Introduction: Unveiling the Secrets of Forex Profitability

Forex, or foreign exchange trading, has emerged as a lucrative financial market where individuals strive to capitalize on currency fluctuations. However, navigating this complex realm can be daunting, especially for beginners. To guide you on this profitable journey, this comprehensive guide will unravel the essential strategies, techniques, and knowledge to maximize your earnings in the forex market. Whether you’re a seasoned trader or just starting your forex adventure, this article will equip you with the insights to achieve consistent profits.

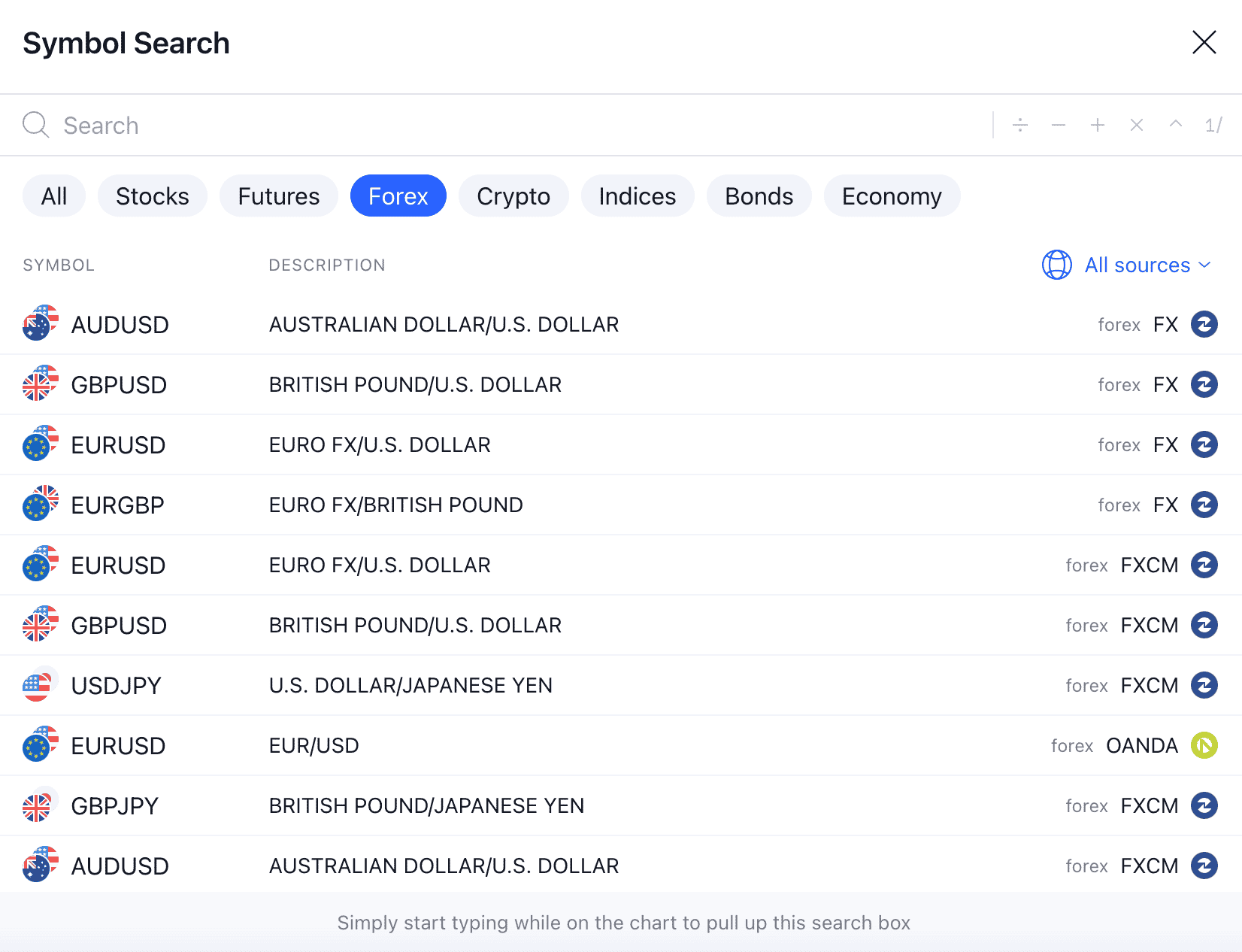

Image: www.business2community.com

Understanding Forex: The Foundation of Profitable Trading

Forex, short for foreign exchange, is a global marketplace where currencies are traded against each other continuously, 24 hours a day, five days a week. The primary goal of forex trading is to speculate on the value of currencies and profit from fluctuations in their exchange rates. By buying and selling currencies at the right time, traders can generate substantial returns. However, it’s essential to remember that forex trading carries its own risks, and it’s important to approach it with a well-informed strategy and effective risk management measures.

Mastering the Strategies: Embark on the Path to Profits

The forex market presents a multitude of trading strategies, each with its unique characteristics and potential for profitability. Some of the most popular strategies include:

• Trend Trading: This strategy involves identifying and riding long-term or intermediate-term trends in the market. By aligning with the overall direction of the market, trend traders aim to capture significant gains.

• Range Trading: This strategy focuses on identifying currency pairs that tend to fluctuate within specific price ranges. Range traders look for opportunities to buy or sell at the boundaries of these ranges and profit from the expected reversals.

• Scalping: Scalpers are active traders who seek to realize small profits from frequent, short-term trades. Leveraging rapid price movements, they aim to capture multiple small gains throughout the trading day.

• Day Trading: Day traders buy and sell currencies within a single trading day, closing all positions before the market closes. This strategy requires constant monitoring and rapid decision-making abilities.

The choice of trading strategy depends on individual risk tolerance, available time, and market conditions. By understanding the nuances of each strategy and aligning it with their preferences, traders can increase their chances of sustained profitability.

