Have you ever found yourself standing at a foreign currency exchange counter, wondering how many dollars your euros are worth? The world of currency exchange can be a confusing maze, especially when trying to decipher the fluctuating rates and understand the intricacies of international finance. This article will offer a comprehensive guide to converting 75 euros to US dollars, exploring the factors that influence exchange rates, and providing practical tips for maximizing your conversion returns.

Image: forex-station.com

Understanding the relationship between euros and US dollars is crucial for travelers, businesses, and anyone who handles international transactions. From planning a trip to Europe to managing financial investments, having a grasp on the current exchange rate can significantly impact your budget and financial decisions. By delving into the world of currency conversion, we’ll shed light on the key variables that drive exchange rate movements and empower you to make informed decisions in the global marketplace.

What is the Current Exchange Rate for 75 Euros?

The exchange rate between euros and US dollars is constantly in flux, influenced by a wide range of economic factors. As of today, 75 euros are equivalent to approximately $80.65. This figure is based on the current mid-market rate, which represents the average rate at which banks are buying and selling euros. However, the actual rate you’ll receive when exchanging 75 euros at a bank or currency exchange bureau can be slightly different due to various fees and margins.

Factors That Influence the Euro-to-Dollar Exchange Rate

The exchange rate between the euro and the US dollar is a complex interplay of economic forces, including:

1. Interest Rates

Central banks in both the United States and the Eurozone adjust interest rates to influence economic activity. Higher interest rates attract foreign investors, increasing demand for the currency and causing it to appreciate. Conversely, lower interest rates can weaken the currency.

Image: moneymunch.com

2. Economic Growth

Strong economic growth in a country typically leads to currency appreciation as investors are attracted to its robust economy. Conversely, slow or negative economic growth can weaken a currency.

3. Government Debt

High levels of government debt can put pressure on a country’s currency. Investors may become hesitant to invest in a nation with a high debt burden, leading to decreased demand and currency depreciation.

4. Political Stability and Uncertainty

Political instability and uncertainty can negatively impact a country’s currency. Investors may lose confidence in a nation with volatile politics, potentially leading to capital flight and currency depreciation.

5. Trade Flows

The balance of trade between two countries can also influence their exchange rates. If a country exports more goods than it imports, this can increase demand for its currency and cause it to appreciate.

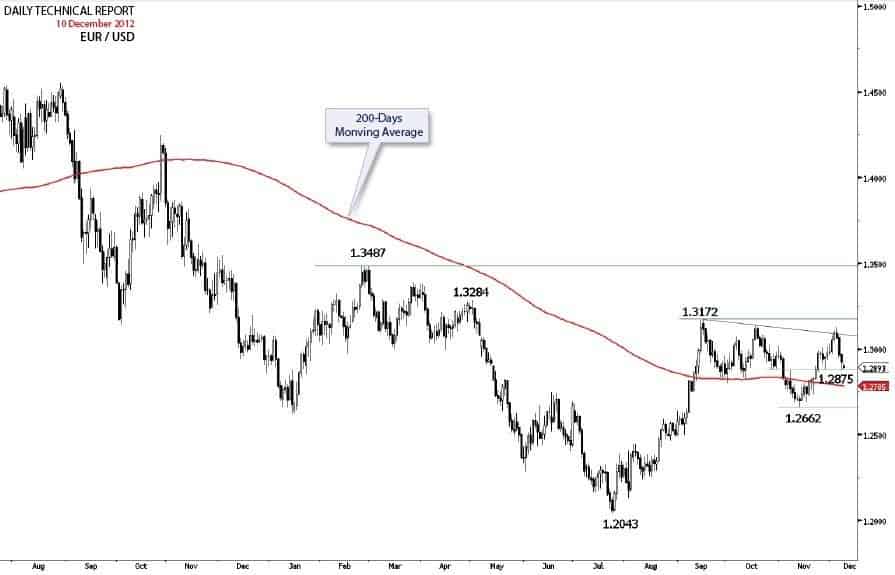

Historical Exchange Rate Trends

Over the past years, the euro-to-dollar exchange rate has fluctuated significantly, with periods of appreciation and depreciation. In the wake of the 2008 financial crisis, the euro experienced a period of weakness against the dollar. However, in subsequent years, the euro rebounded and gained strength, even reaching parity with the dollar in 2017.

Practical Tips for Converting Euros to USD

When converting euros to US dollars, there are several strategies you can employ to maximize your return:

1. Compare Exchange Rates

Before exchanging euros, compare rates at various banks, currency exchange bureaus, and online services. Look for mid-market rates, which are generally the most favorable. Avoid exchanging euros at airports or tourist destinations as these usually have inflated exchange rates.

2. Use a Debit or Credit Card

Using a debit or credit card for purchases while traveling can often provide better exchange rates than cash transactions. However, ensure that your card has a low foreign transaction fee.

3. Consider an ATM Withdrawal

Withdrawing money from an ATM using your debit card can offer competitive exchange rates. However, check with your bank for any international ATM fees.

4. Exchange a Small Amount

If you’re unsure how much you’ll need, it’s wise to exchange a small amount of euros initially. This prevents you from losing a significant amount on unfavorable exchange rates.

5. Monitor Exchange Rate Fluctuations

Stay informed about exchange rate movements. Consider using exchange rate tracking apps or websites to monitor trends and identify favorable opportunities.

The Future of the Euro-to-Dollar Exchange Rate

Predicting future exchange rate movements is a challenging task, but some analysts suggest that the euro could continue to gain strength against the dollar in the coming years. This is due to factors such as the relative strength of the European economy and the potential for the Federal Reserve to raise interest rates more aggressively than the European Central Bank. However, geopolitical uncertainties, global economic conditions, and other factors could easily impact these predictions.

75 Euros To Usd

Conclusion

Navigating the world of currency exchange can seem daunting, but with a clear understanding of the factors influencing exchange rates and by employing practical strategies, you can maximize your conversion returns. Remember to compare rates, use a debit or credit card when appropriate, and monitor exchange rate movements to make informed financial decisions. By staying informed, you’ll be well-equipped to bridge the gap between euros and US dollars and make the most of your international financial transactions.