Have you ever found yourself mesmerized by the intricate patterns formed by the price movements of different currency pairs on a Forex chart? These patterns, known as breakout patterns, provide valuable insights into the potential future direction of the market.

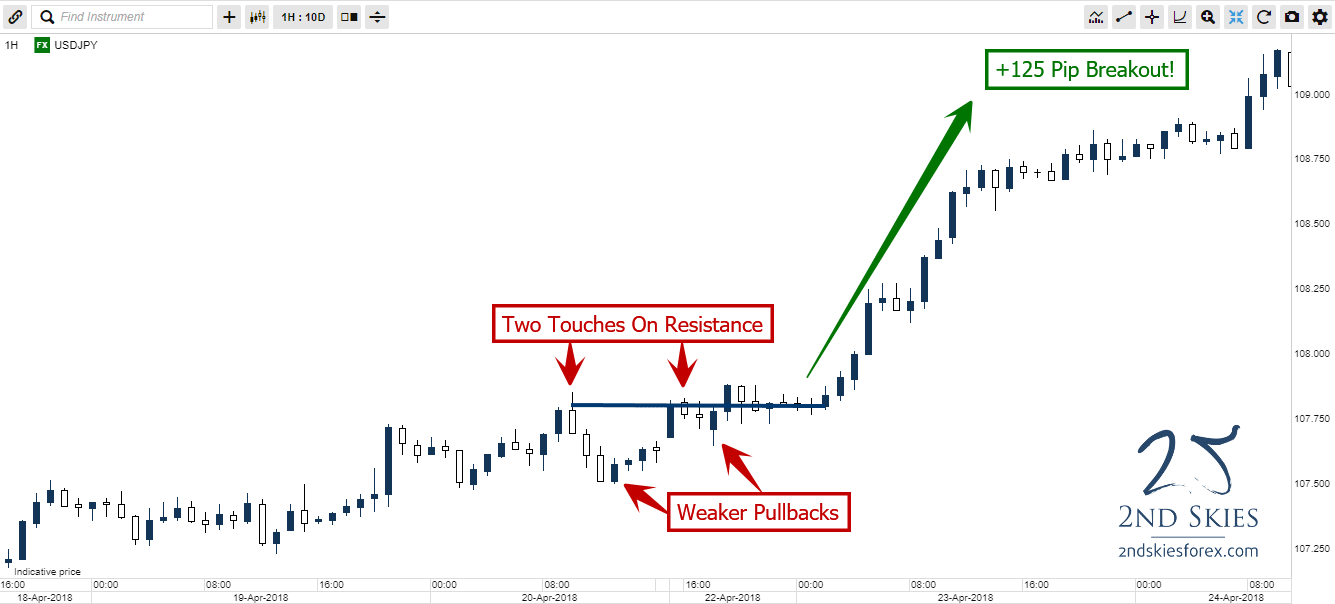

Image: 2ndskiesforex.com

In this article, we will delve into the world of breakout patterns, exploring the different types, their significance, and how to interpret them effectively. Whether you’re a seasoned trader or just starting your Forex journey, this guide will equip you with the knowledge and skills necessary to master these crucial chart formations.

Introducing Breakout Patterns

Breakout patterns are technical analysis tools that signal potential breakouts of a particular price range. These patterns occur when the price of a currency pair breaks through a specific resistance level (for an uptrend) or support level (for a downtrend), indicating a potential change in market sentiment.

Breakout patterns are often used to confirm the validity of a trend or identify potential turning points in the market. They can provide traders with valuable information about the strength of the trend and the likelihood of the price continuing in the same direction.

Types of Breakout Patterns

There are several different types of breakout patterns, each with its unique characteristics and implications. Here is an overview of some of the most common patterns:

- Triangular Patterns: Formed when the price consolidates within a triangle-shaped formation, breakout patterns from these indicate a continuation of the trend in the direction of the breakout.

- Rectangle Patterns: Similar to triangles, rectangle patterns indicate sideways movement with limited price action. The breakout can indicate a change in trend or a continuation.

- Flag and Pennant Patterns: These patterns form after a sharp price movement, resembling a flag or pennant. Breakouts from flags and pennants usually indicate a continuation of the trend.

- Cup and Handle Patterns: The cup and handle pattern indicates a bullish breakout potential, where the “cup” represents a prolonged downtrend and the “handle” is a consolidation period.

- Double and Triple Top/Bottom Patterns: These patterns indicate potential reversal points. Double or triple tops may signal a downtrend, while bottoms may suggest an uptrend.

Interpreting Breakout Patterns

Interpreting breakout patterns effectively requires careful analysis of the chart and consideration of various factors. Here are some tips to help you:

- Volume: High volume during a breakout confirms the strength of the move.

- Duration: The longer the consolidation period, the more significant the breakout.

- Trend Analysis: Breakout patterns that align with the prevailing trend have a higher probability of success.

- False Breakouts: Not all breakouts lead to successful trends; it’s important to be aware of false breakouts.

- Confirmation: Consider other technical indicators, such as moving averages or oscillators, for confirmation.

Remember, breakout patterns are not foolproof indicators, but they can provide valuable insights when used in conjunction with other technical analysis tools and risk management strategies.

Image: www.indexsignal.com

The Importance of Breakout Patterns

Breakout patterns hold significant importance for Forex traders. They provide crucial information about potential trend reversals, continuations, and support/resistance levels. By correctly identifying and interpreting breakout patterns, traders can develop more informed trading strategies and improve their overall profitability.

Conclusion

In the realm of Forex trading, breakout patterns are indispensable tools that empower traders to navigate market fluctuations with greater confidence. Understanding the different types of breakout patterns, their implications, and how to interpret them effectively is paramount for successful trading. By incorporating breakout patterns into your technical analysis toolkit, you can enhance your decision-making process and maximize your chances of capitalizing on market opportunities.

Are you ready to unlock the power of breakout pattern analysis in your Forex trading? Take the next step in your journey and explore the wealth of information available online, engage with experienced traders, and practice your skills through demo trading. The world of Forex awaits your exploration. Embrace the challenge, master the art of breakout patterns, and conquer the markets.

All Type Breakout Forex Chart Patterns

Frequently Asked Questions (FAQ)

Q: How do I identify a breakout pattern?

A: Breakout patterns are identified when the price of a currency pair breaks through a key resistance or support level with significant volume.

Q: What is the difference between a false breakout and a true breakout?

A: A false breakout occurs when the price briefly breaks through a support or resistance level but quickly reverses direction. A true breakout is confirmed when the price sustains the breakout level for an extended period.

Q: Which breakout patterns are most reliable?

A: The reliability of breakout patterns varies depending on market conditions. However, some of the most reliable patterns include symmetrical triangles, ascending triangles, and cup and handle patterns.

Q: How can I use breakout patterns to improve my trading?

A: Breakout patterns can be used to identify potential trade entries and exits. By understanding the implications of each pattern, traders can make more informed decisions about when to enter or exit a trade.

Q: Is it possible to profit consistently from breakout patterns?

A: While breakout patterns can be valuable trading tools, it’s important to remember that they are not foolproof indicators. Consistent profitability in Forex trading requires a comprehensive approach that combines technical analysis with risk management and a deep understanding of market dynamics.