In the dynamic world of foreign exchange (forex), a handful of currency pairs command the spotlight, driving global trade and shaping investment strategies. These currency pairs, known as the majors, play a pivotal role in the forex market, offering traders unparalleled opportunities and challenges. Embark on a journey to unravel the intricacies of the major forex pairs and gain invaluable insights into this exhilarating financial landscape.

Image: ufxtradingwiki.blogspot.com

Understanding the Forex Market

The forex market, a decentralized global network, sees the exchange of currencies between nations, corporations, and individual traders. Its sheer size and liquidity make it the largest and most actively traded financial market in the world. As a global melting pot of currencies, the forex market experiences constant flux and volatility, creating a breeding ground for profit and peril.

The Dominance of Major Forex Pairs

Amidst the myriad of currency pairs traded, a select few stand out as the majors, accounting for the lion’s share of daily trading volume. These pairs are anchored by the world’s most powerful currencies and are widely recognized for their stability, liquidity, and predictable trading patterns. Understanding the dynamics of these major pairs is crucial for successful forex navigation.

USD/EUR: The Euro-Dollar Powerhouse

The undisputed heavyweight of the forex market, the USD/EUR currency pair pits the U.S. dollar, the world’s reserve currency, against the euro, representing the economic might of the eurozone. Dubbed the “Euro,” this pair garners immense attention due to its high liquidity and correlation to global economic events.

Image: emugepavo.web.fc2.com

USD/JPY: Japanese Yen’s Resilience

The USD/JPY pair pits the U.S. dollar against the resilient Japanese yen. Due to Japan’s strong economy and position as a safe-haven asset, the yen often attracts investors during times of market uncertainty. This pair offers traders an alternative perspective on the global economic climate.

GBP/USD: Sterling’s Global Influence

The GBP/USD currency pair, affectionately known as “Cable,” pairs the British pound sterling with the U.S. dollar. Considered a barometer of the U.K. economy, Cable reflects the political and economic sentiments surrounding the United Kingdom. Its strong liquidity and historical significance make it a popular choice among forex traders.

USD/CHF: Swiss Franc’s Safe Haven Status

The USD/CHF currency pair pairs the U.S. dollar with the Swiss franc, a renowned safe-haven currency. In times of market turmoil, the franc often strengthens against the dollar, leading to its popularity as a defensive asset. This pair provides traders with a risk-averse approach to forex trading.

AUD/USD: Australian Dollar’s Commodity Correlation

The AUD/USD currency pair, nicknamed the “Aussie,” pairs the Australian dollar with the U.S. dollar. Given Australia’s strong correlation to global commodity prices, the Aussie’s value is heavily influenced by economic growth in China, a major consumer of its natural resources. This pair offers exposure to both currency and commodity markets.

NZD/USD: New Zealand Dollar’s Dynamic Fluctuations

Similar to the Aussie, the NZD/USD currency pair pairs the New Zealand dollar with the U.S. dollar. Known as the “Kiwi,” this pair mirrors the economic conditions of New Zealand, primarily driven by dairy and agricultural exports. Its high volatility makes it a trader’s delight.

CAD/USD: Canadian Dollar’s Economic Ties

The CAD/USD currency pair matches the Canadian dollar with the U.S. dollar, reflecting the close economic relationship between the two nations. Aptly named “Loonie,” this pair is heavily influenced by the price of oil, a key export for Canada. Its stability and liquidity make it a popular choice for long-term forex strategies.

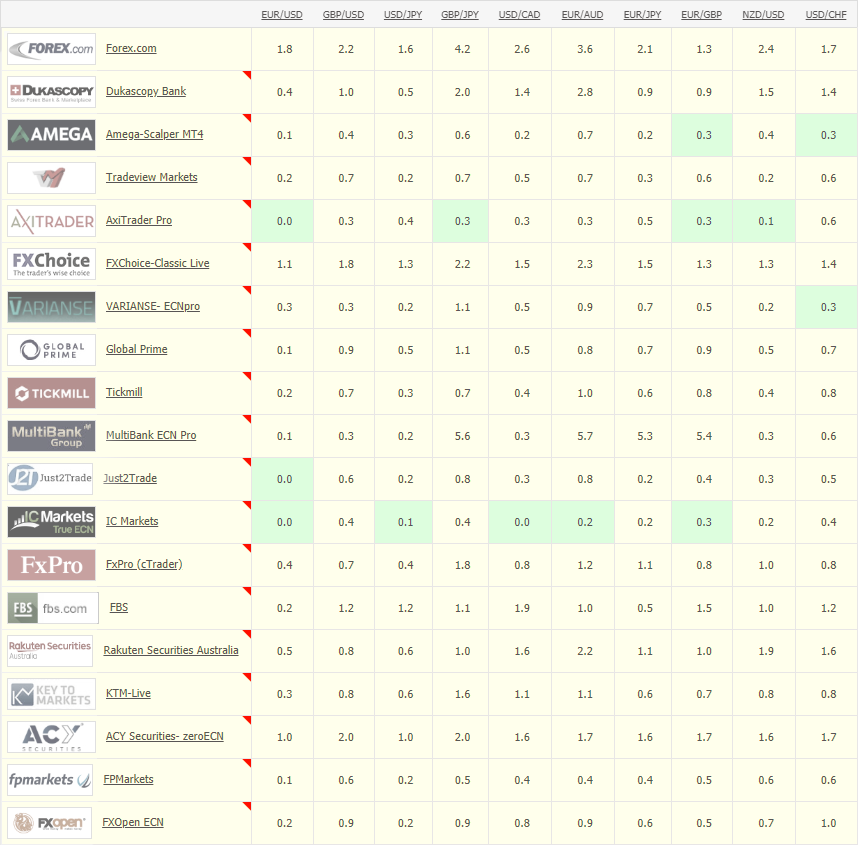

What Are The Major Forex Pairs

Unlocking Forex Profits and Pitfalls

Trading the major forex pairs can be an exhilarating and potentially lucrative endeavor, but it’s essential to approach it with caution and a thorough understanding of the market. Volatility, geopolitical events, and macroeconomic factors can all impact currency values, presenting both opportunities and risks.

To navigate the ever-shifting forex landscape successfully, traders must arm themselves with knowledge, develop sound strategies, and manage risk effectively. By embracing the insights provided by the major currency pairs, traders can unlock the gateway to forex profitability.