Successful price action trading requires patience, discipline, and a deep understanding of market psychology.” – Mark Douglas, trading coach

Benefits of Price Action Trading

- Simplicity and Accessibility: Price action trading is straightforward, accessible to both experienced and novice traders.

- Objective and Unbiased: Technical analysis removes emotional biases, allowing traders to make rational decisions based on market data.

- Early Signal Detection: Price action provides early warnings of potential price reversals or trend continuations, enabling quick and profitable reactions.

Beginners Guide To Price Action Forex Trading Images

Conclusion

Price action forex trading empowers you with the ability to navigate the complexities of financial markets. By grasping the principles, mastering the strategies, and leveraging expert insights, you can unlock the potential for financial success. Remember, the key to successful trading lies in constant learning, adapting to evolving market conditions, and maintaining a disciplined approach. Embark on this journey with confidence, unravel the secrets of price action, and conquer the financial markets.