Introduction

India’s foreign exchange (forex) reserves are a crucial component of the country’s economic strength and stability. These reserves comprise the value of foreign currency assets held by the Reserve Bank of India (RBI) and commercial banks. Forex reserves play a vital role in managing international trade and mitigating external shocks to the economy. In this article, we will delve into a year-by-year analysis of India’s forex reserves, exploring their trends, factors influencing their fluctuation, and their implications for the country’s financial health.

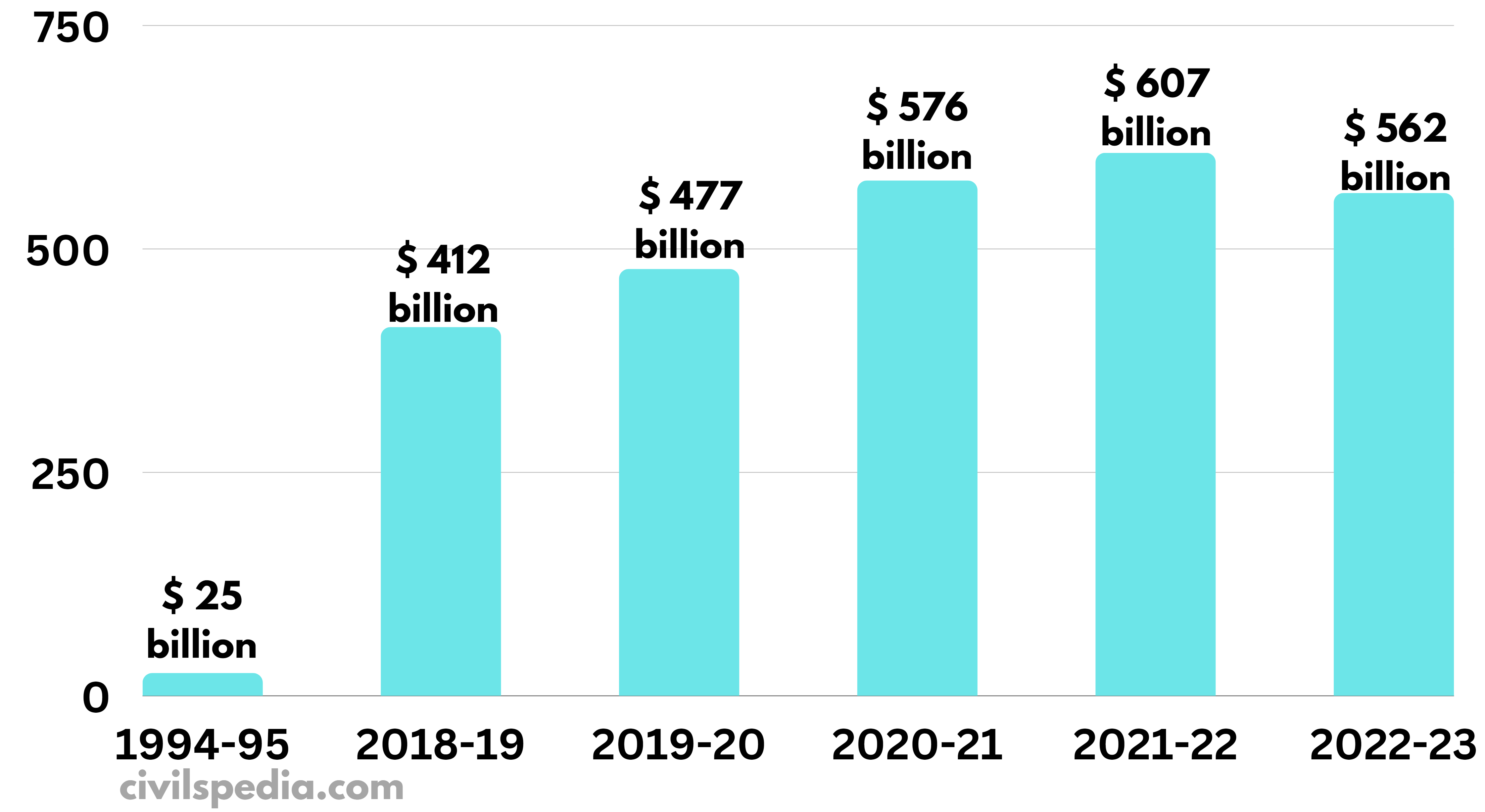

Image: civilspedia.com

Historical Growth and Trends

India’s forex reserves have witnessed a steady rise over the past decades, reflecting the country’s improving economic fundamentals and growing integration with the global economy. In 1990-91, India’s forex reserves stood at a meager $5.8 billion. By 2000-01, they had grown to $33.1 billion. The following decade saw a significant surge, with reserves reaching $292.8 billion by 2011-12.

In recent years, India’s forex reserves have continued to increase, albeit at a more gradual pace. As of March 2023, the country’s forex reserves stand at $561.2 billion, among the highest in the world.

Factors Influencing Fluctuations

The level of India’s forex reserves is influenced by various factors, including:

1. Foreign Direct Investment (FDI): FDI inflows, when foreign investors invest in Indian companies, contribute to an increase in forex reserves.

2. Portfolio Investments: Foreign institutional investors (FIIs) investing in India’s stock and debt markets also boost forex reserves.

3. Exports: Earnings from the export of goods and services contribute to forex reserves.

4. Remittances: Funds sent back to India by non-resident Indians (NRIs) add to forex reserves.

5. External Commercial Borrowings (ECBs): Loans taken by Indian companies and banks from foreign institutions can increase reserves.

6. Imports: Payments for imported goods and services lead to a reduction in forex reserves.

Significance of High Forex Reserves

Robust forex reserves provide numerous benefits to India’s economy:

1. Stable Exchange Rate: High forex reserves enable the RBI to intervene in the foreign exchange market to maintain a stable rupee-dollar exchange rate.

2. Import Cover: Forex reserves provide a cushion to finance imports, even during periods of low export earnings.

3. Confidence of Creditors: High reserves enhance investor confidence and reduce the perceived risk associated with investing in India.

4. Reduced External Vulnerabilities: Ample forex reserves provide resilience against external shocks, such as a sudden withdrawal of foreign capital.

Image: defencepk.com

Recent Developments

In recent months, India’s forex reserves have experienced a slight decline due to factors such as increased imports and portfolio outflows. However, the reserves remain at a comfortable level, and the RBI has been actively intervening to stabilize the rupee against the US dollar.

India Forex Reserves Per Year By Year

Conclusion

India’s forex reserves have grown significantly over the years, reflecting the country’s economic growth and global integration. Robust forex reserves play a crucial role in ensuring economic stability and mitigating external risks. As India continues to grow and integrate with the global economy, the importance of maintaining adequate forex reserves will only increase.