Introduction

In the fast-paced realm of foreign exchange (forex), understanding the mechanics of price action is paramount for lucrative trading. Among the numerous technical analysis tools, the Average Power (AP) Indicator stands apart as a potent gauge of market momentum, providing traders with an edge in deciphering market trends. This article delves into the intricate details of the AP Imp version, illuminating its calculation, interpretation, and practical applications in forex trading.

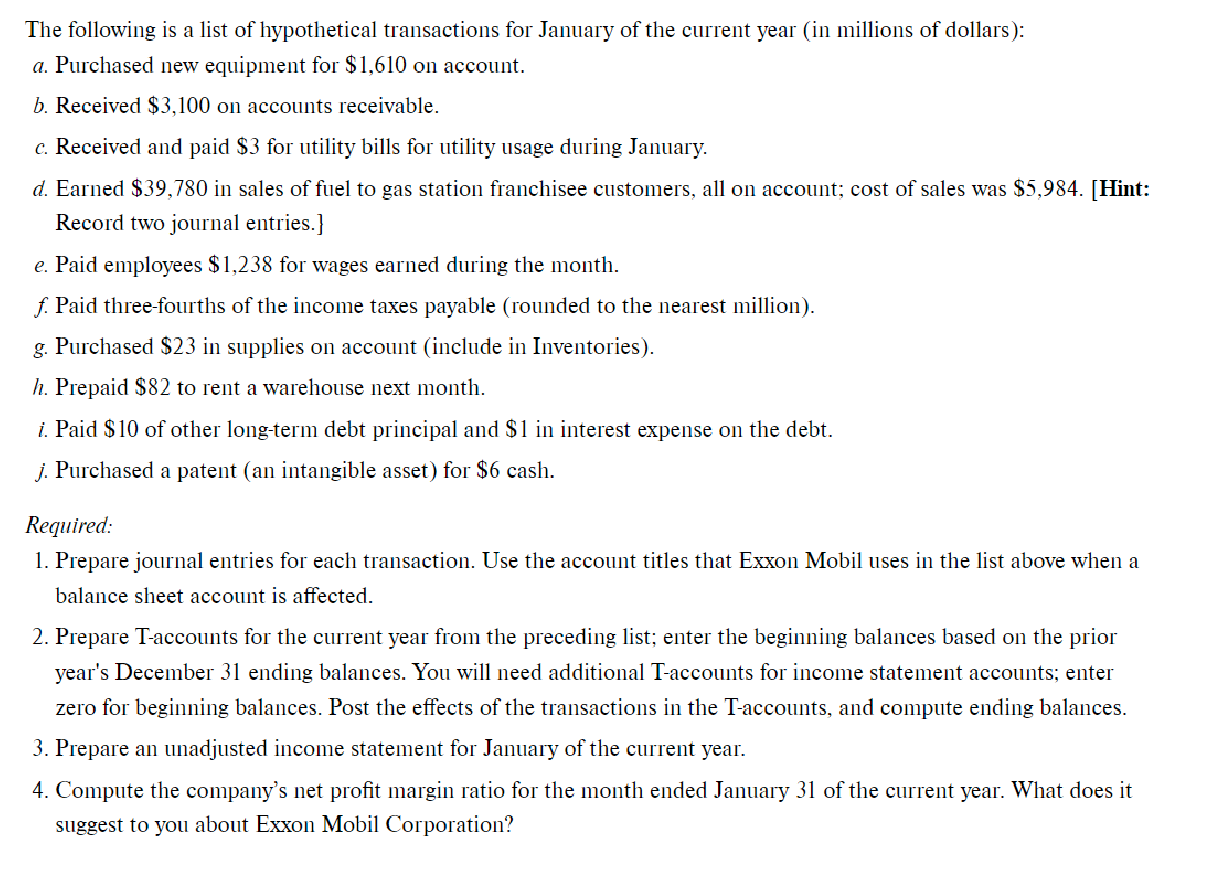

Image: www.chegg.com

Understanding the AP Imp Calculation

The AP Imp, short for Average Power with Impulse, takes the concept of the standard AP Indicator a step further. It incorporates an Impulse Factor (IF) that gauges the force behind price changes, providing a more comprehensive assessment of market dynamics. The formula for AP Imp is:

AP Imp(n) = [(Typical Price(n) – Typical Price(n-1)) x IF(n)] / ATR(n)

where:

- n refers to the current period

- Typical Price = (High + Low + Close) / 3

- IF(n) = Impulse Factor = Volume(n) / ATR(1)

- ATR(n) = Average True Range

The AP Imp metric essentially quantifies the magnitude of price fluctuations, taking into account both the actual price change and the relative strength of the price movement. By incorporating volume, it assigns greater significance to high-volume price swings, which are indicative of strong market conviction.

