Opening the doors to the dynamic realm of forex trading is a journey that commences with establishing a forex account. This account serves as the foundational pillar for executing trades and navigating the ever-evolving foreign exchange market. In this comprehensive guide, we will embark on a detailed exploration of the steps involved in setting up a forex account, unraveling the intricacies and empowering aspiring traders with the knowledge they need to commence their trading ventures.

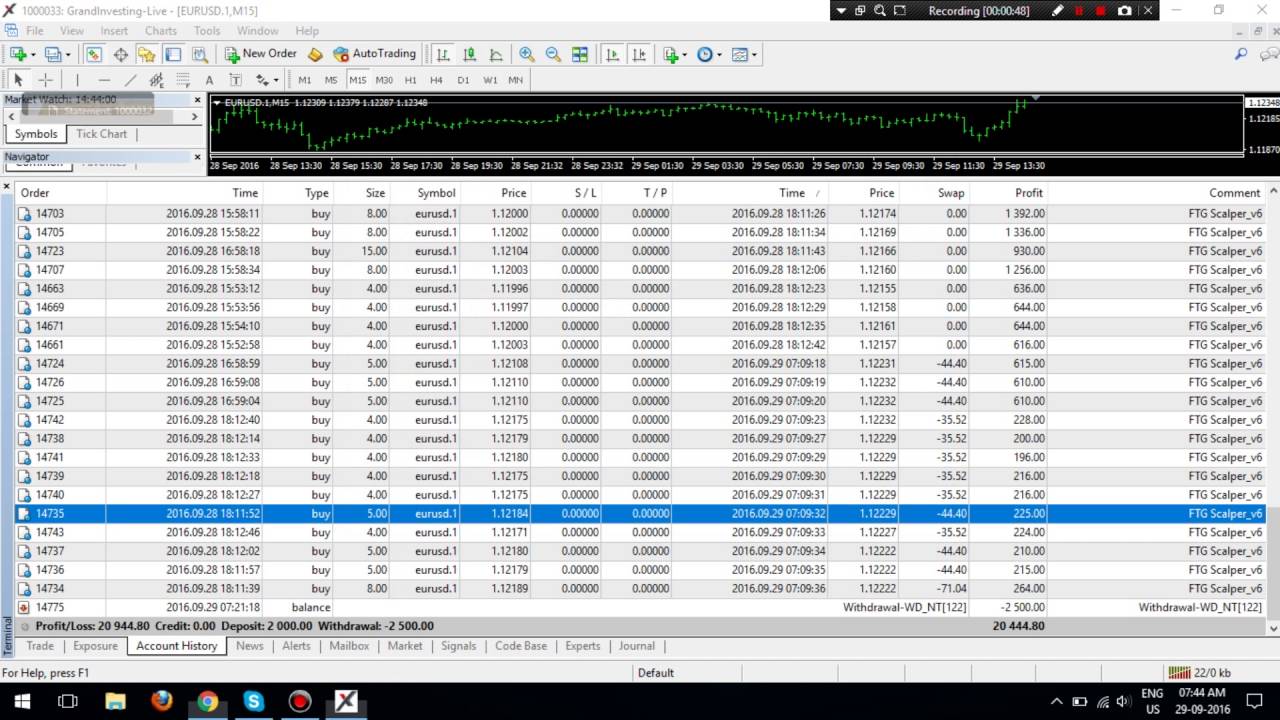

Image: www.youtube.com

Before delving into the practicalities, let’s shed light on the significance of having a forex account: Firstly, it acts as a secure online repository for your trading capital. Secondly, it provides access to trading platforms where you can execute orders for buying and selling currencies. Additionally, forex accounts facilitate the tracking of your trades, monitoring profits and losses, and making informed decisions based on market analysis.

Selecting a Trustworthy Broker

One of the most crucial steps is choosing a reputable forex broker. This decision is the cornerstone of your trading experience, affecting the trading conditions, fees, platform, and overall reliability. To identify the best broker for your needs, consider the following factors:

-

Regulation: Opt for brokers regulated by reputable financial authorities, ensuring compliance with strict industry standards and adherence to ethical practices.

-

Trading Fees: Compare the fees charged by different brokers, including spreads, commissions, and other transaction costs, to minimize the impact on your trading profitability.

-

Platform Features: Choose a broker that offers a trading platform that aligns with your trading style and objectives. Features to consider include user-friendliness, technical analysis tools, and mobile accessibility.

Navigating the Registration Process

Once you have identified a suitable broker, you can proceed with registering for an account. This typically involves submitting personal information, providing proof of identity, and completing a questionnaire to assess your trading knowledge and experience. Here’s a step-by-step walkthrough of the registration process:

-

Visit the broker’s website and locate the “Create Account” or “Sign Up” option.

-

Enter your personal details such as name, address, and contact information accurately.

-

Upload a copy of your government-issued ID or passport for identity verification.

-

Complete a brief questionnaire about your trading experience, investment goals, and risk tolerance.

-

Upon submitting the required information, the broker will review your application and notify you of the account approval typically within a short timeframe.

Understanding Account Types

Forex brokers usually offer various account types tailored to traders with diverse needs and experience levels:

-

Standard Account: These accounts offer basic trading conditions, suitable for beginners and traders with modest capital.

-

Mini Account: Designed for traders with limited capital, mini accounts enable trading with smaller lot sizes (micro-lots) and lower minimum deposit requirements.

-

VIP Account: VIP accounts cater to experienced traders with substantial trading capital. They often come with exclusive benefits such as personalized account management, lower spreads, and access to premium trading tools.

Image: statrys.com

Funding Your Account

After your account is approved, you need to fund it with the desired trading capital. Most brokers support various funding methods, including:

-

Bank Transfer: Transfer funds directly from your bank account for a secure and reliable option, although it can take several days to process.

-

Credit/Debit Card: A familiar and convenient method, credit/debit card deposits are typically processed instantly, enabling you to start trading right away.

-

E-Wallets: Electronic wallets such as PayPal and Skrill offer quick and easy funding, making them a popular choice for many traders.

Understanding Basic Forex Trading Concepts

Before executing trades, it’s essential to understand some fundamental forex trading concepts:

-

Currency Pairs: Forex trading involves trading currency pairs, where you buy one currency while simultaneously selling another.

-

Spread: The spread is the difference between the bid price (at which you sell) and the ask price (at which you buy). It represents the broker’s commission on each trade.

-

Leverage: Leverage is a feature that allows you to trade with capital greater than your account balance. While it can magnify profits, it also amplifies losses, so use it judiciously.

Commencing Trading

Once your account is funded and you have familiarized yourself with the basics, you can start trading. Here’s a simplified walkthrough of how to place a trade:

-

Select the currency pair you wish to trade using the trading platform.

-

Determine the direction of your trade (buy or sell) based on your market analysis.

-

Specify the trade size (in lots) and set stop-loss and take-profit orders to mitigate risk.

-

Review the order details and confirm the trade execution.

How To Set Up A Forex Account

Conclusion

Setting up a forex account is a crucial initial step in embarking on your forex trading journey. By carefully choosing a reputable broker, selecting an appropriate account type, and familiarizing yourself with fundamental trading concepts, you can lay a solid foundation for successful trading endeavors. As you navigate the dynamic world of forex, remember to continuously seek knowledge, refine your strategies, and adapt to evolving market conditions. With patience and dedication, forex trading can be an enriching and potentially rewarding endeavor.