For aspiring and seasoned Forex traders alike, timing is everything. Just as the ebb and flow of the tides influence maritime navigation, market conditions ebb and flow, creating periods favorable for trading and others that test even the most resilient traders. Identifying the worst months to trade Forex is crucial for minimizing losses and maximizing profits in this dynamic and often unpredictable financial landscape.

Image: www.youtube.com

Beyond Seasonality: Understanding the Market’s Rhythms

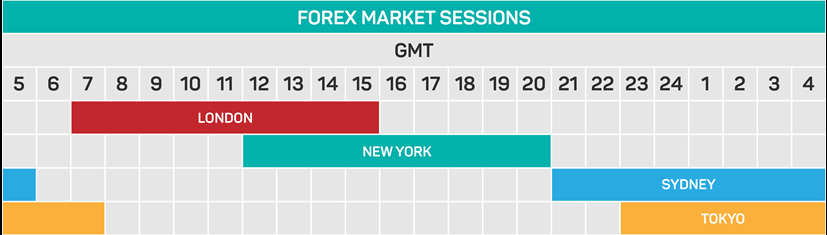

The Forex market, unlike traditional stock exchanges, operates around the clock, five days a week. However, beneath this relentless activity lies a hidden seasonality that savvy traders must heed. Certain months consistently present higher volatility, lower liquidity, and riskier trading conditions, making them prime candidates for cautious maneuvering.

Top Contenders: December and January

Statistically, December and January stand out as the most challenging months for Forex traders. The festive season often leads to reduced market activity as investors and traders take time off, resulting in lower liquidity. This lack of liquidity can amplify market fluctuations, making it difficult to predict price movements accurately.

Furthermore, the post-holiday period in January can be equally treacherous due to heightened market volatility. As traders return from their break, they may have a different perspective on market conditions, which can trigger significant price swings.

Summer Slumber: July and August

Summer months, particularly July and August, also tend to be unfavorable for Forex trading. During this time, market activity tends to slow down as traders head on vacation or reduce their trading activity due to the warmer weather. This decrease in trading volume can lead to wider spreads, making it more challenging to execute trades profitably.

Additionally, summer months can bring unpredictable market movements due to the absence of major news events or economic releases. This lack of catalysts for price action can result in prolonged periods of consolidation or sideways trading, making it difficult to generate substantial profits.

Image: forexscalpersignals1.blogspot.com

Trading Amidst Volatility: October and November

While not as challenging as December and January, October and November can also pose difficulties for Forex traders. These months often witness heightened market volatility due to the buildup towards the end of the calendar year. Major economic events and central bank meetings can trigger significant price swings, requiring traders to be highly adaptable and responsive to rapidly changing market conditions.

Furthermore, the run-up to the holiday season can introduce additional market uncertainty as traders adjust their positions and prepare for potential year-end profit-taking or window-dressing.

Worst Months To Trade Forex

Navigating Market Headwinds: Strategies for Success

While the worst months to trade Forex present significant challenges, they are not insurmountable. By understanding the market’s seasonal tendencies and employing sound trading strategies, traders can mitigate risks and potentially turn adversity into opportunity:

- Embrace Diversification: Expand your trading portfolio to include multiple currency pairs to minimize the impact of adverse conditions in any single market.

- Reduce Leverage: Limit the amount of leverage applied to your trades during unfavorable months to reduce potential losses due to amplified market movements.

- Focus on Technical Analysis: Technical analysis, which studies price patterns and charts, can provide valuable insights into market trends, even during low-liquidity periods.

- Monitor Market News: Stay abreast of economic and political events that may influence market sentiment and price action, regardless of the time of year.

- Manage Risk Effectively: Implement robust risk management strategies such as stop-loss orders and position sizing to limit potential losses during volatile periods.

- Consider Scaling Back: If market conditions are particularly unfavorable, it may be prudent to reduce trading activity or take a break altogether, waiting for more promising market conditions.