Are you an avid traveler or a frequent business professional who juggles multiple currencies? Forex cards have emerged as indispensable tools for managing finances abroad, allowing you to exchange currencies conveniently and avoid hefty transaction fees. However, the question that often arises is how to transfer the remaining balance on your forex card to your bank account once you’re back home. Understanding the process of transferring forex card amounts to your bank account is crucial to ensure a seamless and efficient transaction. This article will provide a comprehensive guide to help you navigate this process with ease.

Image: theenterpriseworld.com

Defining Forex Cards: Understanding the Basics

Forex cards, also known as currency cards or travel cards, are prepaid cards that allow you to load multiple currencies onto a single card. They offer several advantages, including the ability to lock in favorable exchange rates, avoid ATM withdrawal fees, and make purchases in foreign currencies without incurring hefty exchange rate markups.

Many banks and financial institutions issue forex cards to their customers. These cards can be used worldwide, giving you the flexibility to manage your finances conveniently while traveling or transacting in foreign currencies.

Transferring Forex Card Balances: A Step-by-Step Guide

Transferring the remaining balance on your forex card to your bank account is a straightforward process that typically involves the following steps:

1. Check Card Policies and Fees:

Before initiating a transfer, carefully review the terms and conditions associated with your forex card. Some cards may have restrictions on transferring balances, such as minimum or maximum transfer amounts, or may charge fees for the transaction. Understanding these terms will help you avoid any unexpected charges or delays.

Image: www.apnaplan.com

2. Gather Necessary Information:

To initiate the transfer, you will need to provide specific information, including your bank account number, the corresponding routing number, and the amount you wish to transfer. Ensure that you have all this information readily available to facilitate a smooth transaction.

3. Contact Your Card Issuer:

Reach out to the bank or financial institution that issued your forex card. They will provide you with the necessary instructions and guidance for initiating the transfer. You can contact them via phone, email, or through their online banking platform, depending on the preferred method of communication.

4. Initiate the Transfer:

Once you have gathered all the required information and have contacted your card issuer, you can proceed with initiating the transfer. Provide the necessary details, such as your bank account information and the transfer amount, and follow the instructions provided by your card issuer. Some banks may require you to complete a transfer form or provide additional verification measures for security purposes.

5. Processing Time:

The processing time for forex card transfers may vary depending on the card issuer and the destination bank. It typically takes a few business days for the transfer to be completed and reflected in your bank account. During this period, your funds will be in transit and will not be available for use.

Additional Tips for Forex Card Transfers

- Consider exchange rates when transferring funds. Transferring large amounts when exchange rates are favorable can help you maximize your savings.

- Be aware of any fees associated with the transfer, such as processing fees or exchange rate markups. Factor these fees into your calculations to avoid surprises.

- Keep records of your transfers, including the date, amount, and reference number, for future reference or in case of any discrepancies.

- If you have any questions or encounter any difficulties during the transfer process, don’t hesitate to contact your card issuer for assistance.

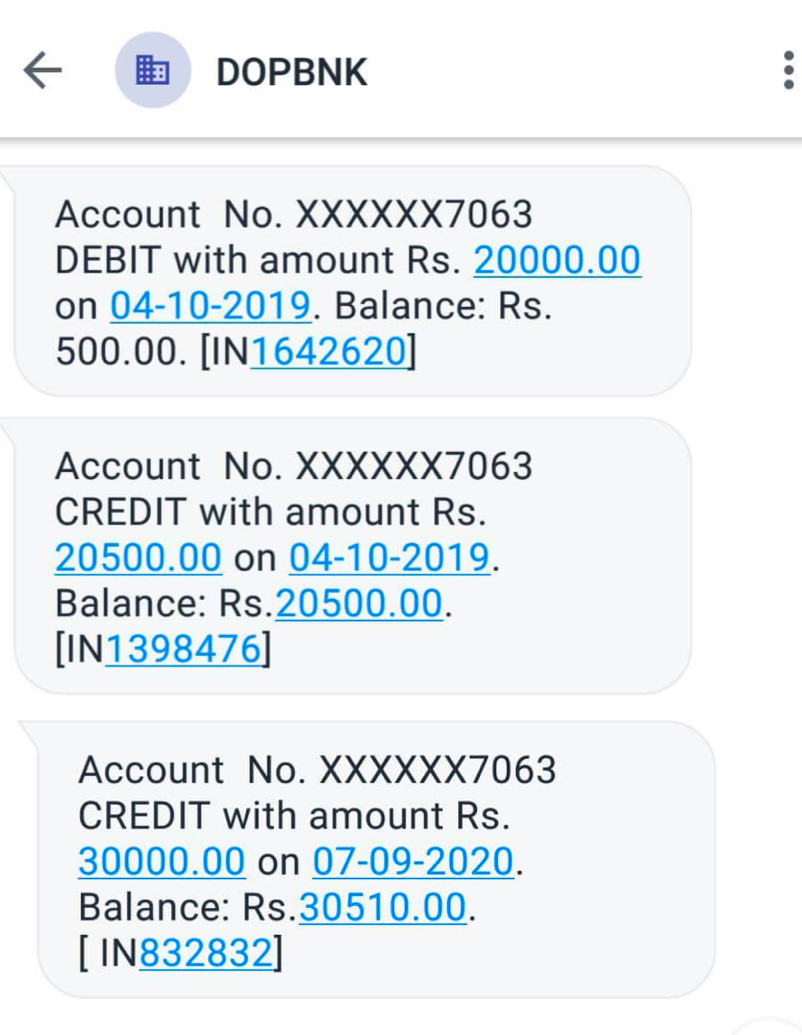

Transfer Forex Card Amount To Bank Account

Conclusion

Transferring the remaining balance on your forex card to your bank account is a straightforward process that can be easily accomplished by following the steps outlined in this article. By understanding the process and knowing what to expect, you can ensure a smooth and efficient transfer of funds. Forex cards offer numerous benefits for travelers and individuals dealing with foreign currencies, and knowing how to manage your forex card balance effectively will allow you to optimize the use of this convenient financial tool.