Embark on an enlightening journey into the world of forex trading, where global currencies converge in a dynamic dance. Mastering the art of monitoring this ever-evolving market is paramount to achieving success. In this immersive guide, we’ll delve into the intricacies of forex market monitoring, providing you with the knowledge and tools to navigate its complexities with confidence.

Image: www.quora.com

Navigating the Forex Market’s Labyrinth

The foreign exchange market, commonly known as forex, stands as the largest financial marketplace globally, facilitating the trading of currencies across borders. Its sheer size and volatility can be both alluring and daunting, making effective monitoring an essential skill for both seasoned traders and those embarking upon this financial adventure.

Monitoring the forex market is not merely an exercise in observing market movements; it is the key to unlocking crucial insights, identifying potential trading opportunities, and minimizing risk. By actively tracking the market, you gain the power to make informed decisions, harnessing market dynamics to your advantage.

The Art of Dissecting Economic Data

Economic data holds the power to shape the ebb and flow of the forex market, acting as the lifeblood that gives it direction. Economic indicators, such as unemployment rates, GDP growth forecasts, and consumer sentiment indices, provide valuable glimpses into a country’s economic health, influencing investors’ perceptions of its currency’s strength and stability.

Mastering the art of dissecting economic data requires a keen eye for detail and an understanding of how each indicator can impact currency valuations. By meticulously analyzing this data, you can anticipate shifts in market sentiment and identify potential trading opportunities before others.

Charting the Market’s Pulse: Technical Analysis

While economic data provides fundamental insights, technical analysis offers another dimension to forex market monitoring. By studying historical price movements, candlestick patterns, and technical indicators, you can uncover patterns and trends that can help you predict future market behavior.

Technical analysis empowers traders with a visual representation of the market’s pulse, enabling them to identify support and resistance levels, potential market reversals, and entry and exit points for their trades. Combining technical analysis with fundamental data analysis provides a comprehensive approach to forex market monitoring, enhancing your ability to make informed trading decisions.

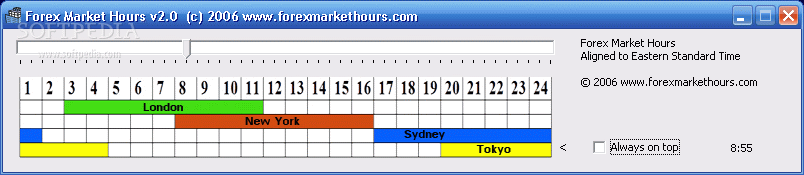

Image: www.softpedia.com

Trading on the Pulse of the Forex Market

Once you have mastered the art of monitoring the forex market, it’s time to translate your insights into profitable trades. This is where real-time monitoring and market reactivity come into play. By staying abreast of the latest market developments and news events through reputable sources, you can identify opportunities for quick execution and minimize risk.

The forex market’s relentless motion offers opportunities for both gains and losses, and effective monitoring is your shield against impulsive decisions. By carefully evaluating market conditions, you can enter and exit trades with greater confidence, maximizing your potential profits while mitigating losses.

The Psychological Edge: Mastering Your Emotions

In the high-stakes world of forex trading, emotions can be your greatest ally or your worst enemy. Fear, greed, and overconfidence can cloud your judgment and lead to irrational decisions. Cultivating emotional resilience is crucial to long-term success in forex trading.

Mastering your emotions requires self-discipline, patience, and a commitment to learning from your mistakes. Embrace a growth mindset, viewing setbacks as opportunities for learning and refinement. By keeping your emotions in check, you can maintain a clear and rational perspective, maximizing your chances of making sound trading decisions.

How To Monitor Forex Market

https://youtube.com/watch?v=cZ3CI7ZJhPE

Conclusion: The Path to Forex Market Mastery

Forex market monitoring is an art that requires a deep understanding of market dynamics, economic indicators, and technical analysis. By embracing the principles outlined in this comprehensive guide, you can empower yourself with the knowledge and skills to navigate the complexities of this ever-evolving market with greater confidence and success.

Remember, the journey to forex market mastery is an ongoing one. Embrace the learning curve, stay abreast of the latest trends and developments, and never cease to refine your approach. By investing in your knowledge and emotional resilience, you will unlock the potential to harness the power of the forex market and emerge as a successful trader.