Unlocking the Secrets of Candlesticks: A Guide to Technical Analysis

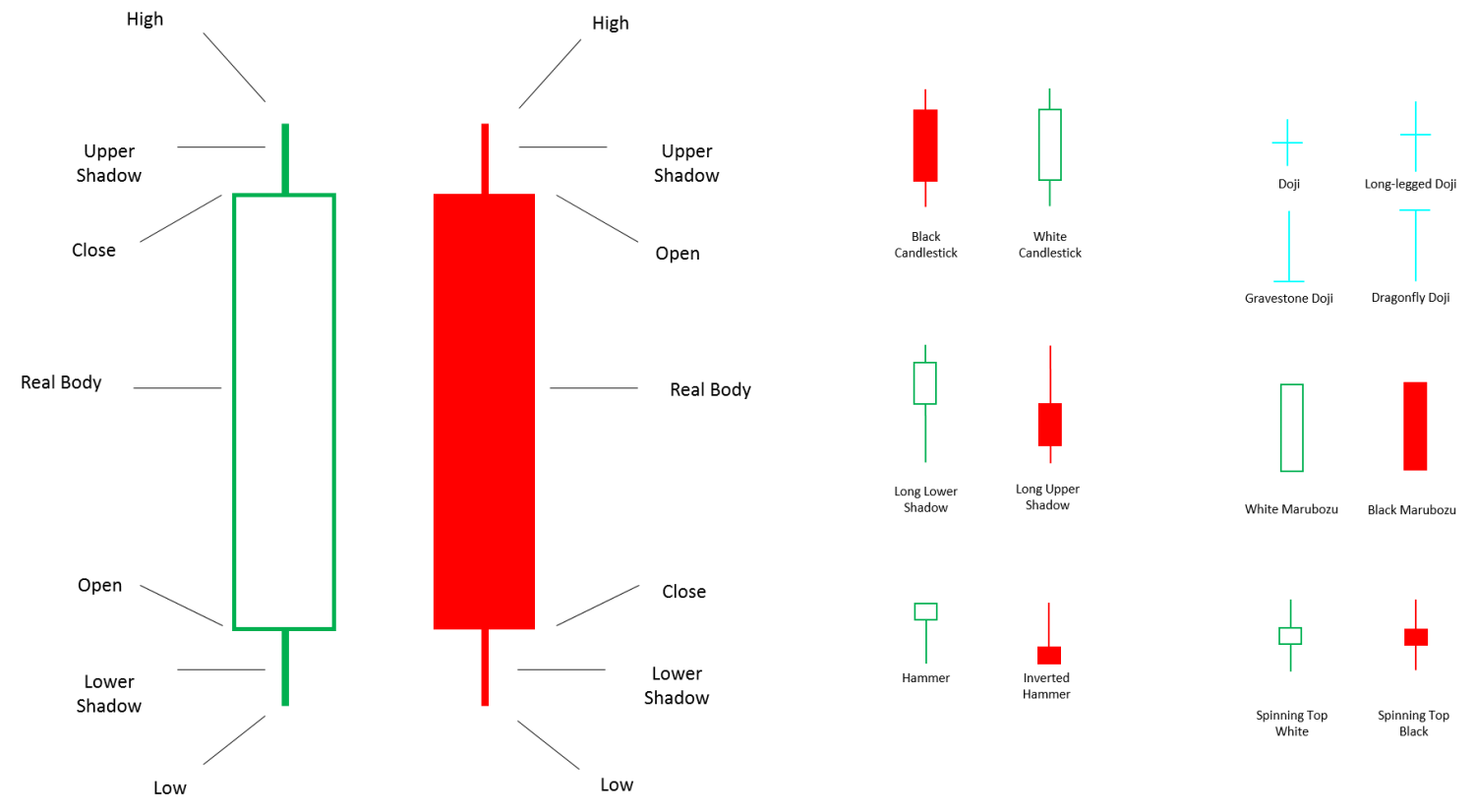

Technical analysis plays a crucial role in successful trading. Candlesticks, a powerful charting tool, provide valuable insights into market behavior, allowing traders to make informed decisions. In this comprehensive guide, we will delve into the intricacies of the candlestick pattern, illuminating its significance and helping traders harness its potential for superior trading outcomes.

Image: www.pinterest.com

Candlestick Pattern: A Comprehensive Overview

Candlesticks, originating from Japanese rice trading in the 18th century, are graphical representations of price action over a specific period. They consist of real bodies (depicting the open and close prices) and wicks (displaying the highest and lowest prices). Each candlestick reflects market sentiment, providing traders with clues about the supply and demand dynamics.

Candlesticks are further classified into various patterns, each carrying distinct implications. Understanding these patterns—such as bullish and bearish engulfing, hammers and shooting stars, and spinning tops—enables traders to identify potential reversals, trend continuation, and consolidation.

Bullish Candlestick Patterns

Bullish candlestick patterns signal an increase in buying pressure, indicating a potential uptrend. Some prominent bullish patterns include:

Bearish Candlestick Patterns

Bearish candlestick patterns suggest an increase in selling pressure, signaling a possible downtrend. Some prominent bearish patterns encompass:

Image: howtotradeonforex.github.io

Neutral Candlestick Patterns

Neutral candlestick patterns indicate indecision in the market, suggesting potential consolidation or trendless movement. Some common neutral patterns encompass:

Utilizing Candlestick Patterns for Trading

Candlestick patterns provide valuable insights into market sentiment and potential price movements, enabling traders to make sound trading decisions.

Combining Candlestick Patterns with Other Indicators

To enhance trading decisions, traders often combine candlestick patterns with other technical indicators like moving averages, support and resistance levels, and volume indicators. This confluence of analysis provides a more comprehensive understanding of market dynamics and potential trading opportunities.

Trading Psychology: Managing Emotions

Trading is a highly emotional endeavor, and controlling one’s emotions is paramount. Candlestick patterns should be used as a tool to guide decision-making, but traders must remain disciplined and avoid succumbing to fear or greed during market fluctuations.

Candle Sticks Pattern

Conclusion

Trading with candlestick patterns can be a potent tool in the arsenal of any trader seeking profitability. Analyzing candlestick patterns, understanding their implications, and combining them with other indicators and sound trading psychology can provide a competitive edge in navigating the often volatile financial markets.

Are you ready to harness the power of candlestick patterns in your trading endeavors? Let’s delve into the world of technical analysis and unlock the secrets to making informed trading decisions!