Technical Analysis: Unveiling Market Trends and Patterns

Technical analysis is a powerful tool that enables forex traders to interpret price movements and anticipate future market behavior. This approach utilizes historical price data, charts, and indicators to identify trends, patterns, and support and resistance levels. By recognizing these technical indicators, traders can make informed decisions and optimize their entries and exits.

Some of the most widely used technical analysis tools include trendlines, moving averages, Fibonacci retracements, and candlestick patterns. By combining multiple technical indicators and observing their confluence, traders can develop a comprehensive understanding of the market and identify potential trading opportunities.

Image: www.youtube.com

Risk Management: The Cornerstone of Sustainable Profits

Risk management is paramount in forex trading, as it safeguards your capital from unexpected losses and ensures the longevity of your trading career. A sound risk management strategy involves several key principles:

• Position Sizing: Determine the appropriate trade size based on your account balance and risk tolerance. Avoid risking too much on a single trade to prevent substantial losses.

• Stop-Loss Orders: Place stop-loss orders at strategic price levels to automatically close positions and limit losses in case of adverse price movements.

• Take-Profit Orders: Set take-profit orders to lock in profits when the market reaches your target price. This helps secure your gains and prevent potential reversals.

• Hedging Strategies: Explore hedging strategies to mitigate risks and protect open positions.

Adhering to a disciplined risk management framework empowers traders to trade with confidence, preserve their capital, and maximize their long-term profitability.

How To Make Profit In Forex

Conclusion: Embracing the Journey to Forex Success

Forex trading offers a path to substantial financial rewards but requires knowledge, skill, and a comprehensive understanding of market dynamics. By mastering effective trading strategies, utilizing technical analysis, and implementing robust risk management measures, you can increase your chances of consistent profitability in the forex market.

Remember that the journey to forex success is an ongoing process that demands continuous learning and adaptation. Embrace the challenges, refine your strategies, and stay updated with market trends to maximize your earnings and achieve your financial goals in this dynamic and ever-evolving market.