Introduction

Delving into the dynamic world of forex trading can be an enriching experience, empowering you to tap into global currency fluctuations for potential financial gains. Among the various currency pairs available, XAUUSD stands out as a popular choice, with ‘XAU’ representing gold and ‘USD’ representing the US dollar. This comprehensive guide is crafted to equip you with the knowledge and insights you need to navigate the complexities of XAUUSD trading successfully, maximizing your chances of navigating the markets with confidence and reaping the potential rewards.

Image: bestsystemforexwinners.blogspot.com

Understanding XAUUSD Trading

XAUUSD trading involves speculating on the future value of gold relative to the US dollar. Gold is a timeless asset considered a safe haven, retaining its value amidst market uncertainties. In this pair, a rising price indicates a strengthening gold against the dollar, while a falling price suggests gold is weakening against the dollar. Understanding the fundamental factors influencing gold, such as economic data, global events, and geopolitical tensions, is crucial for effective trading.

Technical Analysis Techniques

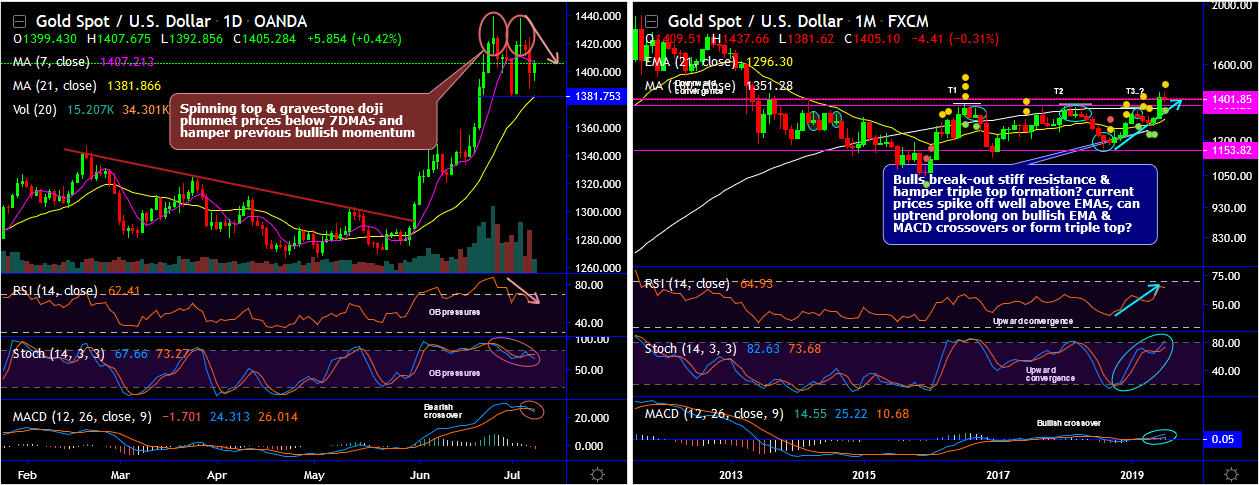

Technical analysis plays a significant role in XAUUSD trading, utilizing past price data to forecast future price movements. Popular technical indicators include:

- Moving Averages: Displaying the average price over a specific period, providing support and resistance levels.

- Relative Strength Index (RSI): Measuring the magnitude of recent price changes, indicating overbought or oversold conditions.

- Bollinger Bands: Enveloping the price action within upper and lower bands, signaling potential breakouts or reversals.

Fundamental Analysis Considerations

While technical analysis is valuable, incorporating fundamental analysis enhances decision-making by considering external factors impacting the value of gold and the US dollar, such as:

- Economic Data: GDP growth, inflation rates, and unemployment figures influence currency values.

- Political Events: Geopolitical tensions, elections, and changes in government policies impact market sentiment.

- Central Bank Actions: Interest rate decisions and monetary policies influence currency values.

Image: www.colibritrader.com

Risk Management Strategies

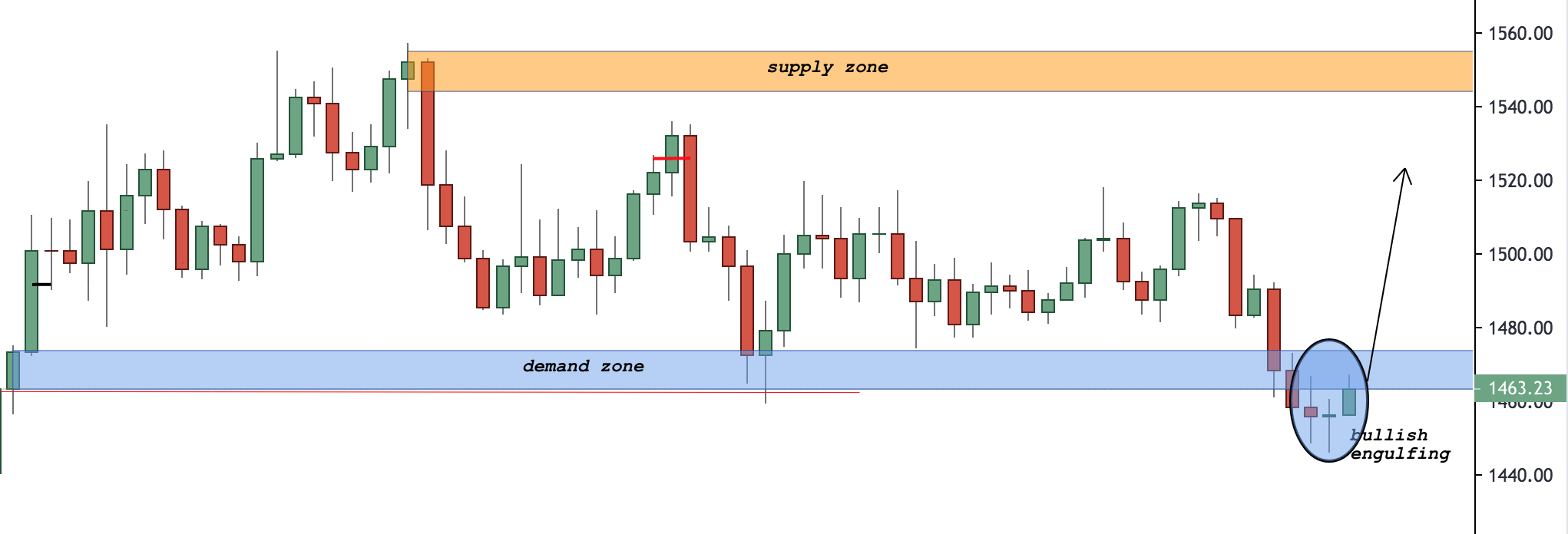

Risk management is paramount in XAUUSD trading, ensuring you preserve capital while maximizing potential gains. Key strategies include:

- Setting Stop-Loss Orders: Automating order execution to limit potential losses if prices move against you.

- Position Sizing: Trading with a size appropriate to your account balance, minimizing the impact of adverse price movements.

- Hedging: Employing opposite positions to offset potential losses in one position with gains in another.

Trading Psychology

Emotional control is crucial in successful trading. Avoid FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt), as they can lead to impulsive decisions. Develop a trading plan, stick to it, and avoid letting emotions dictate your actions.

How To Trade Xauusd Forex

Conclusion

Engaging in XAUUSD forex trading can be a rewarding endeavor, but it requires a comprehensive understanding of the market dynamics, technical and fundamental analysis techniques, and risk management strategies. By following the guidance outlined in this guide, you can equip yourself with the knowledge and skills necessary to trade XAUUSD confidently and increase your chances of unlocking the potential profits it offers.