Interpreting AP Imp

The AP Imp value is interpreted in relation to zero. Positive values suggest an uptrend, signifying that the current period’s price movement is both upward and stronger than the average movement over the specified period. Conversely, negative values indicate a downtrend, characterized by downward price action that is also more forceful than usual.

The absolute value of AP Imp provides insight into the strength of the trend. Higher absolute values correspond to more pronounced market momentum, while lower absolute values reflect weaker trending conditions. Traders can anticipate more predictable price movements when AP Imp readings deviate further from zero.

Practical Applications in Forex Trading

The AP Imp Indicator is a potent tool for identifying trading opportunities and refining trading strategies in forex markets:

-

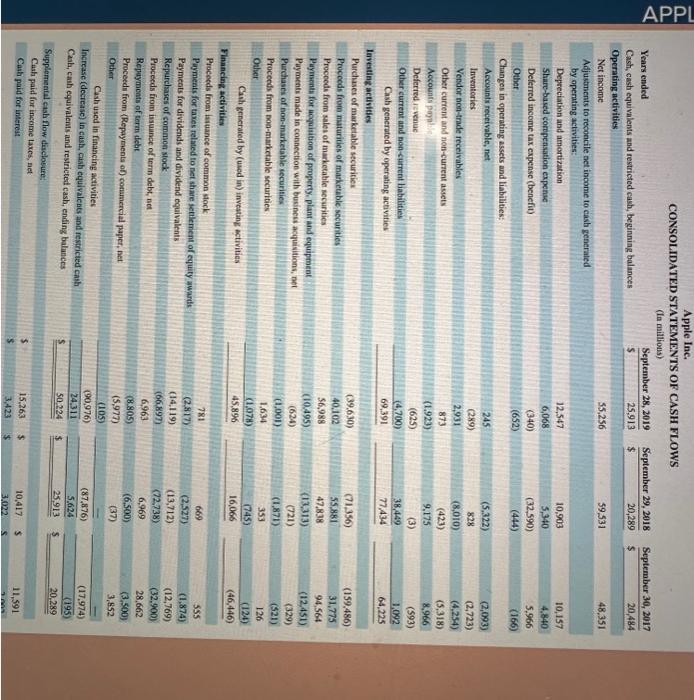

Image: www.chegg.comTrend Confirmation:

AP Imp confirms market trends by reinforcing the analysis of other technical indicators, such as Moving Averages or Ichimoku Kinko Hyo.

-

Momentum Assessment:

The absolute values of AP Imp quantify market momentum. Traders can use these values to gauge the speed and intensity of price movements, assisting in entry and exit timing.

-

Trend Reversals:

Divergences between the price action and AP Imp values can signal potential trend reversals. When AP Imp diverges from price highs or lows, traders should be alert to potential trend exhaustion or reversals.

-

Risk Management:

AP Imp values can aid in risk management by indicating periods of high volatility. Higher Imp indicates a more dynamic market environment, necessitating tighter stop-loss levels and cautious trading.

Cautions and Best Practices

While AP Imp is a versatile indicator, traders should bear in mind its limitations:

-

Lagging Indicator:

Like other momentum indicators, AP Imp is a lagging indicator, following actual price movements.

-

Parameter Optimization:

The default parameters (n=14) may not be optimal for all markets or trading styles. Traders may experiment with different settings to fine-tune the indicator’s responsiveness to their specific needs.

-

Cumulative Effect:

AP Imp values are cumulative, meaning they encompass a larger window of time. This can make it less reactive to short-term fluctuations.

Ap Imp Full Form In Forex Terms

Conclusion

The AP Imp Indicator is a powerful tool in the forex trader’s arsenal. By incorporating the concept of impulse into the standard Average Power calculation, it provides a comprehensive measure of market momentum, helping traders assess trends, interpret price dynamics, and refine trading strategies. Remember, the key to successful indicator usage lies in understanding its limitations and complementing it with other analytical methods. By harnessing the asymmetric power of AP Imp, forex traders can enhance their market insights and seize trading opportunities with greater confidence.