Introduction

In the dynamic and globalized world of foreign exchange (forex) trading, trust and security are paramount for both individual traders and institutional investors. One crucial aspect of ensuring financial integrity is the utilization of auditor certificates for forex payments.

Image: mungfali.com

Auditor Certificates: A Gateway to Trust

What are Auditor Certificates?

Auditor certificates are official documents issued by independent accounting firms that attest to the accuracy and reliability of a company’s financial statements. In the context of forex payments, auditor certificates provide independent verification that a payment processor or broker complies with applicable financial reporting standards.

Importance of Auditor Certificates

Auditor certificates play a pivotal role in establishing confidence among stakeholders in the forex market. They serve as impartial evidence that a company’s financial records are accurate and transparent. This reduces the risk of fraud, embezzlement, and other financial irregularities within the payment ecosystem.

Understanding the Audit Process

The audit process involves a comprehensive review of a company’s financial records by independent auditors. Auditors assess whether the financial statements fairly present the company’s financial performance and position in accordance with accepted accounting standards.

During the audit, auditors examine accounting records, bank reconciliations, and other supporting documentation to ensure accuracy and compliance. They also evaluate internal controls and risk management practices to mitigate potential weaknesses in the payment processing system.

Latest Trends and Developments

The forex payment landscape is constantly evolving, with new technologies and regulations emerging. Auditors are at the forefront of these changes, adapting their methodologies to address the evolving risks associated with digital payments and cross-border transactions.

Updates and news sources from industry forums and social media platforms indicate an increasing focus on data security, anti-money laundering compliance, and the implementation of blockchain technology in forex payments. Auditors are working closely with payment processors and brokers to ensure they stay compliant and protect customer funds.

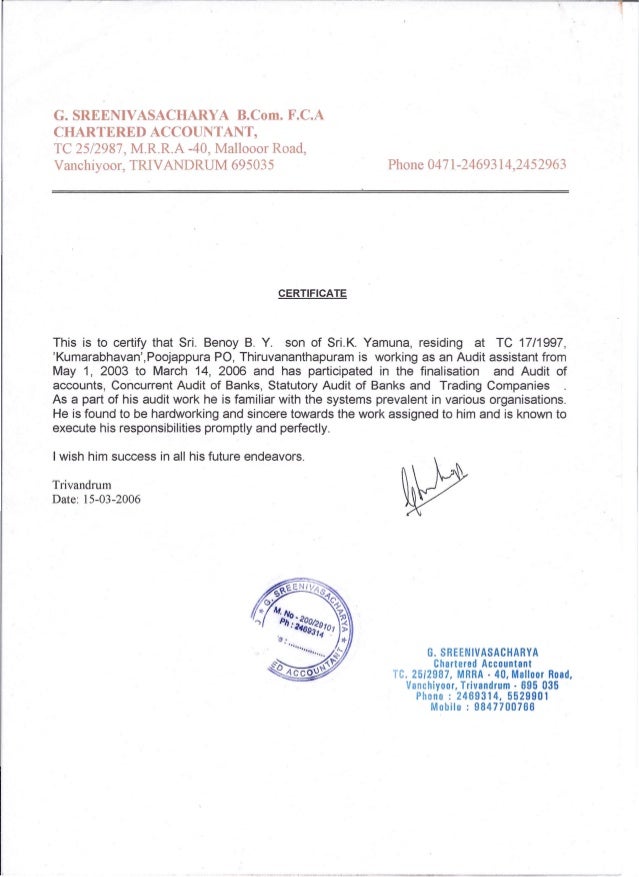

Image: www.scribd.com

Tips and Expert Advice

For traders and investors seeking to enhance the security of their forex payments, the following expert advice is invaluable:

Choose Licensed and Regulated Payment Processors

Opt for payment processors that possess the requisite licenses and regulatory approvals from reputable financial authorities. This indicates adherence to stringent operating standards and oversight.

Inspect Auditor Certificates

Thoroughly scrutinize auditor certificates issued to the payment processor. Verify that the audit firm is reputable, independent, and has a proven track record in the financial services industry.

Understand Payment Processing Procedures

Familiarize yourself with the payment processing procedures of the chosen provider. Seek clarity on the segregation of duties, risk management measures, and internal controls implemented to protect customer funds.

Frequently Asked Questions

Q: Can I request an auditor certificate from my payment processor?

A: Yes, you have the right to request an auditor certificate for the payment processor you use. It is a standard practice to demonstrate compliance and transparency.

Q: How often are auditor certificates updated?

A: Typically, auditor certificates are issued annually. However, payment processors may undergo additional audits or reviews throughout the year to maintain ongoing compliance.

Auditor Certificates For Forex Payments

Conclusion

Auditor certificates are an indispensable tool in safeguarding the integrity of forex payments. By partnering with payment processors that hold valid auditor certificates, traders and investors can minimize risk, strengthen their financial positions, and engage in forex trading with greater peace of mind.

Are you interested in learning more about the significance of auditor certificates for forex payments? Is there any specific aspect of the topic you would like to explore further? Share your thoughts and engage with the community to delve deeper into this crucial topic.