Imagine being able to trade currencies from the comfort of your home, accessing a global market worth trillions of dollars. That’s the power of forex, the foreign exchange market, where currencies are traded 24 hours a day, five days a week. Understanding forex trading session times GMT is crucial to navigating this dynamic market and maximizing your trading opportunities.

Image: www.forexmarkethours.com

What is Forex Trading and Why is it Important?

Forex trading involves the buying and selling of currency pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). Traders aim to profit from the fluctuations in exchange rates. Forex trading has become increasingly popular due to its 24/5 accessibility, high liquidity, and the potential for substantial returns.

Exploring Forex Trading Session Times GMT

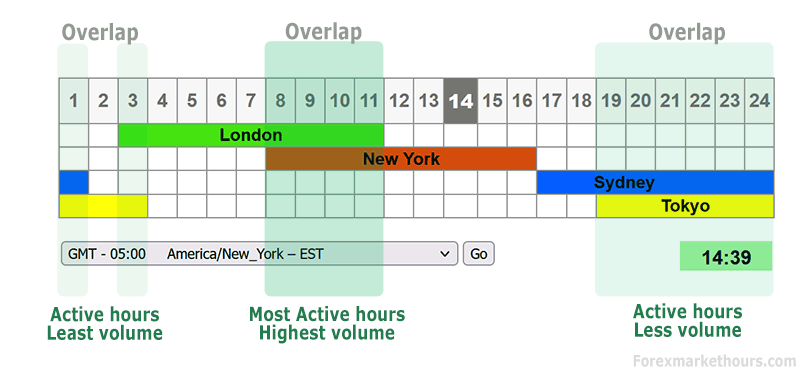

The forex market operates 24 hours a day, but trading activity is concentrated during specific session times. These sessions are divided into four major hubs:

Sydney Session (10:00 PM GMT to 7:00 AM GMT): The Sydney session kicks off the forex trading day. It is characterized by low trading volume, making it suitable for scalping and short-term trading strategies.

Tokyo Session (12:00 AM GMT to 9:00 AM GMT): The Tokyo session sees increased trading volume as Japan, the world’s third-largest economy, wakes up. This session is often marked by strong price fluctuations, providing opportunities for breakout and range-trading strategies.

London Session (8:00 AM GMT to 5:00 PM GMT): The London session is the busiest trading session of the day, with a high volume and volatility. Traders can find numerous trading opportunities during this active period.

New York Session (1:00 PM GMT to 10:00 PM GMT): The New York session overlaps with the London session, extending trading hours and providing another period of high activity. This session is known for its impact on major currency pairs, such as EUR/USD and GBP/USD.

Maximizing Trading Opportunities

Understanding forex trading session times GMT allows traders to tailor their strategies to specific market conditions. The following tips can help you maximize trading opportunities:

-

Identify High-Volume Sessions: The London and New York sessions offer the highest trading volume and volatility, providing the best opportunities for profit.

-

Capitalize on Overlaps: The overlap between the London and New York sessions is a period of high activity and volatility, creating potential for lucrative trades.

-

Monitor Currency Pairs: Different currency pairs perform differently during each session. For example, EUR/USD is highly traded during the London session, while USD/JPY tends to be more active during the Tokyo session.

-

Consider Economic Events: Key economic events, such as interest rate announcements and economic indicators, can significantly impact currency prices. Research upcoming events and align your trading strategy accordingly.

Image: forexfibonacciscalperstrategy.blogspot.com

Forex Trading Session Times Gmt

Harnessing the Power of Forex Trading

By mastering forex trading session times GMT, traders can navigate the global currency market with confidence and precision. This knowledge empowers individuals to make informed decisions, identify trading opportunities, and maximize their chances of success. So, embrace the vibrant world of forex trading, delve into the intricate tapestry of session times, and unlock the potential for financial success.