Introduction

Time frames are an integral aspect of forex trading, often making the difference between profitable and losing trades. Understanding the various time frames and their implications can empower traders to make informed decisions, enhance their trading strategies, and optimize their chances of success in the volatile world of forex.

From the bustling one-minute charts to the broader monthly perspectives, each time frame offers unique insights, requiring traders to navigate them skillfully. By delving deeper into the significance of time frames, we’ll uncover their profound influence on forex trading and arm you with the knowledge to exploit them to your advantage.

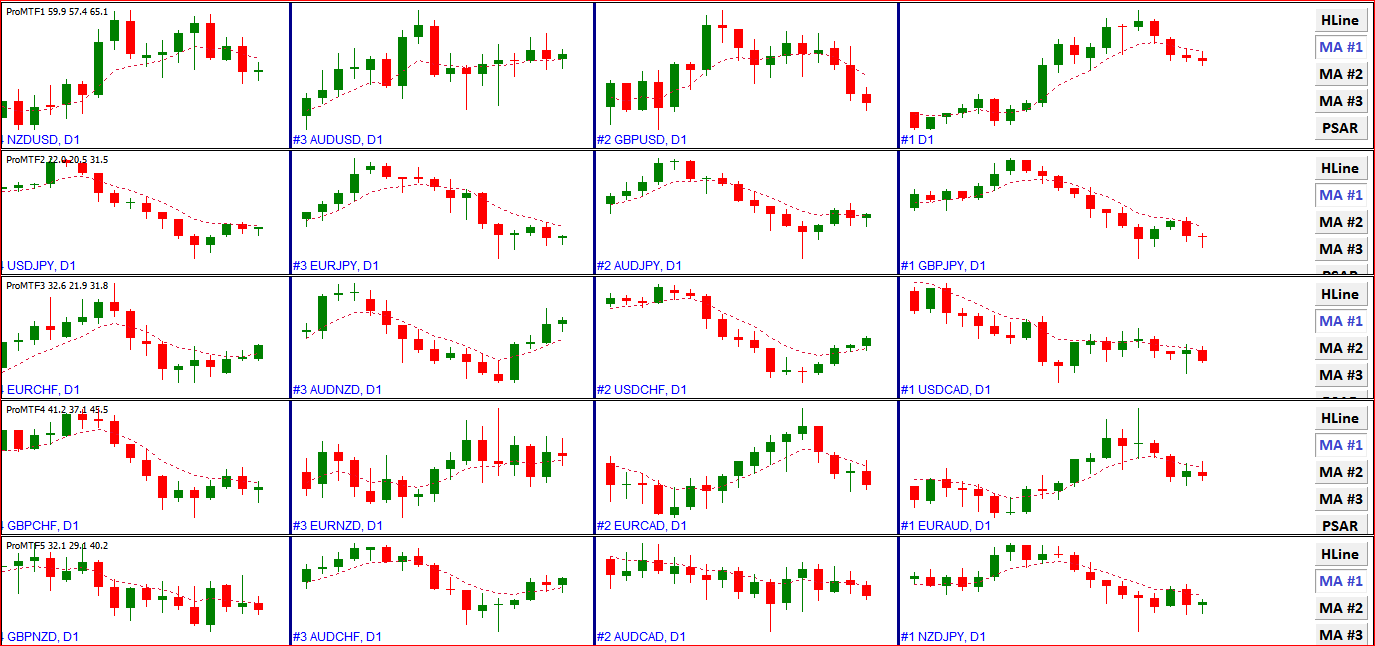

Image: www.beyond2015.org

The Spectrum of Time Frames

Forex time frames encompass a wide range, from the fleeting one-minute charts that capture rapid price fluctuations to the sweeping monthly charts that reveal long-term market trends. Below is a breakdown of some commonly used time frames:

- One-Minute Chart: Provides a highly detailed view of price action, capturing every tick and fluctuation.

- Five-Minute Chart: Offers a slightly broader perspective, smoothing out minor price movements.

- Hourly Chart: Ideal for identifying short-term trends and support and resistance levels.

- Daily Chart: Provides a comprehensive daily overview, revealing longer-term trend patterns.

- Weekly Chart: Captures weekly price action, allowing traders to gauge market sentiment and potential turning points.

- Monthly Chart: Offers a broad, long-term perspective, ideal for strategic planning and identifying major market shifts.

The Nuances of Each Time Frame

Each time frame carries distinct characteristics and implications that traders must be aware of:

One-Minute to Hourly Charts: These short-term charts are suited for scalping and day trading strategies. They provide real-time insights into price movements, enabling traders to capitalize on quick fluctuations. However, these charts can be susceptible to noise and false signals, demanding caution and risk management.

Daily to Weekly Charts: These medium-term charts offer a balance between short-term price action and long-term trend identification. They are commonly used for swing trading and position trading strategies. Traders can use these charts to gauge market sentiment, identify potential reversals, and plan entries and exits accordingly.

Monthly Charts: These long-term charts are indispensable for strategic trading decisions. They provide a comprehensive view of market cycles, major trend shifts, and support and resistance levels. Traders can use monthly charts to identify areas of potential market turning points and plan their trades with a broader perspective.

Choosing the Right Time Frame for Your Needs

The optimal time frame for trading depends on individual preferences, trading strategies, and risk tolerance. Here are some considerations:

- Scalpers and Day Traders: One-minute to hourly charts provide the necessary granularity for quick trades.

- Swing Traders: Daily to weekly charts offer a balance between detailed price action and trend identification.

- Position Traders: Monthly charts provide a broad perspective for long-term, strategic trades.

Traders should experiment with different time frames to discover what suits their trading style and objectives best. A combination of multiple time frames can also enhance trading insights and decision-making.

Image: forexprofitprotector.com

Understanding Time Frames In Forex

Conclusion

Mastering time frames in forex trading is essential for developing a successful trading strategy. Understanding the nuances and implications of each time frame allows traders to make informed decisions, exploit market trends, and manage risk effectively. By navigating the spectrum of time frames skillfully, traders can unlock the full potential of forex trading and position themselves for long-term profitability.