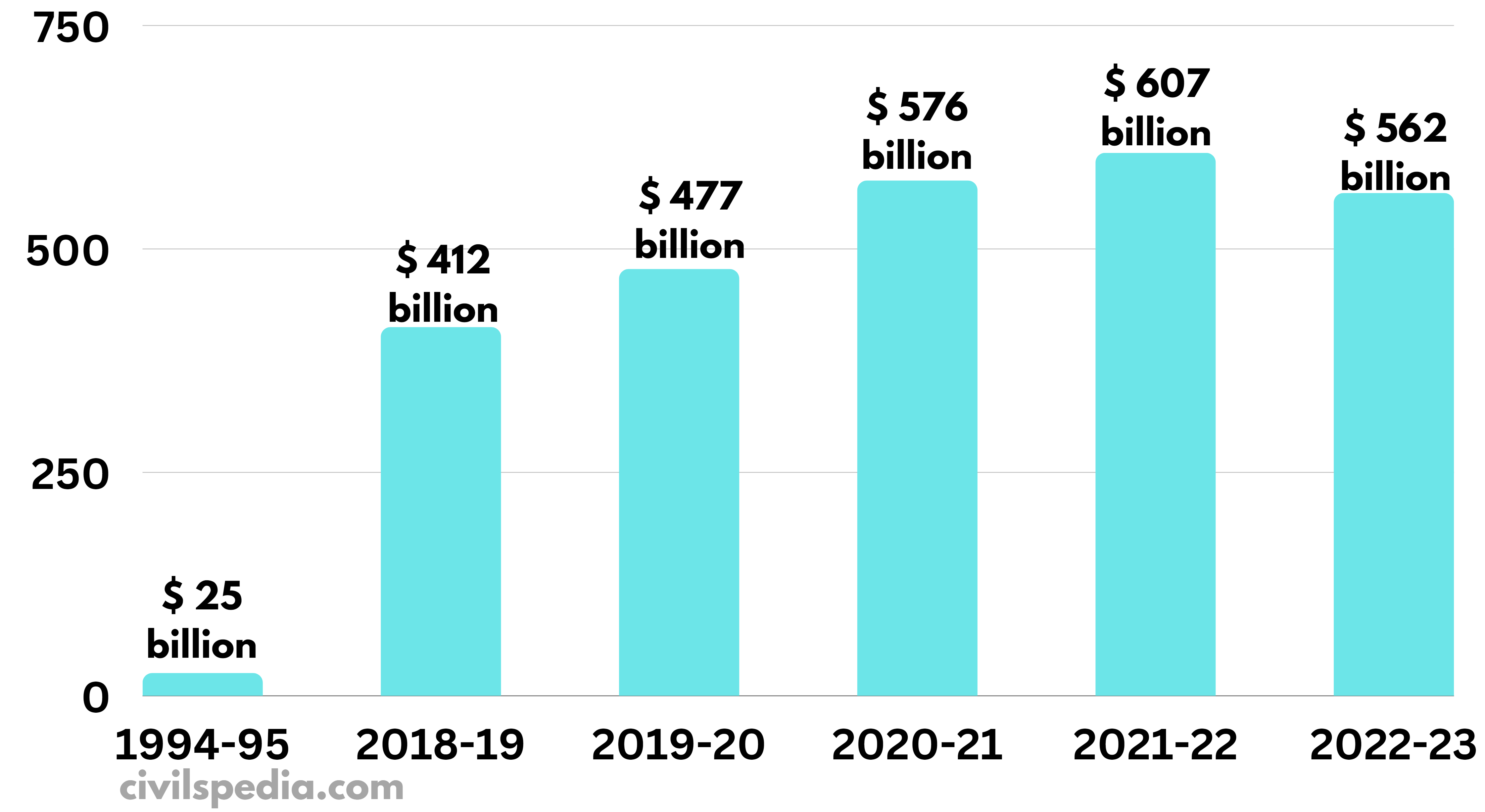

India’s foreign exchange reserves have witnessed unprecedented growth in recent years, showcasing the country’s solid economic standing on the global platform. These reserves play a significant role in safeguarding India’s financial resilience, bolstering its currency value, and providing a buffer against external economic shocks.

Image: civilspedia.com

This surge in reserves is attributed to multiple factors, including robust foreign direct investment inflows, increased remittances from Indian expatriates, and a steady rise in exports. As of January 2023, India’s forex stockpile has soared to a record high of $633.5 billion, highlighting the nation’s burgeoning economic strength.

Components of India’s Forex Reserves

India’s forex reserves comprise a diverse range of assets:

- Foreign currency assets: Over 90% of the reserves are held in different foreign currencies, primarily in US dollars, euros, and Japanese yen.

- Gold: Gold makes up a significant portion of the reserves, providing a hedge against inflation and geopolitical uncertainties.

- Special Drawing Rights (SDRs): These are international reserve assets created by the International Monetary Fund (IMF) that supplement countries’ official reserves.

- Reserve tranche position at IMF: India’s reserve tranche position at the IMF signifies the amount of foreign currency it can draw upon in times of economic difficulty.

Benefits of India’s Bulging Forex Reserves

- Ensuring Exchange Rate Stability: Forex reserves enable India’s central bank, the Reserve Bank of India (RBI), to intervene in the foreign exchange market to stabilize the country’s currency value against external volatilities.

- Supporting Import Payments: India’s import-driven economy requires substantial foreign exchange reserves to meet its import obligations, including for essential commodities such as oil and gas.

- Boosting Foreign Investor Confidence: Ample forex reserves indicate India’s ability to service its external obligations, which enhances investor confidence and encourages foreign direct investment.

- Mitigating External Shocks: Forex reserves act as a shock absorber during economic crises, allowing India to meet its short-term external financial obligations and maintain liquidity.

- Supporting Economic Growth: Adequate forex reserves facilitate India’s economic growth by promoting investment and consumption while ensuring financial stability.

Image: www.drishtiias.com

Total Forex Reserve Of India

Conclusion

India’s burgeoning forex reserves are a testament to the country’s robust economic fundamentals and resilience against external challenges. These reserves provide a safety net against economic shocks, bolster confidence among domestic and international stakeholders, and support India’s aspirations for sustainable economic growth. India’s prudent management of its forex reserves will continue to underpin its financial stability and economic prosperity in the years to come.