In the tumultuous ocean of Forex trading, where each wave of market movement holds the potential to both uplift and engulf, seasoned sailors rely on a guiding light to navigate the choppy waters, a beacon that cuts through the fog of uncertainty. Enter the world of candlestick patterns, where the art of technical analysis takes flight. These visual representations of price action, with their unique and evocative forms, offer invaluable insights into market sentiment and future price trends, illuminating the path towards profitable trading opportunities.

Image: atelier-yuwa.ciao.jp

Deciphering the Language of Candlesticks

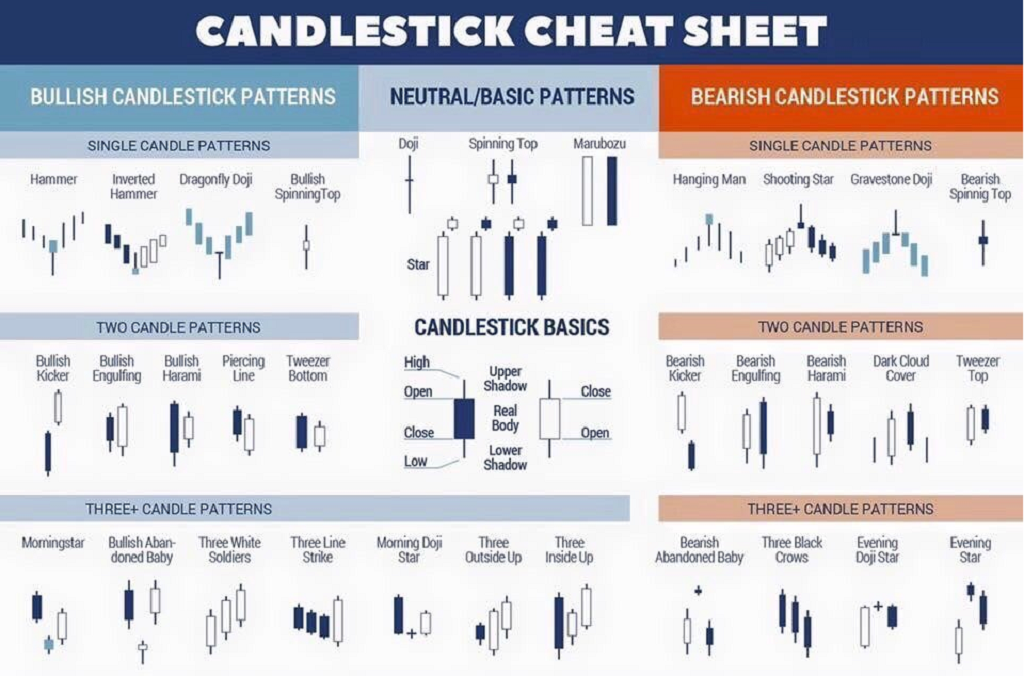

Originating from the vibrant tapestry of Japanese rice markets, candlestick patterns have evolved into an indispensable tool for Forex traders around the globe. Their essence lies in the combined study of a candle’s body, shadow, and relationship with adjacent candles, each element contributing to a tale of market momentum, indecision, or reversal. It is a language unto its own, a visual dialect spoken by the market itself, revealing the hidden truths behind price fluctuations.

Typically, a candle’s body represents the range between the open and close prices, while the shadows, or wicks, extend beyond the body to encompass the price extremes of the observed timeframe. The color of the candle, traditionally green for bullish (upward) movements and red for bearish (downward) trends, adds an additional dimension of market sentiment to the analysis. Understanding the collective story woven by these elements transforms a mere representation of price into a potent roadmap for informed trading decisions.

Exploring the Candlestick Repertoire

The diversity of candlestick patterns is as vast as the market itself, with numerous variations gracing the Forex landscape. Some of the most commonly encountered and interpretable patterns include:

- Bullish Engulfing Pattern: A bullish engulfing pattern signifies a surge in buying pressure and often foreshadows an upward market trend. It emerges when a red candle is followed by a green candle, with the green candle’s body engulfing the entire body of the preceding red candle.

- Bearish Engulfing Pattern: Conversely, a bearish engulfing pattern portends a decline in market sentiment. It materializes when a green candle is succeeded by a red candle, with the red candle’s body fully encapsulating the body of the preceding green candle.

- Doji: A doji, with its small body and extended shadows of equal length, symbolizes market indecision. It represents a moment of equilibrium between bullish and bearish forces, often hinting at a potential trend reversal.

- Hammer: A hammer is characterized by a small body seated atop a long lower shadow and a short upper shadow. It typically appears at the conclusion of a downtrend and signals a potential market reversal.

- Hanging Man: Similar to a hammer, a hanging man features a small body, but in this instance, it is positioned at the apex of a long upper shadow and a short lower shadow. This pattern often emerges near the summit of an uptrend, indicating a possible trend reversal.

Navigating the Forex Currents with Candlesticks

While candlestick patterns provide invaluable guidance, they are not infallible oracles. Price action is often complex and subject to myriad influencing factors, making it essential to consider candlestick patterns in conjunction with other technical analysis tools, such as trend lines, moving averages, and support and resistance levels. By weaving these elements into a comprehensive analytical tapestry, traders gain a more nuanced perspective, allowing for more informed decision-making.

Image: www.pinterest.com.au

Tips and Expert Insights

To harness the full potential of candlestick patterns in Forex trading, consider the following tips and expert advice:

- Context is Key: Never interpret a candlestick pattern in isolation. Always examine it within the broader context of market conditions, including prevailing trends, current news events, and economic indicators, to gain a well-rounded perspective.

- Confirmation Matters: While candlestick patterns offer valuable insights, it is prudent to seek confirmation from additional technical indicators before making trading decisions. A confluence of signals strengthens the reliability of the pattern’s interpretation.

- Risk Management is Paramount: Regardless of the perceived strength of a candlestick pattern, always implement sound risk management practices. Determine appropriate stop-loss and take-profit levels to safeguard against potential losses.

Frequently Asked Questions

Q: Are candlestick patterns effective in all market conditions?

A: While candlestick patterns are generally reliable, their effectiveness can vary depending on market volatility and liquidity. In volatile markets, patterns may not form as clearly, and in thin markets, they may be less reliable due to a lack of trading volume.

Q: Can candlestick patterns predict future market movements with certainty?

A: Candlestick patterns offer insights into probable market direction but do not provide absolute predictions. They should be combined with other technical analysis tools and market context for more accurate forecasts.

Types Of Candels In Forex

https://youtube.com/watch?v=0RCj4l6BhF0

Embark on Your Forex Odyssey

Whether you are a seasoned Forex trader or just setting sail on this captivating adventure, the world of candlestick patterns offers an invaluable compass to guide your journey. By learning to decipher their intricate language and applying them in conjunction with other analytical tools, you will transform yourself into a more confident and savvy navigator of the Forex markets, unlocking the potential for both financial success and personal growth. So, as you embark on this captivating odyssey, let the illuminating light of candlestick patterns illuminate your path towards trading triumph.

Are you ready to dive deeper into the fascinating depths of candlestick patterns and unlock the secrets of Forex trading? Embark on this enriching journey today and let the knowledge you gain be your guiding star towards financial horizons.