An Alarming Decline: Pakistan’s Forex Reserves Fall to Critical Levels

In October 2018, Pakistan’s foreign exchange reserves witnessed a disheartening decline, dropping to a critically low level. This alarming trend sparked concerns among economists and policymakers, calling for immediate measures to address the situation. The dwindling reserves raised questions about the country’s ability to meet its external obligations and maintain a stable economy.

Image: www.livemint.com

Pakistan’s Foreign Exchange Reserves: An Overview

Foreign exchange reserves, often referred to as forex reserves, are the store of international currencies held by a central bank or other monetary authority. These reserves act as a safety net, allowing the country to make payments for imports, service its foreign debt, and intervene in the foreign exchange market to maintain the stability of its domestic currency.

Trends and Developments in Pakistan’s Forex Reserves

Over the past few years, Pakistan’s forex reserves have exhibited a volatile trajectory. The country’s reserves have fluctuated significantly, primarily due to factors such as changes in exports, remittances, and foreign direct investment. The latest decline in October 2018 marked a particular low point, raising concerns about Pakistan’s economic stability.

Factors Contributing to the Decline in Forex Reserves

Several factors have contributed to the recent decline in Pakistan’s forex reserves. These include:

-

Declining exports: Pakistan’s exports have been facing challenges, leading to a decrease in foreign exchange earnings.

-

Increased imports: The country’s imports have outpaced exports, putting pressure on forex reserves.

-

Repayment of foreign debt: Pakistan has been repaying its foreign debt obligations, which has depleted its forex reserves.

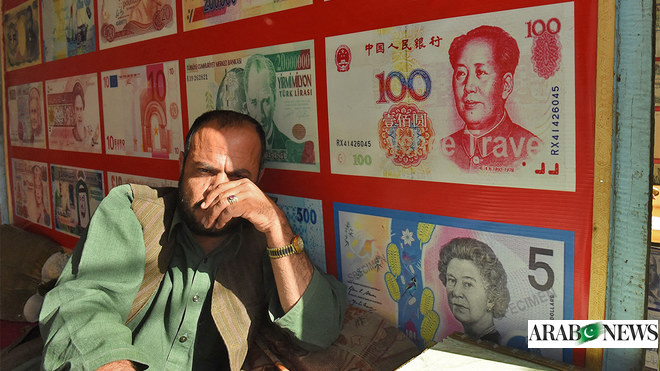

Image: www.arabnews.pk

Implications for Pakistan’s Economy

The decline in Pakistan’s forex reserves has significant implications for the country’s economy. It can lead to:

-

Currency贬值: Reduced forex reserves may lead to a depreciation of the Pakistani rupee, making imports more expensive and affecting businesses and consumers.

-

Economic instability: A sustained decline in forex reserves can result in economic instability, undermining confidence in the economy and deterring foreign investment.

-

Difficulty in meeting external obligations: Pakistan may face difficulty in meeting its external obligations, such as debt repayments and import payments, if its forex reserves continue to decline.

Tips and Expert Advice

To address the situation, economists and policymakers advise Pakistan to implement measures such as:

-

Enhancing export competitiveness: Focus on increasing exports to generate more foreign exchange earnings.

-

Reducing non-essential imports: Curbing unnecessary imports can help conserve forex reserves.

-

Attracting foreign investment: Pakistan should encourage foreign direct investment to supplement its forex reserves.

-

Seeking external assistance: The country may consider seeking financial assistance from international organizations or friendly countries to bolster its reserves.

Conclusion

Pakistan’s dwindling forex reserves in October 2018 highlighted the need for urgent economic measures to address the situation. The decline in reserves is a reminder of the importance of maintaining healthy foreign exchange buffers to ensure economic stability and the country’s ability to meet its international obligations.

Pakistan Forex Reserves October 2018

Interested in learning more about Pakistan’s forex reserves?

[Call to Action: Contact us for further information or insights]