Imagine being a seasoned surfer, effortlessly navigating the colossal waves of the forex market. To conquer this vast ocean, it’s crucial to master the art of timing – the ebb and flow of market sessions that orchestrate the rise and fall of currency prices.

Image: vitocejayem.web.fc2.com

The Essence of Forex Trading Time

Forex trading time encompasses the specific hours during which the global forex market is in operation. These sessions are spread across different time zones, allowing traders to access markets around the clock. Understanding the nuances of each session is paramount to maximizing trading opportunities and navigating market volatility.

Global Forex Trading Sessions

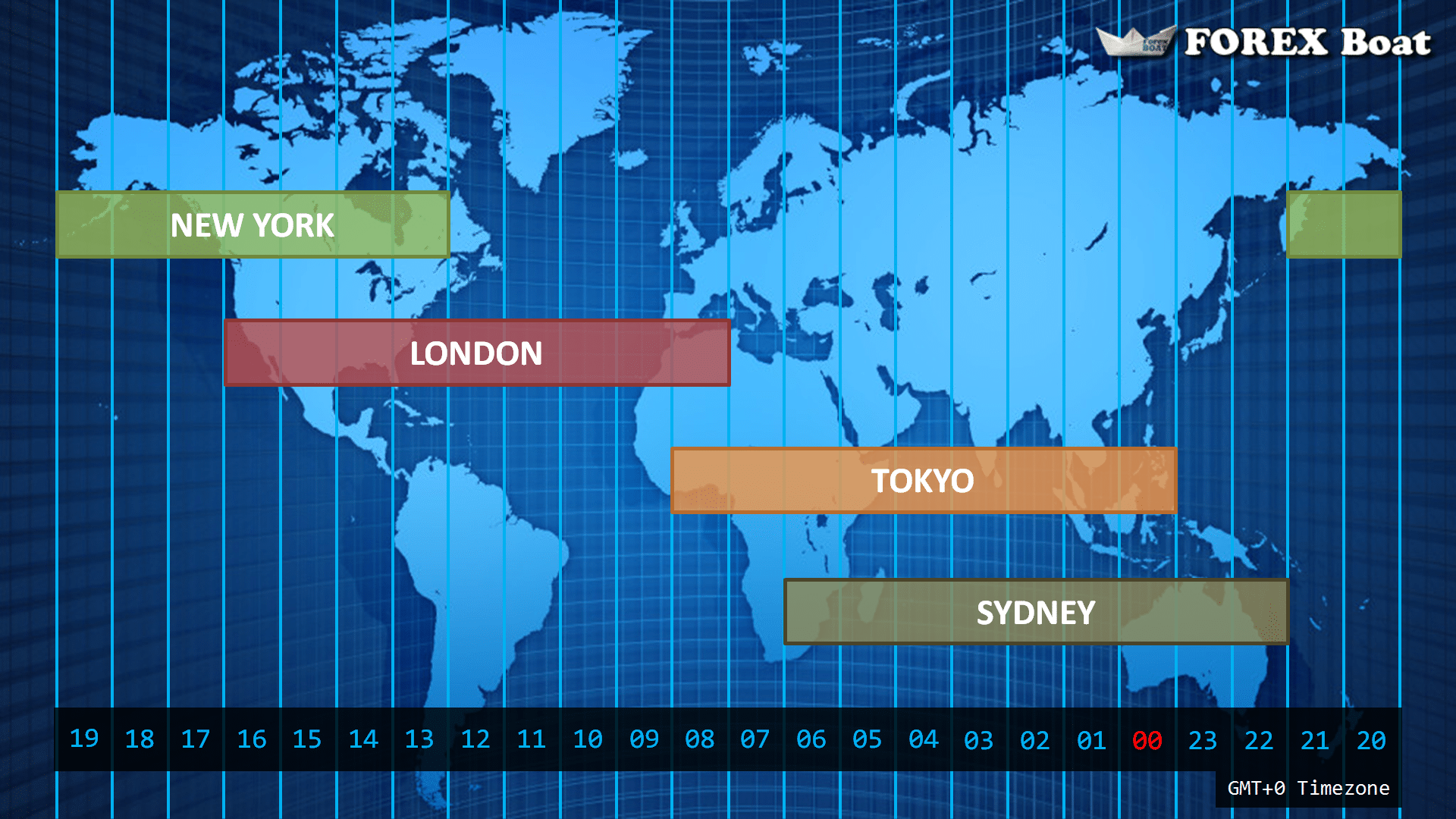

The forex market operates continuously throughout the week, except for weekends, across four primary trading sessions:

- Sydney Session: 22:00 – 07:00 UTC

- Tokyo Session: 00:00 – 09:00 UTC

- London Session: 08:00 – 17:00 UTC

- New York Session: 13:00 – 22:00 UTC

Identifying Trading Opportunities

Each trading session offers unique characteristics. The Sydney session marks the beginning of the trading week, with activity centered around the Australian dollar. The Tokyo session sees increased volatility with the Japanese yen, while the London session is known for its high liquidity and considered the “world’s financial center.” The New York session often brings significant market movements as major banks and institutional traders become active.

By recognizing these nuances, traders can align their trading strategies with the most favorable conditions. For instance, those specializing in trading the Japanese yen may focus on the Tokyo session, while those seeking volatility may prefer the London session. Understanding the time-based characteristics of different currencies is integral to optimizing trading strategies.

Image: howtotradeonforex.github.io

Clocking the Intermarket Correlations

Forex trading time is intrinsically linked to the global financial markets. Key economic events, central bank announcements, and political news can significantly impact currency prices. Traders who stay informed about these events and their potential impact on the market can capitalize on market fluctuations.

For example, a strong economic report may lead to a rise in the value of a country’s currency, while a geopolitical crisis may cause a sharp decline. By monitoring news and events, traders can position themselves to trade the resulting price movements.

Expert Advice and Tips for Mastering Forex Trading Time

To harness the power of forex trading time, consider these expert tips:

- Identify your target currency pair and study its historical behavior during different trading sessions.

- Familiarize yourself with the market open and closing times for your preferred trading session.

- Use economic calendars to monitor key events and news releases that may impact currency prices.

- Consider the role of time-based indicators like the Relative Strength Index (RSI) to identify overbought or oversold market conditions.

- Manage your risk by implementing proper trade management strategies, such as stop-loss and take-profit orders.

FAQs on Forex Trading Time

Q: Why is it important to understand forex trading time?

A: Knowing the trading time allows traders to match their strategy with the most suitable market conditions, increasing the potential for favorable trading outcomes.

Q: Which trading session is the most liquid?

A: The London session, from 08:00 – 17:00 UTC, has the highest liquidity, making it ideal for trading strategies that rely on market volatility and swift execution.

Q: How can I stay updated with market events?

A: Subscribe to economic calendars, follow reputable financial news sources, and stay informed about major economic and political events that may affect currency markets.

What Is Forex Trading Time

Conclusion

Harnessing the power of forex trading time is a masterstroke in the journey towards successful trading. By understanding the global trading sessions, recognizing intermarket correlations, and implementing expert tips, traders can navigate market fluctuations, seize trading opportunities, and elevate their trading endeavors.

Are you ready to plunge into the rhythmic flow of forex trading time and become a maestro of market timing?