In the tumultuous world of foreign exchange (forex) trading, managing risk is paramount to achieving sustained success. Hedging emerges as a pivotal strategy in this regard, empowering traders to mitigate their exposure to adverse price fluctuations while safeguarding their profits. This article delves into the intricate world of forex hedging, exploring its fundamental principles, diverse techniques, and the advantages it offers in navigating the volatile forex market.

Image: www.forexstrategiesresources.com

Understanding the Concept of Hedging

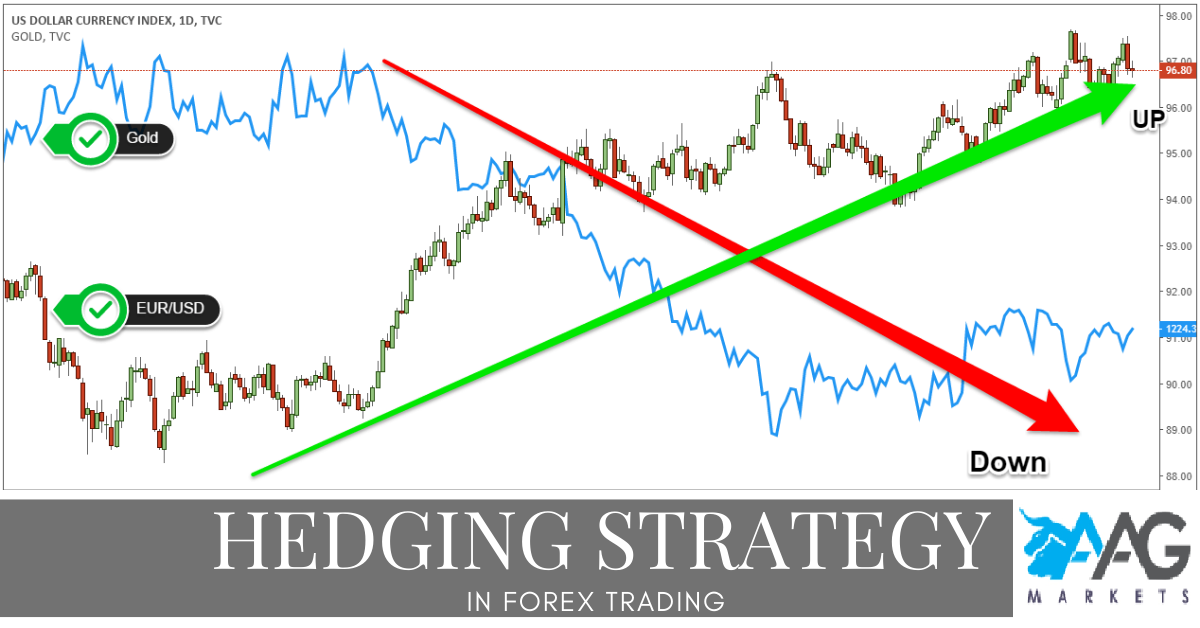

Hedging, in essence, is a risk management strategy that involves engaging in offsetting transactions to minimize potential losses. It essentially entails creating a position in one market that counterbalances the risk associated with a position in another market. This allows traders to reduce their overall market exposure, thereby limiting the impact of unpredictable price movements.

Techniques for Forex Hedging

The forex market offers an array of hedging techniques, each tailored to specific trading objectives and risk appetites. Some of the most common approaches include:

- Currency Pair Hedging: This straightforward method involves holding equal but opposite positions in two currency pairs that are highly correlated. For instance, a trader may long EUR/USD while同時に shorting USD/JPY, as the two pairs typically move in opposite directions.

- Hedging with Futures and Options: Futures and options contracts allow traders to hedge against currency fluctuations with greater flexibility. A trader may buy a futures contract in the currency they want to hedge against or purchase an option that provides the right, but not the obligation, to buy or sell a particular currency at a predetermined price.

- Cross Hedging: This advanced technique involves hedging a position in one currency pair against price movements in another currency pair that exhibits some degree of correlation. For example, a trader with a long EUR/USD position may hedge by shorting EUR/JPY, as both pairs are influenced by the movement of EUR.

Benefits of Hedging in Forex

Hedging in forex offers a plethora of advantages for traders:

- Reduced Risk: Hedging significantly diminishes the potential for substantial losses by offsetting risk exposure.

- Portfolio Protection: Hedging helps in safeguarding overall portfolio value by balancing profitable positions with hedging positions.

- Enhanced Profitability: By mitigating risk, hedging enables traders to extract maximum收益 from their profitable positions.

- Increased Stability: Hedging promotes trading stability by minimizing the impact of market volatility, allowing traders to maintain consistent returns.

Image: www.allperfectstories.com

What Hedging Means In Forex

Conclusion

Hedging in forex is an invaluable risk management strategy that empowers traders to navigate the complexities of the валютный рынок. Whether employed to protect profits or limit losses, hedging offers a range of techniques tailored to diverse trading styles and risk tolerances. By incorporating effective hedging strategies into their trading plans, forex traders can significantly bolster their chances of long-term success.