The foreign exchange market, commonly known as forex, is the most substantial and liquid financial market globally, facilitating trillions of dollars in transactions each day. This vibrant arena attracts traders from all walks of life, from retail investors to seasoned professionals, all vying for a slice of the action. But just how many people trade forex? This question has been the subject of much debate, with varying estimates floating around.

Image: capital.com

In this comprehensive guide, we embark on a journey to unravel the enigmatic landscape of forex trading participation. We’ll delve into the historical roots of forex, uncover the motivations and demographics of traders, and explore the geographical distribution of this ubiquitous financial phenomenon. Join us as we unveil the captivating world of forex trading and gain insights into the intricacies of this remarkable market.

A Historical Perspective: The Genesis of Forex Trading

The origins of forex trading can be traced back to the gold standard era, where currencies were pegged to the value of gold. However, theBretton Woods system, established in 1944, shifted the paradigm to fixed exchange rates among major currencies. This arrangement restricted currency fluctuations and hindered the development of a robust forex market.

The demise of the Bretton Woods system in 1971 marked a watershed moment, ushering in a new era of floating exchange rates. This significant shift paved the way for the emergence of a globalized forex market, free from government intervention. The advent of electronic trading platforms in the 1990s further fueled the growth of the forex market, making it accessible to a broader base of traders.

Motivations and Demographics: Who Trades Forex?

The forex market encompasses a diverse range of participants, each driven by unique motivations and objectives. Retail traders, often individuals trading with smaller capital, seek profit opportunities by speculating on currency price movements. Institutional traders, including banks, hedge funds, and investment firms, engage in large-scale transactions to manage risk, hedge against currency fluctuations, and facilitate international trade.

The demographics of forex traders vary widely, with no specific age, gender, or educational background being exclusive prerequisites. However, a common thread among successful traders is a thirst for knowledge, a keen understanding of market dynamics, and a disciplined approach to risk management.

Geographical Distribution: Where is Forex Traded?

Forex trading is a global phenomenon, transcending geographical boundaries and time zones. Traders from every corner of the globe participate in this decentralized market, with trading activity concentrated in major financial hubs. London, New York, Tokyo, Zurich, and Singapore stand as the primary forex trading centers, accounting for a significant portion of daily transactions.

Nevertheless, the advent of online trading platforms has democratized access to the forex market, enabling traders from remote locations to participate in this global arena. Technological advancements have broken down geographical barriers, creating a truly interconnected trading landscape.

Image: howtotradeonforex.github.io

The Allure of Forex: Captivating Features of the Market

The allure of forex trading lies in its inherent characteristics, which offer unique advantages and opportunities to participants:

-

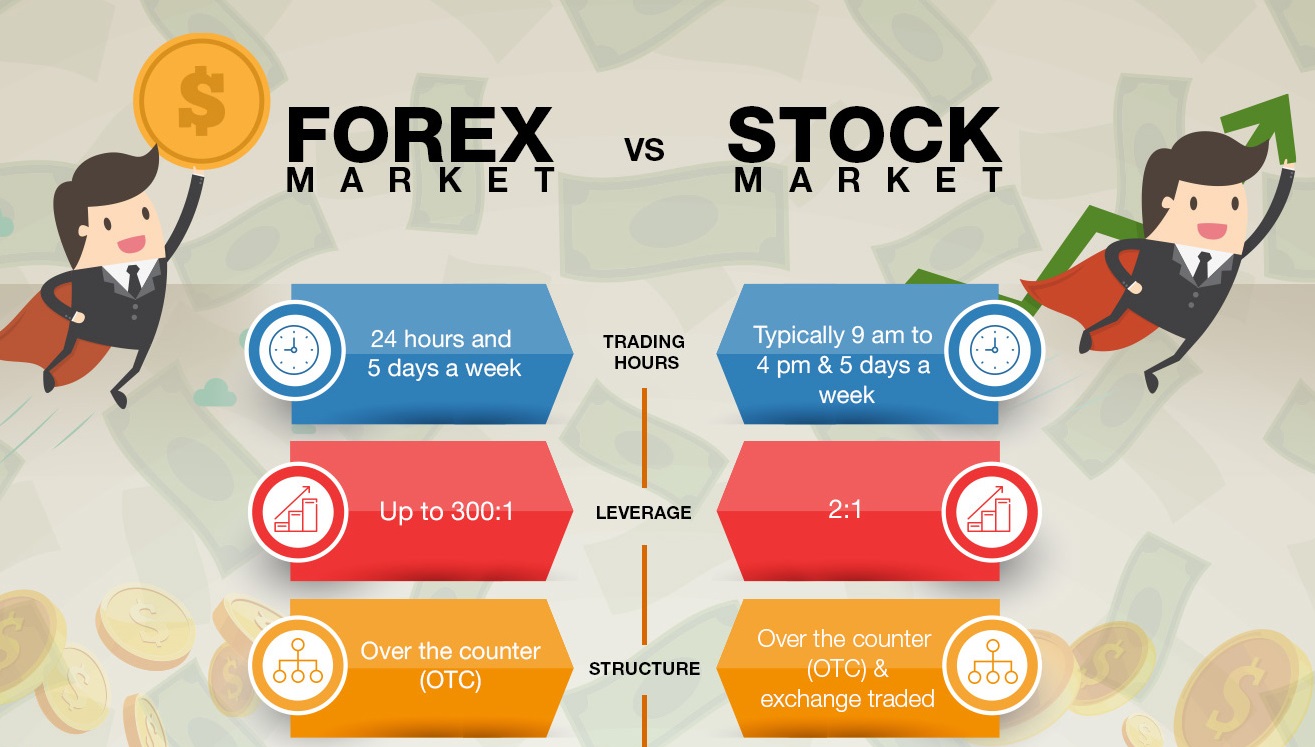

24-Hour Market: The forex market operates around the clock, five days a week, allowing traders to capitalize on market movements at their convenience.

-

High Liquidity: Forex is the most liquid financial market, with trillions of dollars traded daily. This liquidity ensures that orders can be executed swiftly and efficiently, even during periods of heightened volatility.

-

Leverage: Forex brokers offer leverage, enabling traders to control positions larger than their account balance. While leverage magnifies potential profits, it also amplifies losses, requiring traders to exercise caution and discipline.

-

Variety of Currency Pairs: The forex market encompasses numerous currency pairs, representing different countries and economic regions. This diversity provides traders with ample opportunities to exploit price differentials and capitalize on global events.

-

Low Transaction Costs: Compared to other financial markets, forex trading typically involves lower transaction costs, such as spreads and commissions. This cost-effectiveness makes forex accessible to a broader range of traders.

How Many People Trade Forex

https://youtube.com/watch?v=FfYMIhxG-1g

Conclusion: The Future of Forex Trading

The forex market continues to evolve at a rapid pace, driven by technological advancements and changing economic landscapes. The increasing adoption of artificial intelligence, machine learning, and algorithmic trading is transforming the way traders analyze markets and execute trades.

As the global economy becomes increasingly interconnected, the demand for forex trading is expected to grow. The proliferation of mobile trading platforms and the rise of emerging market economies will further expand the reach of the forex market. As the world hurtles towards a more digital and globalized future, the allure of forex trading will undoubtedly persist and captivate traders for years to come.