Forex, the foreign exchange market, is a colossal and dynamic global marketplace where currencies are traded 24 hours a day, five days a week. While this vibrant market presents immense opportunities for profit, it also carries inherent risks. Managing these risks effectively is crucial for preserving and growing your hard-earned capital.

Image: forexflexearobotreview.blogspot.com

In this comprehensive guide, we will embark on an in-depth journey exploring the fundamentals of risk management in forex. We will equip you with the knowledge and tools necessary to quantify, mitigate, and control potential losses, empowering you to trade with confidence and navigate the intricacies of this complex market.

Calculating Risk Exposure: A Fundamental Step

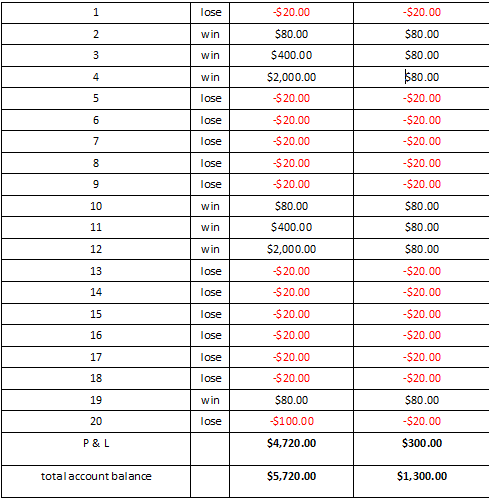

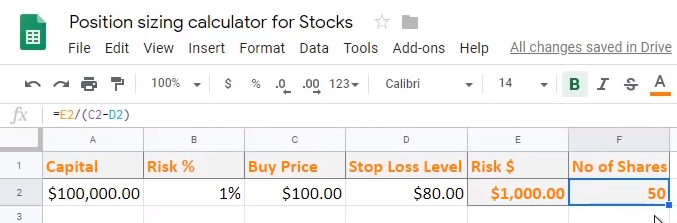

The cornerstone of risk management in forex lies in calculating your risk exposure. This entails determining the potential loss you could incur on each trade. As a general rule, it is advisable to limit your risk to a small portion of your account balance, typically no more than 1-2%. By adhering to this prudent strategy, you minimize the impact of any potential losses.

Several formulas can be employed to calculate your risk exposure. A fundamental formula involves multiplying the total size of your position (in units of currency) by the pip value (the value of each point movement in the exchange rate) and the number of pips you are willing to risk.

Position Sizing: Striking a Delicate Balance

Position sizing, the determination of the number of units to trade, plays a pivotal role in risk management. The key here is to strike a balance between potential profit and acceptable risk. A larger position size amplifies potential profits but also magnifies potential losses. Conversely, a smaller position size reduces both potential profits and losses.

To determine an appropriate position size, consider your account balance, risk tolerance, and the volatility of the currency pair you are trading. Experienced traders often utilize a risk-reward ratio to guide their position sizing decisions, ensuring a favorable balance between potential gains and potential losses.

Stop-Loss Orders: Your Safety Net in Volatile Markets

The forex market is renowned for its volatility, with currency prices fluctuating erratically at times. To protect your capital from sudden adverse movements, stop-loss orders prove invaluable. A stop-loss order automatically closes your position when the market price reaches a predetermined level, preventing further losses beyond your designated threshold.

The placement of your stop-loss order is of paramount importance. Setting it too tightly can result in premature exits from potentially profitable trades. On the other hand, placing it too loosely may expose you to excessive losses. Finding the optimal placement for your stop-loss order requires careful consideration of market volatility, trading strategy, and personal risk tolerance.

The Importance of Leverage: A Double-Edged Sword

Leverage, the ability to control a large position with a relatively small amount of capital, is a double-edged sword in forex trading. While leverage can amplify profits, it also amplifies losses. The greater the leverage employed, the smaller the price movement required to trigger a margin call or account liquidation.

Using leverage responsibly requires a deep understanding of its implications and a disciplined approach to risk management. It is essential to employ leverage judiciously, commensurate with your trading experience, risk tolerance, and financial resources.

Risk Management Strategies: A Myriad of Approaches

Risk management in forex involves a diverse array of strategies, each tailored to specific trading styles and risk profiles. Some popular risk management strategies include:

- Hedging: Balancing positions in opposite directions to reduce overall exposure to risk.

- Diversification: Spreading your trades across various currency pairs to minimize the impact of any single currency’s unfavorable movement.

- Correlation Analysis: Identifying and trading currency pairs with low or negative correlations to reduce portfolio risk.

- Technical Analysis: Utilizing technical indicators to identify potential market trends and trading opportunities, allowing for more informed risk management decisions.

Emotional Control: A Crucial Aspect Often Overlooked

Risk management in forex trading encompasses not only technical strategies but also the equally critical aspect of emotional control. The dynamic nature of the market can trigger strong emotions, which, if unchecked, can lead to impulsive decisions and poor risk management practices.

Maintaining emotional composure in the face of market fluctuations requires discipline, patience, and a clear understanding of your trading strategy and risk tolerance. By practicing mindfulness and objectivity, you can avoid the pitfalls of fear and greed, ensuring rational decision-making and effective risk management.

Conclusion: Empowering Yourself with Knowledge and Discipline

Risk management in forex trading is not merely a collection of formulas and strategies; it is a mindset, a discipline that empowers you to navigate the complexities of the market with confidence and resilience. By mastering the principles outlined in this comprehensive guide, you equip yourself with the tools and knowledge necessary to calculate risk, implement effective risk management practices, and maintain emotional control. Remember, the path to successful forex trading lies in embracing calculated risks, managing them effectively, and always learning from your experiences.

Image: notariaurbina.cl

How To Calculate Risk Management Forex

https://youtube.com/watch?v=5Od9z–iqIU