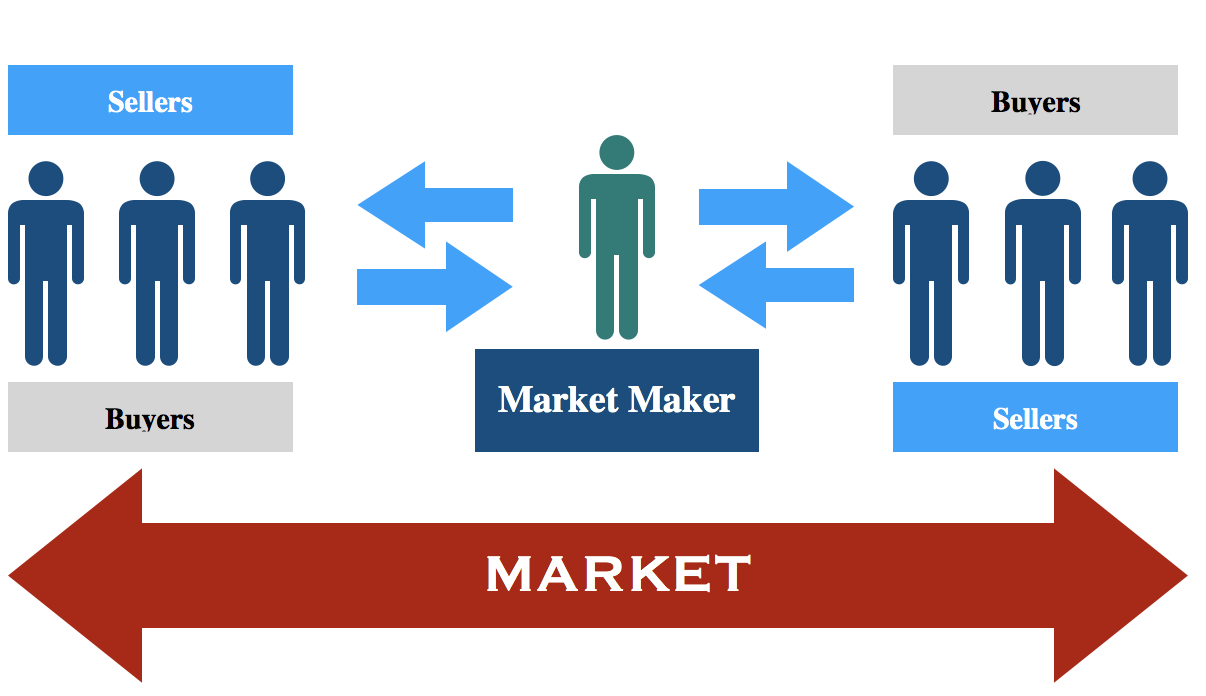

In the fast-paced world of forex trading, understanding the inner workings of the market is crucial for success. Among the key players in this financial arena, forex market makers stand out as the unsung heroes who provide liquidity and facilitate trades. But how exactly do these enigmatic entities make their fortunes? In this comprehensive guide, we’ll embark on an illuminating journey to decode the lucrative strategies employed by forex market makers, revealing the secrets behind their financial success.

Image: marketbusinessnews.com

Who are Forex Market Makers?

Forex market makers are financial institutions or individuals who stand ready to buy or sell a specific currency pair at any given time. They quote two prices simultaneously: the bid price, which is the price at which they are willing to buy, and the ask price or offer price, which is the price at which they are willing to sell. The difference between these two prices is known as the spread, which is a significant source of revenue for market makers.

How Do Forex Market Makers Make Money?

There are several primary strategies that forex market makers employ to generate profits.

1. The Spread

The most common way market makers earn profits is through the spread. As mentioned earlier, the spread is the difference between the bid and ask prices of a currency pair. Market makers profit when they buy a currency at the bid price and then sell it at the ask price, or vice versa. The size of the spread varies depending on the currency pair traded and market conditions.

Image: www.bank2home.com

2. Position Trading

Market makers may also engage in position trading, where they hold onto currencies for varying periods to take advantage of price movements. For example, if they anticipate the value of a particular currency to increase, they may buy a large amount of that currency at the current bid price and then sell it later at a higher ask price.

3. Arbitrage Trading

Arbitrage trading involves taking advantage of price discrepancies between different markets or exchanges. For instance, if a market maker observes that the price of a currency pair is higher on one exchange than another, they may buy it on the cheaper exchange and sell it on the more expensive exchange, thereby profiting from the price difference.

4. Hedging Strategies

Market makers use hedging strategies to mitigate their risk exposure. Hedging involves entering into offsetting positions in different markets or currencies. This helps to reduce the potential losses they may incur from adverse price movements.

Risks and Challenges Facing Market Makers

While market making can be a lucrative endeavor, it is not without its risks and challenges. Some of the primary risks faced by market makers include:

1. Market Volatility

Market volatility can significantly impact market makers’ profits. Sudden and unexpected price fluctuations can result in losses if market makers are not well-hedged.

2. Technological Disruptions

Technological glitches or outages can disrupt market makers’ ability to trade, leading to missed opportunities or even financial losses.

3. Legal and Regulatory Changes

Market makers are subject to various regulations and laws, which can change over time. Failure to comply with these regulations can lead to penalties or even legal action.

How Do Forex Market Makers Make Money

Conclusion

Understanding the secrets of forex market makers provides a valuable glimpse into the fascinating world of currency trading. Through their role as liquidity providers and facilitators of trades, market makers play a vital part in the efficient functioning of the forex market. By employing a combination of strategies, such as capturing the spread, engaging in position trading, and utilizing arbitrage and hedging techniques, market makers generate substantial profits while also assuming a certain level of risk. Armed with this knowledge, traders and investors can enhance their understanding of the forex market and make informed decisions in their own trading endeavors.