Introduction

The foreign exchange (forex) market is an enigmatic realm, a financial ecosystem where currencies converge and liquidity flows in tireless ebbs and tides. This vast global marketplace serves as the epicenter of monetary transactions, affecting economies, businesses, and individuals alike. But who orchestrates this intricate dance of capital exchange? Who are the players that infuse the forex market with vitality and purpose?

Image: www.forextrading200.com

In this comprehensive exploration, we embark on a journey to unveil the diverse and influential characters that populate the forex stage. From towering institutions to nimble traders, we’ll delve into the motivations, strategies, and interconnected roles that collectively shape the beating heart of the forex market.

The Pillars of the Forex Market

At the apex of the forex hierarchy stand central banks and governments. These titans wield immense influence, manipulating monetary policy and currencies to steer the course of economies. Their interventions can ripple through the market, triggering fluctuations in exchange rates and shaping investment decisions.

Commercial banks and investment firms occupy a pivotal position in the forex market, serving as intermediaries between clients and the broader financial world. They facilitate transactions, execute trades, and provide liquidity to the market, keeping the cogs of currency exchange in motion.

Hedge funds and other large-scale institutional investors are significant actors, wielding abundant financial resources that can move markets. Their sophisticated trading strategies and extensive research capabilities allow them to seek out profit opportunities and navigate the forex market’s complexities.

Retail traders, though far smaller in size, collectively account for a sizeable portion of forex market activity. They bring a diverse range of experiences, from seasoned veterans to novice enthusiasts. While their trades may be modest individually, their collective actions can impact exchange rates and influence market sentiment.

The Forces That Drive the Market

The forex market is a dynamic battlefield where myriad factors collide to determine the ebb and flow of currency values. Economic growth, political stability, interest rate differentials, and expectations all play a crucial role in guiding the movements of exchange rates.

Central bank decisions, such as interest rate adjustments or quantitative easing, can have profound effects on the forex market. Interest rates influence the value of currencies and impact borrowing and investment decisions, making central banks powerful arbiters of currency dynamics.

Political events, both domestic and international, can send shockwaves through the forex market. Wars, elections, or changes in government policies can create uncertainty, triggering currency fluctuations and altering investor appetite for risk.

Economic data provides invaluable insights into the health of nations and their currencies. GDP growth, inflation, and employment figures can paint a detailed picture of economic performance, attracting or repelling investment flows and influencing currency valuations.

The Importance of Trust and Transparency

In the fast-paced world of the forex market, trust and transparency are indispensable pillars. Regulators play a vital role in ensuring fairness, preventing fraud, and maintaining market integrity. By setting rules and enforcing compliance, they foster a sense of confidence that attracts investors and promotes healthy market growth.

Financial institutions and brokers also bear the responsibility of nurturing trust in the forex market. Transparency in pricing, clear communication, and ethical business practices are essential for building strong relationships with clients and sustaining a reputation of integrity.

With so many diverse participants and myriad factors influencing the forex market, understanding the interconnected roles and motivations of each player is paramount. This knowledge empowers investors, businesses, and individuals to navigate this dynamic landscape with greater confidence and informed decision-making.

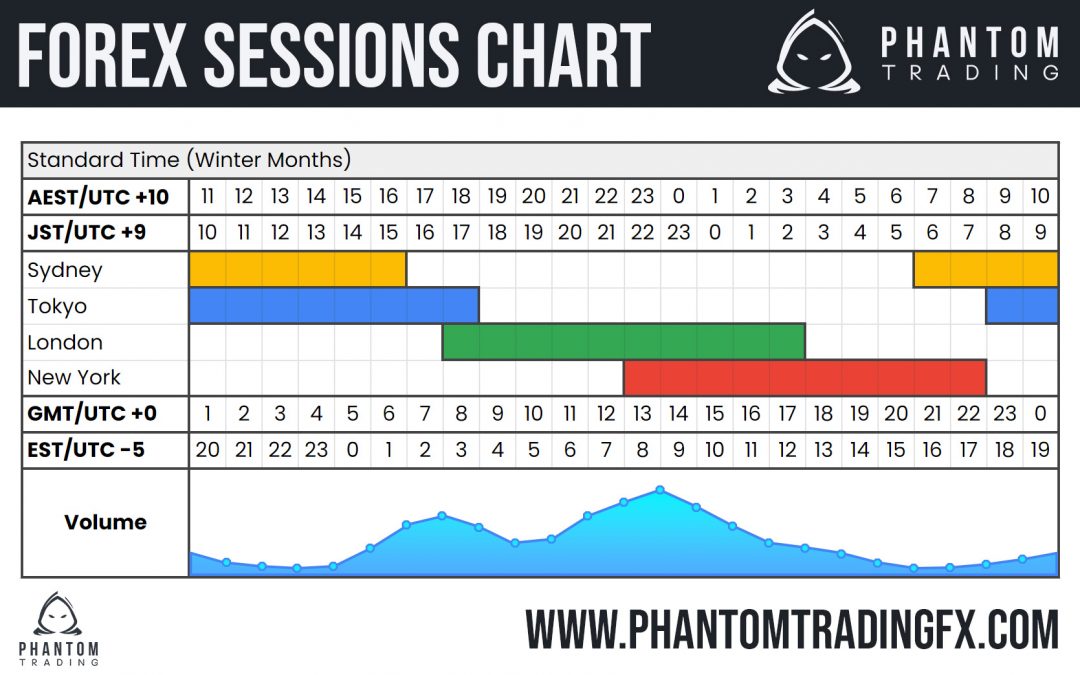

Image: phantomtradingfx.com

Who Makes Up The Forex Market

Conclusion

The forex market is a symphony of interconnected participants, each playing a distinctive part in shaping its ever-evolving dynamics. Central banks, commercial banks, hedge funds, retail traders, and regulators form a vibrant ecosystem that drives currency exchange and fuels global economic growth.

Understanding the diverse motivations and strategies of these market participants is not only a testament to the complexity of the forex market but also a key to unlocking its potential. Whether you’re a seasoned investor, an aspiring trader, or simply curious about the forces that move the financial world, unraveling the cast of characters behind the scenes will provide invaluable insights and empower you to navigate this dynamic landscape with greater clarity and confidence.