Are you a forex trader who’s tired of losing money and struggling to turn a profit? If so, mastering the concept of break-even is essential for your success. In this comprehensive guide, we’ll take you on a deep dive into break-even in forex, providing you with everything you need to elevate your trading game.

Image: www.pinterest.com

What is Break Even in Forex?

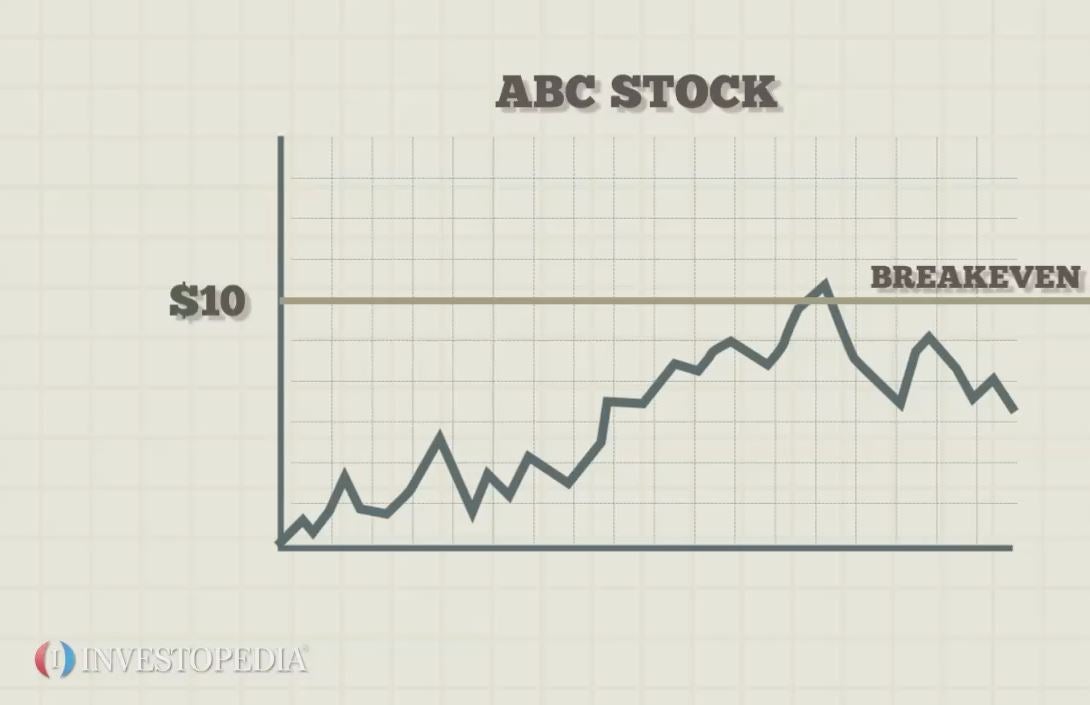

Break-even is the point at which your trade neither makes nor loses money. It occurs when the selling price of an asset equals the initial purchase price plus any trading costs. In other words, break-even is the threshold at which you recover your initial investment without making any profit or suffering any losses.

Understanding break-even is crucial because it helps you determine the potential profitability of your trades and manage your risk effectively. It allows you to set realistic profit targets and avoid taking unnecessary losses.

Calculating Your Break-Even Point

Calculating your break-even point is straightforward. You need to factor in the following elements:

- Entry Price: The price at which you enter the trade

- Exit Price: The price at which you plan to exit the trade

- Trading Costs: Any commissions, spreads, or other fees associated with the trade

To calculate your break-even point, simply subtract the entry price from the exit price and then add back any trading costs.

For example, if you enter a trade at $1.1000 and plan to exit at $1.1100, and there is a $2 spread, your break-even point would be $1.1102.

The Significance of Break Even

Break-even is a pivotal concept in forex trading for several reasons:

- Risk Management: Understanding break-even allows you to set stop-loss orders appropriately, limiting your potential losses.

- Profit Targets: Knowing your break-even point enables you to set realistic profit targets and avoid overleveraging.

- Trade Evaluation: Assessing your trades against their break-even points can help you identify areas for improvement and refine your trading strategies.

Image: satsdikk.blogspot.com

Tips for Mastering Break-Even Trading

To maximize your trading success, consider these expert tips:

- Calculate Your Break-Even Point Accurately: Use the formula mentioned earlier to ensure precision and avoid false assumptions.

- Set Realistic Profit Targets: Don’t be overly ambitious; set achievable profit targets that exceed your break-even point reasonably.

- Manage Your Risks: Implement proper risk management strategies to mitigate potential losses and protect your capital.

- Emotions in Check: Avoid making impulsive decisions based on emotions. Stick to your trading plan and be patient.

Meaning Of Break Even In Forex

Conclusion

Mastering break-even in forex trading is an indispensable skill that can transform your trading journey. By understanding break-even, you gain the power to calculate your risk, set realistic profit targets, and make informed trading decisions. Remember, patience, discipline, and a commitment to learning are key ingredients for success. Embrace the power of break-even trading and unlock the potential to excel in the dynamic world of forex.