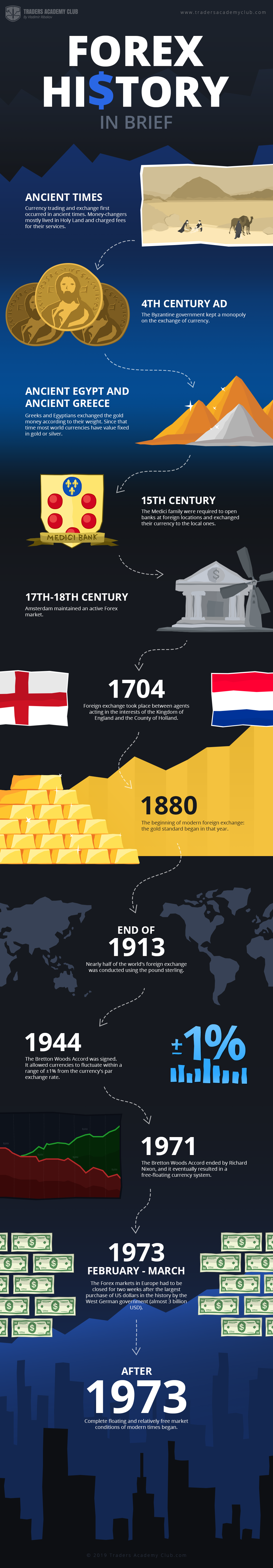

The foreign exchange market, a pulsating artery in the global financial system, has a lineage that spans centuries. Its inception can be traced back to the dawn of commerce, when traders from distant lands sought to exchange their wares for those produced in other regions. As civilizations flourished, so too did the need for a standardized means of valuing and exchanging different currencies.

Image: vladimirribakov.com

The true birthplace of the modern forex market, however, is shrouded in the mists of time. Some historians attribute its inception to the rise of international trade during the Middle Ages, while others argue that it emerged during the Renaissance era, a time of burgeoning global exploration and economic growth.

The Birth of Currency Speculation

The year 1873 saw the introduction of the gold standard, a monetary system that pegged the value of paper currency to the price of gold. This development laid the foundation for currency speculation, as traders began to profit from fluctuations in exchange rates. The emergence of telegraph communications further accelerated the growth of the forex market, allowing traders to transmit orders and receive updates on currency prices in real-time.

The Interwar Period and Post-World War II Era

The interwar period, marked by economic instability and political upheaval, witnessed a surge in forex trading. Currency speculation became a refuge for those seeking to protect their assets from inflation and currency devaluations. The aftermath of World War II brought about a new era in the forex market. The Bretton Woods Agreement of 1944 established a system of fixed exchange rates, aimed at promoting stability in the global currency market.

The Floating Exchange Rate Era

In 1971, the United States abandoned the gold standard, effectively ending the Bretton Woods system. This momentous event ushered in an era of floating exchange rates, where the value of currencies was determined primarily by market forces. The floating exchange rate regime unleashed a torrent of growth in the forex market, as traders capitalized on the potential for currency appreciation and depreciation.

Image: indexaco.com

The Globalization of the Forex Market

The rise of the internet and technological advancements in the late 20th century catapulted the forex market into a new dimension. Online trading platforms democratized access to the market, allowing retail traders to participate alongside institutional players. This era also witnessed the emergence of high-frequency trading, where complex algorithms and lightning-fast execution transformed the industry.

Current Trends and Future Outlook

The forex market continues to evolve at an unrelenting pace. Cryptocurrencies, digital assets that utilize blockchain technology, are disrupting traditional currency markets. Decentralized finance (DeFi) platforms are also gaining traction, offering innovative financial products and services to millions worldwide.

Tips and Expert Advice for Navigating the Forex Market

Navigating the forex market requires a blend of knowledge, strategy, and risk management. Seasoned traders often emphasize the following tips for those looking to succeed:

- Educate Yourself: Devote time to understanding the intricacies of the forex market, including currency dynamics, economic indicators, and trading strategies.

- Start Small: Beginners should begin with small trades and gradually increase their exposure as they gain confidence and expertise.

- Manage Risk Effectively: Employ risk management strategies such as stop-loss orders and position sizing to minimize potential losses.

- Learn from Others: Engage with experienced traders, attend webinars, and read industry publications to expand your knowledge and perspectives.

- Stay Disciplined: Adhere to your trading plan, avoid emotional decision-making, and maintain a level head even in volatile market conditions.

FAQs on the Forex Market

Q: What is the minimum capital required to trade forex?

A: The minimum capital required can vary depending on the broker and trading style. However, it is advisable to start with an amount that you can comfortably afford to lose.

Q: Is it possible to make money consistently in forex trading?

A: While it is certainly possible to generate profits through forex trading, it requires significant knowledge, skill, and a robust trading plan. Consistent profitability is not guaranteed, and traders should always be mindful of the risks involved.

Q: Are there any reputable forex brokers?

A: Yes, there are numerous reputable forex brokers. It is essential to conduct thorough research and choose a broker that is regulated, transparent, and offers competitive trading conditions.

History Of The Forex Market How It All Began

Conclusion

The history of the forex market is a testament to human ingenuity and the relentless pursuit of financial gain. From its humble beginnings to its current status as a global financial powerhouse, the forex market has played a pivotal role in shaping the economies of nations and the lives of countless individuals. As technology continues to disrupt the industry, it remains an ever-evolving landscape, offering both opportunities and challenges to those who dare to venture within its borders.

Are you intrigued by the history and complexities of the forex market? Share your thoughts and questions in the comments below!