As the world’s financial markets buzz with activity, the foreign exchange (forex) markets stand out as a perpetual rhythm of buying, selling, and trading currencies. With traders across the globe connected through an intricate network, these markets offer unparalleled opportunities for investors seeking to profit from currency fluctuations.

Image: s3.amazonaws.com

The dynamic ebb and flow of forex markets can be influenced by a multitude of factors, from political events to economic data releases. Understanding which markets are active at any given moment is crucial for traders to make informed decisions and seize the best trading opportunities.

Dissecting Market Hours

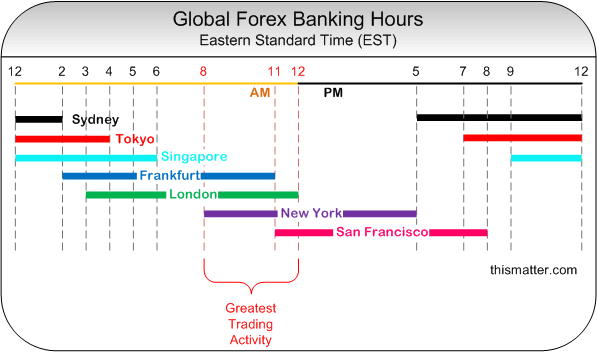

The global forex market operates 24 hours a day, five days a week, spanning across different time zones. However, specific trading sessions experience heightened activity and liquidity, influenced by regional business hours.

The three primary forex trading sessions are as follows:

- Asian Session: Begins around midnight GMT and concludes at 4 AM GMT. This session is characterized by participation from financial hubs in Tokyo, Hong Kong, and Singapore.

- European Session: Overlaps with the Asian Session, starting at 8 AM GMT and lasting until 5 PM GMT. Trading activity during this session is centered around London, Frankfurt, and Zurich.

- North American Session: Commences at 1 PM GMT and extends to 10 PM GMT. Major trading hubs in New York and Chicago drive activity during this session.

Navigating Market Overlaps

The intersection of these trading sessions presents unique opportunities for traders. The overlap between the Asian and European sessions, known as the London Fix, is a period of high liquidity and volatility, particularly for major currency pairs like EUR/USD and GBP/USD.

Similarly, the overlap between the European and North American sessions, dubbed the New York Fix, offers another pocket of increased activity and trade volume. Traders can capitalize on the convergence of liquidity from both hemispheres to find optimal trading conditions.

Tips for Optimal Trading

To maximize success in forex trading, it’s essential to align your trading strategy with market hours. Here are some expert tips:

- Identify High-Volume Sessions: Focus your trading on the periods of greatest liquidity, such as during the London Fix or New York Fix.

- Monitor News Releases: Stay updated on economic data releases and geopolitical events that may impact currency values during specific trading sessions.

li>Consider Position Sizing: If trading during a low-volume session, adjust your position sizes accordingly to minimize risk.

Image: www.signalskyline.com

Enlightening FAQ

Q: What factors determine the activity of a forex market?

A: Market activity is driven by various influences, including economic data, political stability, interest rate decisions, and global events.

Q: Is there a single dominant forex market?

A: No, the global forex market is decentralized, with multiple trading hubs operating simultaneously.

What Forex Markets Are Open Right Now

Conclusion

Understanding the dynamics of forex market hours empowers traders to make strategic decisions and elevate their trading strategies. By aligning with the busiest trading sessions, monitoring key news events, and following expert advice, traders can optimize their trading opportunities and navigate the ever-changing forex landscape with greater confidence.

Are you ready to explore the fascinating world of forex trading? Immerse yourself in the global markets and discover the boundless opportunities that await.