Introduction

In the realm of forex trading, managing risk is paramount to preserving capital and maximizing profitability. Among the arsenal of risk management tools at a trader’s disposal, stop loss and take profit orders play a crucial role in limiting potential losses and safeguarding profits. Understanding these essential tools is key to navigating the volatile forex market with confidence.

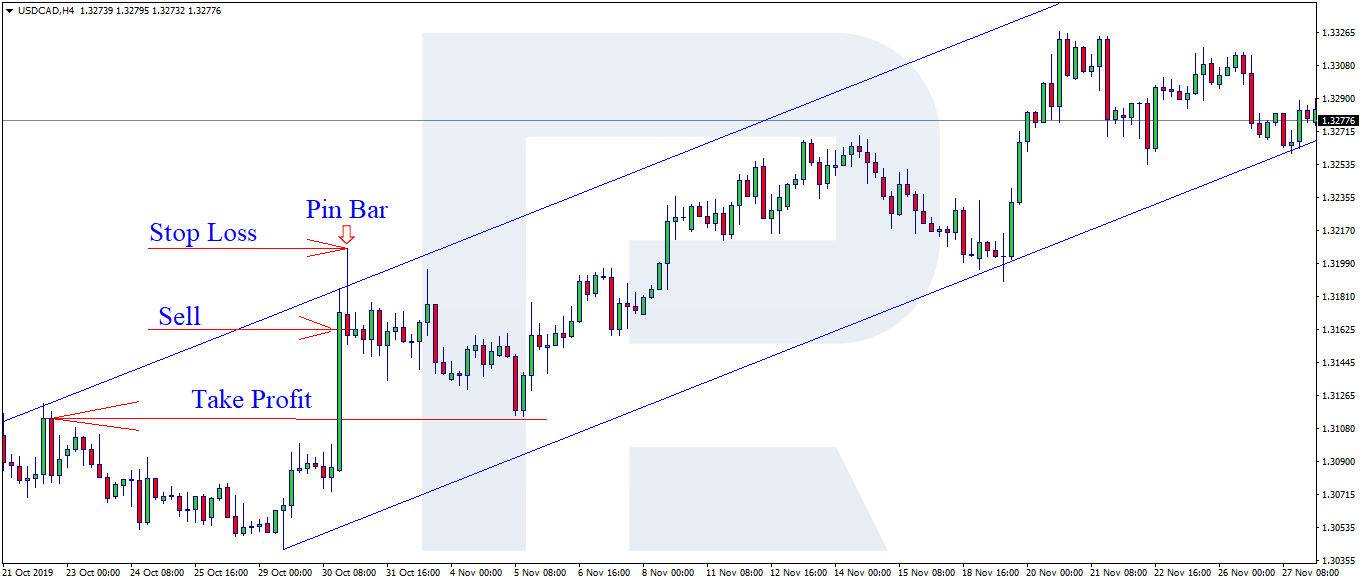

Image: blog.roboforex.com

What is a Stop Loss Order?

A stop loss order is a conditional trade instruction that automatically closes a position when it reaches a predetermined price level, limiting potential losses in an unfavorable market movement. When the price of the traded instrument (e.g., a currency pair) falls to the stop loss level, the position is automatically sold or bought, depending on the trade’s direction.

Types of Stop Loss Orders

There are two main types of stop loss orders:

- Trailing Stop: This type of stop loss moves dynamically as the price of the instrument changes. It is often used in trending markets to lock in profits while still allowing for potential additional gains.

- Static Stop: This type of stop loss remains at a fixed price level. It is commonly used to protect against large losses or to exit a trade at a specific price.

Benefits of Using Stop Loss Orders

- Limit Losses: Stop loss orders serve as a safety net, ensuring that losses are capped at a predetermined level. This helps prevent catastrophic losses that could erode a trading account.

- Preserve Capital: By limiting losses, stop loss orders protect the trader’s trading capital. This allows for more trades to be executed, increasing the potential for long-term profitability.

- Define Risk-Reward Ratio: Using stop loss orders allows traders to define their risk-reward ratio. With a known potential loss, traders can adjust their trade size accordingly to maintain an acceptable balance between risk and return.

Image: forexdewascalper.blogspot.com

What is a Take Profit Order?

A take profit order is another conditional trade instruction that automatically closes a position when it reaches a predetermined price level, securing profits. When the price of the traded instrument rises to the take profit level, the position is automatically sold or bought, depending on the trade’s direction.

Types of Take Profit Orders

- Trailing Take Profit: Similar to trailing stop loss orders, trailing take profit orders adjust dynamically as the price of the instrument changes. This helps maximize profits by extending the trade in a favorable market movement.

- Static Take Profit: This type of take profit order remains at a fixed price level. It is often used to target a specific profit goal or to lock in a certain amount of profit.

Benefits of Using Take Profit Orders

- Secure Profits: Take profit orders guarantee that profits are taken at a predetermined price level, protecting against potential market reversals.

- Prevent Greed: By setting a take profit order, traders can limit the temptation to ride a profitable trade until it becomes a loss. This prevents the common pitfall of “giving back” profits due to market fluctuations.

- Focus on Risk Management: By locking in profits, take profit orders allow traders to focus on managing risk and potentially entering new trades without worrying about protecting past gains.

Best Practices for Using Stop Loss and Take Profit Orders

- Identify Support and Resistance Levels: Place stop loss and take profit orders at key technical levels such as support and resistance zones, which indicate potential price reversal points.

- Use Risk-Reward Analysis: Calculate a risk-reward ratio before placing stop loss and take profit orders. A positive ratio indicates that the potential reward outweighs the potential loss.

- Adjust Stop Loss and Take Profit Levels: Monitor market conditions and adjust stop loss and take profit orders accordingly. Moving these orders as the price moves in a favorable direction can enhance profitability.

- Discipline and Patience: Resist the temptation to override stop loss or take profit orders based on emotions. Discipline and patience are essential for successful risk management.

What Is Stop Loss And Take Profit In Forex

Conclusion

Stop loss and take profit orders are indispensable risk management tools for forex traders. By limiting potential losses and securing profits, these orders enable traders to navigate the volatile forex market with confidence and protect their trading capital. Understanding how to use these tools effectively is a cornerstone of successful forex trading and a key to long-term profitability. Remember to conduct thorough research, consult credible sources, and implement these tools with discipline and patience to maximize their effectiveness in your trading strategy.