The stock market is a complex and ever-evolving landscape, with a vast array of indices and metrics used to measure market performance. Among these, value-weighted indices stand out as important tools for investors seeking to gauge the performance of a specific market segment or the overall market. Understanding the value-weighted index formula is crucial for investors to make informed investment decisions.

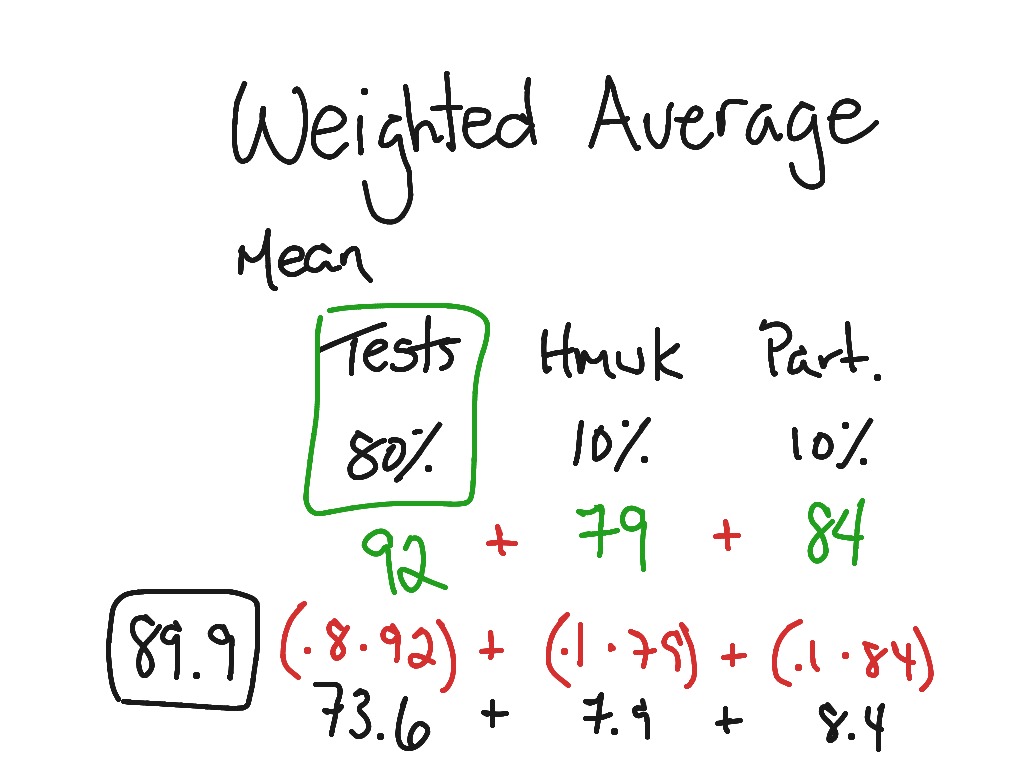

Image: www.showme.com

What is a Value-Weighted Index?

