As an aspiring forex trader in India, staying abreast of the regulatory landscape is paramount. The Reserve Bank of India (RBI) plays a crucial role in governing this market, ensuring transparency and minimizing risks. In this comprehensive guide, we delve into the RBI’s rules and regulations for forex trading, empowering you with the knowledge necessary for compliant and successful participation.

Image: www.businesstoday.in

RBI’s Mandate

The RBI serves as the primary regulator for forex trading in India. Its key objectives are to:

- Maintain foreign exchange reserves to support India’s external trade and payments.

- Manage the exchange rate of the Indian rupee against foreign currencies.

- Monitor and regulate foreign exchange transactions to curb illegal activities and maintain financial stability.

Eligibility Criteria

To engage in forex trading, individuals and entities must meet the following eligibility criteria set by the RBI:

- Be a resident of India with a valid Permanent Account Number (PAN)

- Hold a trading account with an authorized forex dealer or broker

- Have a trading strategy and sufficient risk management measures in place

- Adhere to all applicable laws and regulations

Authorized Dealers

The RBI authorizes specific financial institutions to act as forex dealers, enabling individuals to access the forex market. These authorized dealers are subject to strict regulatory oversight and must comply with all RBI guidelines. They play a vital role in facilitating forex transactions, providing hedging instruments, and ensuring market liquidity.

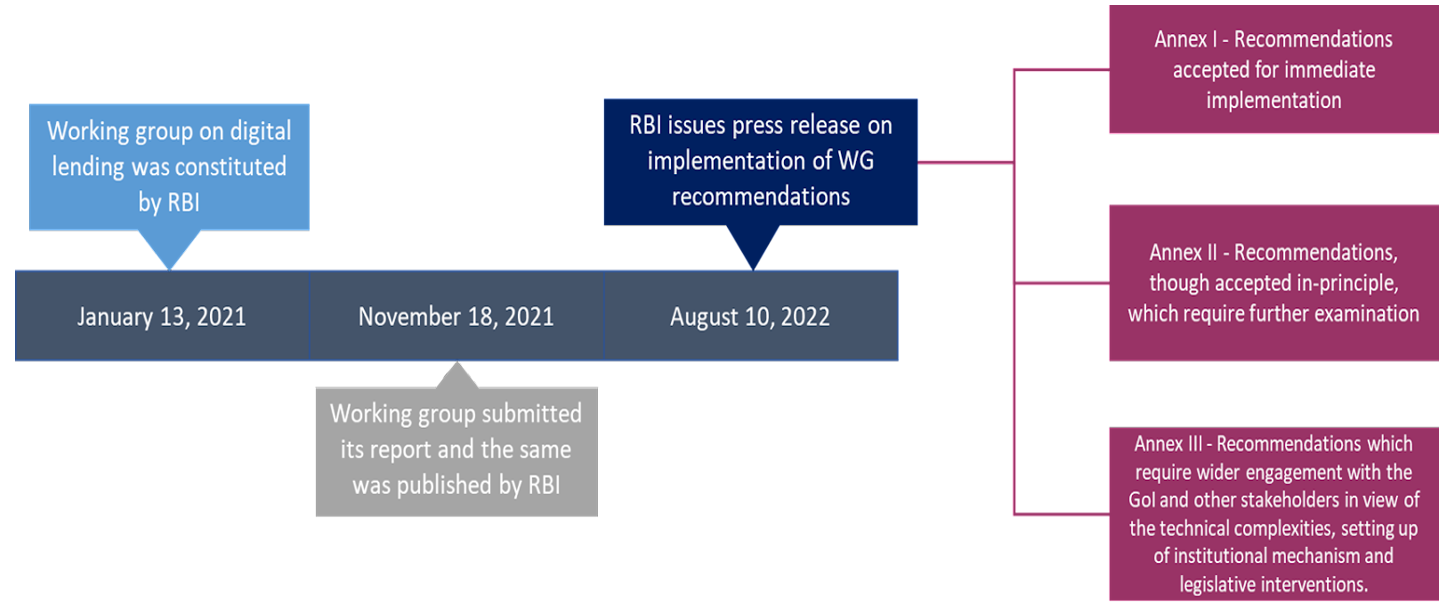

Image: vinodkothari.com

Transaction Limits and Reporting

The RBI imposes limits on the amount of forex transactions that individuals and corporates can undertake. These limits are designed to prevent excessive speculation and ensure the orderly functioning of the forex market. Additionally, all forex transactions must be reported to the RBI within prescribed timeframes. This information is used to monitor market trends, analyze imbalances, and enforce regulations.

Investment Instruments

The RBI allows for a range of investment instruments in the forex market, including currency spot contracts, currency forwards, options, and swaps. Each instrument has its own unique characteristics and regulatory requirements. Traders should carefully assess their risk tolerance and investment goals before selecting an instrument.

Risk Mitigation

Forex trading involves inherent risks, such as currency fluctuations and market volatility. The RBI encourages traders to implement robust risk management strategies, including:

- Using stop-loss orders to limit potential losses

- Leveraging appropriate position sizing techniques

li>Diversifying trading activities across different currency pairs and instruments

Tips for Compliance and Success

To ensure compliance with RBI regulations and enhance trading outcomes, follow these expert tips:

- Thoroughly understand the RBI’s rules and regulations.

- Choose a reputable and authorized forex broker.

- Develop a clear trading strategy and risk management framework.

- Monitor market trends diligently and stay informed about geopolitical events.

- Use technology and tools to aid your trading decisions.

FAQs

Q: Who can engage in forex trading in India?

A: Residents of India with a PAN, trading account, and adequate knowledge and risk management measures.

Q: What are the eligibility criteria to become an authorized forex dealer?

A: Financial institutions with established infrastructure, licensed staff, and a track record of responsible conduct.

Q: What types of forex transactions require RBI approval?

A: Transactions exceeding prescribed limits, investments in foreign assets, and borrowings or lendings in foreign currencies.

Q: How does the RBI monitor forex transactions?

A: Through periodic reporting, inspections, and data analysis.

Q: What are the penalties for violating RBI forex regulations?

A: Penalties include fines, sanctions, and disqualification from forex trading.

Rbi Rules And Regulations For Forex Trading

Conclusion

Compliance with the RBI’s rules and regulations for forex trading is essential for individuals and entities operating in India. By adhering to these regulations, traders can create a safe and transparent trading environment, mitigate risks, and seize opportunities in the global forex market. If you are considering entering this dynamic arena, seek guidance from reputable sources and conduct thorough research to maximize your trading potential while minimizing legal and financial pitfalls. Are you ready to navigate the forex market with confidence under the regulatory umbrella of the Reserve Bank of India?