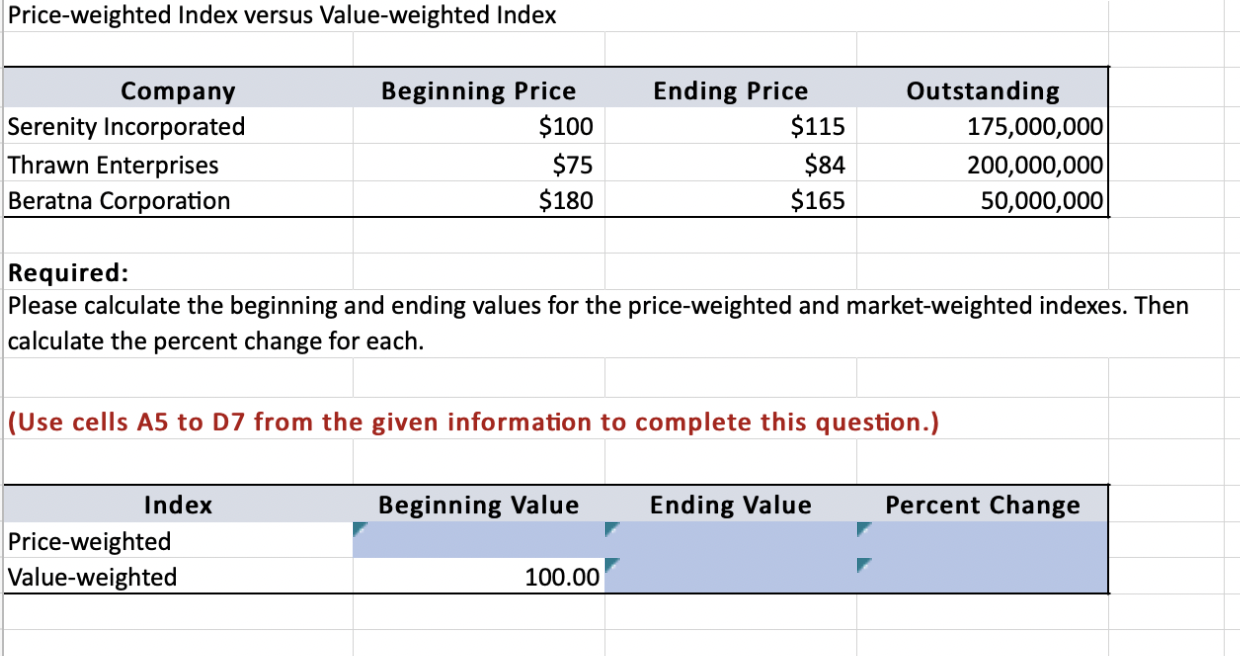

A value-weighted index is a type of stock market index in which the weight of each stock in the index is proportional to its market capitalization. Market capitalization is calculated by multiplying a company’s current share price by the number of its outstanding shares. This means that stocks with higher market capitalizations have a greater impact on the index’s overall value.

Value-Weighted Index Formula

The value-weighted index formula is as follows:

Index Value = Σ (Market Capitalization of Stock i * Index Weight of Stock i)Where:

- Σ represents the summation of all stocks in the index.

- Market Capitalization of Stock i is the market capitalization of the i-th stock in the index.

- Index Weight of Stock i is the weight of the i-th stock in the index, calculated as the Market Capitalization of Stock i divided by the total Market Capitalization of all stocks in the index.

Importance and Applications

Value-weighted indices provide a representation of the performance of a market segment or the overall market. They are widely used by investors and fund managers to track market movements, measure investment performance, and make investment decisions.

Value-weighted indices are particularly useful for tracking the performance of large-cap stocks, as these stocks have a greater impact on the index’s overall value. This makes value-weighted indices an effective tool for investors who want to gauge the performance of these companies.

Benefits and Limitations

Value-weighted indices offer several benefits. They provide a simple and transparent way to track market performance, as the index value is directly influenced by the market capitalizations of the constituent stocks. Additionally, value-weighted indices are less susceptible to manipulation, as large-cap stocks are less likely to experience significant price fluctuations that can distort the index’s value.

However, value-weighted indices also have limitations. They can be less responsive to changes in small-cap stocks, as these stocks have a smaller impact on the overall index value. Furthermore, value-weighted indices may not be as representative of the overall market if the index is dominated by a few large-cap stocks.

Examples of Value-Weighted Indices

Prominent value-weighted indices include:

- The S&P 500 Index

- The Nasdaq Composite Index

- The Dow Jones Industrial Average

- The FTSE 100 Index

- The Nikkei 225 Index

These indices are widely used by investors around the world to track market performance and make investment decisions.

Conclusion

The value-weighted index formula is a fundamental tool for investors seeking to understand the performance of a specific market segment or the overall market. By understanding the formula’s components and limitations, investors can make informed investment decisions and effectively track market movements. Value-weighted indices provide a valuable lens through which investors can gauge market performance and make sound investment choices.

Image: www.chegg.com

Value Weighted Index Formula